In determining whether the electricity production facility is able to make use of the de-minimis exemption from the REMIT reporting requirement the three elements are relevant:

(1) spatial proximity (whether installations are spatially separated)

(2) ownership structure, and

(3) marketing for several smaller installations in one common contract/multiple contracts.

REMIT transactions' and orders' reporting scheme becomes more and more complicated. Extremely laconic provisions of the very REMIT Regulation are in that regard a only legal base for the multiple manuals and interpretations.

The REMIT reporting de minimis threshold (of 10 MW) is not an exemption. Even the cursory overview of Article 4(1)(b) of Commission Implementing Regulation (EU) No 1348/2014 allows for the suspicion, the installation's aggregation rules will make some trouble.

The said Article stipulates that contracts for the physical delivery of electricity produced by a single production unit with a capacity equal to or less than 10MW or by production units with a combined capacity equal to or less than 10MW shall be reportable only upon ACER's (Agency for the Cooperation of Energy Regulators) reasoned request, unless concluded on organised market places. Thus, market participants who only complete such transactions do not have to register at the relevant national regulatory authority.

ACER Q&As are useful when it comes to establishing the role of contracts in the above 10 MW thresholds' calculation rules. The Q&As' example refers to wind power plants, but, as ACER explicitly points out, it applies accordingly for other types of production.

To begin with, ACER recalls Article 2(13) of the aforementioned Regulation, which defines a "production unit" as a facility for generation of electricity made up of a single generation unit or of an aggregation of generation units (thus, a production unit is not always a single production unit (e.g. one wind turbine) but it can also be a combination of units (e.g. several wind turbines)).

The explicit wording of the Regulation 1384/2014 is silent on these elements, but in the ACER's view in defining a production unit the spatial proximity and the ownership structure need to be considered.

Production unit might be a part of a wind farm (e.g. 5 wind turbines) owned by one market participant, but the scale of potential variants is much broader.

ACER considers the following specific examples for wind power plants configurations (accordingly for other types of production) and sets out the regulators' view on the respective aggregation rules:

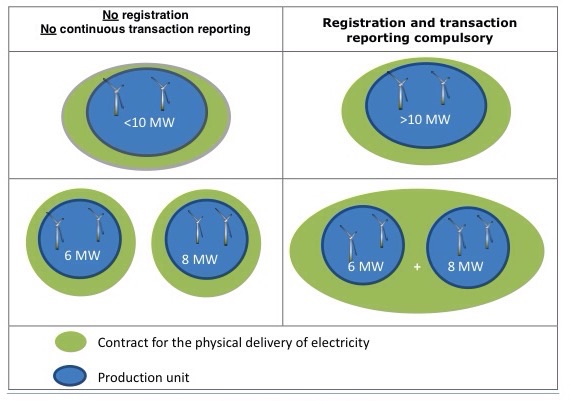

- A) Contracts for the physical delivery of electricity of a wind farm (or parts of the wind farm) with a total production capacity of less than 10MW are not reportable (diagram at the top left (diagram's source: ACER REMIT Q&As - REMIT Portal)).

- B) Contracts for the physical delivery of electricity of a wind farm (or parts of the wind farm) larger than 10MW are reportable (diagram at the top right).

- C) If a market participant has more than one wind farm (or parts of a wind farm) at his disposal which are spatially separated and each of it has a production capacity of less than 10MW and which are marketed in different contracts, these contracts are not reportable (diagram at the bottom left).

- D) If a market participant has more than one wind farm (or parts of a wind farm) at his disposal which are spatially separated and each of it has a production capacity of less than 10MW and which are marketed in one common contract, this contract is reportable (diagram at the bottom right).

If the marketing of the production capacity is performed by a third-party – e.g. the operator of a wind farm – and the wind farm has got a total production capacity larger than 10MW, this third-party has to register as market participant and to report the corresponding contracts.

The practical importance of the above interpretation can not be overestimated. The unambiguous presentation of the regulator's view on this issue deserves appreciation, but, nevertheless, there is also an anxiety on the part of legal certainty, where the business model for concluding contracts is so significant.

The above-mentioned de minimis threshold of 10 MW requires some cautiousness also an account of one more specific differentiation.

Namely, this exemption is available for the counterparty that owns, for example, a 5 MW production unit and sells this output, but not in the case of the same output resale - ACER's another key interpretation.