An interest rate swap (IRS) is defined as a financial product through which two parties exchange flows; for instance, one party pays a fixed interest rate on a notional amount, while receiving an interest rate that fluctuates with an underlying benchmark from the other party. These swaps can be structured in various different ways negotiated by the counterparties involved. This is the most common type of derivative.

|

|

22 January 2024

17 May 2022

The Regulation amends the EMIR clearing obligation due to the cessation of the publication of LIBOR settings.

|

Important update

Commission Delegated Regulation (EU) 2022/750 of 8 February 2022 amending the regulatory technical standards laid down in Delegated Regulation (EU) 2015/2205 as regards the transition to new benchmarks referenced in certain OTC derivative contracts substantially modifies the terms of the IRS clearing obligation. The amendments are quoted below and are not reflected in the remainder in this article.

Amendment to Delegated Regulation (EU) 2015/2205

Delegated Regulation (EU) 2015/2205 is amended as follows:

(1) Article 3 is amended as follows:

(a) the following paragraphs 1a and 1b are inserted:

’1a. By way of derogation from paragraph 1, in respect of contracts pertaining to a class of OTC derivatives set out in the Annex in rows D.4.1, D.4.2 of Table 4, the clearing obligation for such contracts shall take effect on 18 May 2022.

1b. By way of derogation from paragraph 1, in respect of contracts pertaining to a class of OTC derivatives set out in the Annex in rows D.4.3 of Table 4, the clearing obligation for such contracts shall take effect on 18 August 2022.’;

(b) in paragraph 2, the first subparagraph is replaced by the following:

’By way of derogation from paragraphs 1, 1a and 1b, in respect of contracts pertaining to a class of OTC derivatives set out in the Annex and concluded between counterparties which are part of the same group and where one counterparty is established in a third country and the other counterparty is established in the Union, the clearing obligation shall take effect on:

(a) 30 June 2022 in case no equivalence decision has been adopted pursuant to Article 13(2) of Regulation (EU) No 648/2012 for the purposes of Article 4 of that Regulation covering the OTC derivative contracts set out in the Annex to this Regulation in respect of the relevant third country;

(b) the later of the following dates in case an equivalence decision has been adopted pursuant to Article 13(2) of Regulation (EU) No 648/2012 for the purposes of Article 4 of that Regulation covering the OTC derivative contracts referred to in the Annex to this Regulation in respect of the relevant third country:

(i) 60 days after the date of entry into force of the equivalence decision adopted pursuant to Article 13(2) of Regulation (EU) No 648/2012 for the purposes of Article 4 of that Regulation covering the OTC derivative contracts referred to in the Annex to this Regulation in respect of the relevant third country;

(ii) the date when the clearing obligation takes effect pursuant to paragraph 1.’;

(c) paragraph 3 is replaced by the following:

‘3. By way of derogation from paragraphs 1, 1a, 1b and 2, in respect of contracts pertaining to a class of OTC derivatives set out in the Annex, the clearing obligation shall take effect from 18 February 2022 where the following conditions are fulfilled:

(a) the clearing obligation has not been triggered by 18 February 2021;

(b) the contracts are novated for the sole purpose of replacing the counterparty established in the United Kingdom with a counterparty established in a Member State.’;

(2) the Annex is replaced by the text in the Annex to this Regulation.

Interest rate swaps represent the vast majority of the global OTC derivatives market, around 80 to 90% depending on the metrics used (ISDA Europe Conference, Speech by ESMA's Chair Steven Maijoor (2015/1417)).

IRS market

The market for interest rate derivative asset class shows important levels of concentration on a small number of large counterparties - less than 500 counterparties (the ones with portfolios of OTC interest rate derivatives above EUR 5bn) represent 99.4% of the activity, and 8.4% in terms of number of counterparties (ESMA's Consultation Paper on the clearing obligation for financial counterparties with a limited volume of activity, 13 July 2016, ESMA/2016/1125, p. 11 - 13).

On a daily basis SwapClear (a service of LCH.Clearnet) clears about USD 3 trillion in interest-rate derivatives, with USD2trillion in US dollar-denominated contracts, and EUR 475 billion in euro-denominated contracts as the second largest component.

75% of centrally-cleared euro-denominated interest-rate derivatives are cleared in the United Kingdom, mostly through the said SwapClear (Commission Staff Working Document Impact Assessment Accompanying the document Proposal for a Regulation of the European Parliament and of the Council amending Regulation (EU) No 1095/2010 establishing a European Supervisory Authority (European Securities and Markets Authority) and amending Regulation (EU) No 648/2012 as regards the procedures and authorities involved for the authorisation of CCPs and the requirements for the recognition of third-country CCPs, SWD/2017/0246 final - 2017/0136 (COD), 13.06.2017, p. 18 - figures broadly confirmed by BIS triennial data for 2016). Between 2009 and 2015, the share of centrally cleared interest rate over-the-counter derivatives went up from 36% to 60% (Speech by the European Commission's Vice-President Dombrovskis on EMIR REFIT, 4 May 2017 4 May 2017).

ESMA Report on Trends, Risks and Vulnerabilities No. 2. 2017 “EU derivatives markets ─ a first-time overview” (ESMA50-165-421, p. 3, 4) indicates that for interest rate derivatives, 251,916 different counterparty identifiers were reported. Among these, nine were central counterparties (CCPs) authorised to offer services and activities in the EU. 11 were CCPs established in a third country, and an additional 339 were clearing members of either of these CCPs. The more than 250,000 remaining counterparties reflect the widespread use of interest rate derivatives; they include financial and non-financial counterparties, clients to a clearing member in the case of a cleared trade, or non-clearing-member brokers and their clients.

Legislative process regarding IRS mandatory clearing

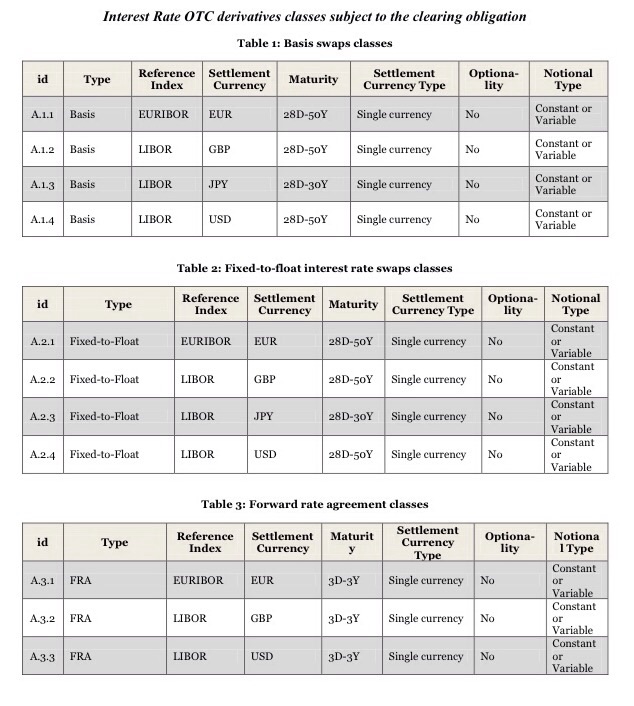

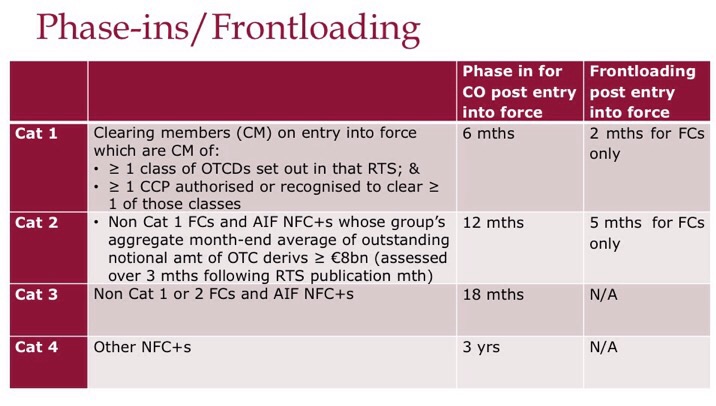

For the purposes of mandatory clearing the European Securities nad Markets Authority (ESMA) proposed to create one class of OTC derivative per product type, when product types are defined as follows:

- Fixed-to-float interest rate swaps (IRS), also referred to as plain vanilla IRS,

- Float-to-float swaps, also referred to as basis swaps,

- Forward Rate Agreements (FRA),

- Overnight Index Swaps (OIS).

In addition, within each of those product types, the following characteristics are used to further define the class: the floating reference rate, the settlement currency, the currency type (i.e. whether the contracts are based on a single currency or on multiple currencies), the maturity, the existence of embedded optionality and the notional amount type (constant, variable or conditional).

Overall, these rules supplement the European Market Infrastructure Regulation (EMIR) and form part of the implementation of the agreement by G20 leaders in 2009 that standardised OTC derivative contracts should be cleared through CCPs.

In the Final Report Draft technical standards on the Clearing Obligation – Interest Rate OTC Derivatives of 1 October 2014 (ESMA/2014/1184) ESMA made the following proposition:

while in the Clearing Obligation under EMIR (no.4) of 11 May 2015 (ESMA/2015/807) ESMA proposed to supplement the above classes of OTC derivatives subject to the clearing obligation with the following ones:

Contracts denominated in the G4 currencies (GBP, EUR, JPY and USD)

After ESMA's Revised Opinion Draft RTS on the Clearing Obligation on Interest Rate Swaps of 6 March 2015 (2015/ESMA/511) the European Commission adopted on 6 August 2015 a Delegated Regulation that requires mandatory clearing through central counterparties for the following types of OTC interest rate derivative contracts denominated in the G4 currencies (GBP, EUR, JPY and USD):

- Fixed-to-float interest rate swaps (IRS), known as 'plain vanilla' interest rate derivatives,

- Float-to-float swaps, known as 'basis swaps',

- Forward Rate Agreements,

- Overnight Index Swaps.

The specific classes within the scope as well as specific features (among others the index used as a reference for the derivative, its maturity, and the notional type) were set out in the Annex to the Delegated Regulation.

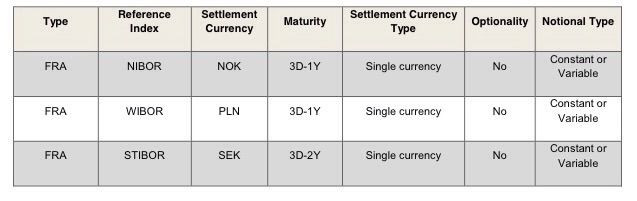

The Regulation envisioned for the phase-in the clearing obligation for the above G4 currencies over a period of three years according to counterparty category (as well as the frontloading requirement for financial counterparties in categories 1 and 2).

The said Delegated Regulation after a scrutiny by the European Parliament and the Council has been published in the Official Journal of the European Union with the entry into force on the twentieth day following publication (Commission Delegated Regulation (EU) 2015/2205 of 6 August 2015 supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council with regard to regulatory technical standards on the clearing obligation).

The rules enter into force on 21 December 2015, and the effective start date for the mandatory clearing of the relevant classes is as follows:

- Category 1 firms have an effective start date of 21 June 2016,

- Category 2 firms follow six months later on 21 December 2016,

- Category 3 firms initially had an effective start date of 21 June 2017, but this deadline has been replaced with the date 21 June 2019 - see Consultation Paper on the clearing obligation for financial counterparties with a limited volume of activity, 13 July 2016, ESMA/2016/1125, Final Report on the clearing obligation for financial counterparties with a limited volume of activity, 14 November 2016, ESMA/2016/1565 and the Commission Delegated Regulation (EU) 2017/751 of 16 March 2017 amending Delegated Regulations (EU) 2015/2205, (EU) 2016/592 and (EU) 2016/1178 as regards the deadline for compliance with clearing obligations for certain counterparties dealing with OTC derivatives,

- Category 4 firms have an effective start date of 21 December 2018.

Under EMIR there is also a frontloading requirement which requires financial counterparties in Category 1 and Category 2 to clear relevant OTC interest rate derivative contracts entered into or novated on or after 21 February 2016 and 21 May 2016, respectively. The frontloading requirement sets out that these contracts must be cleared by the dates on which the clearing obligation takes effect for these two firm categories. There is no frontloading requirement for non-financials in Categories 1 and 2, nor for Category 3 and 4 firms. Among the most vital points are: the counterparties' categorisation, dates from which the IRS mandatory clearing takes effect, frontloading, and intragroup treatment. See below in the boxes some excerpts on the issue.

Commission Delegated Regulation (EU) 2015/2205 of 6 August 2015 supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council with regard to regulatory technical standards on the clearing obligation

Article 3

Dates from which the clearing obligation takes effect

1. In respect of contracts pertaining to a class of OTC derivatives set out in the Annex, the clearing obligation shall take effect on:

(a) 21 June 2016 for counterparties in Category 1;

(b) 21 December 2016 for counterparties in Category 2;

(c) 21 June 2019 for counterparties in Category 3 (Consultation Paper on the clearing obligation for financial counterparties with a limited volume of activity, 13 July 2016, ESMA/2016/1125, Final Report on the clearing obligation for financial counterparties with a limited volume of activity, 14 November 2016, ESMA/2016/1565 and the Commission Delegated Regulation (EU) 2017/751 of 16 March 2017 amending Delegated Regulations (EU) 2015/2205, (EU) 2016/592 and (EU) 2016/1178 as regards the deadline for compliance with clearing obligations for certain counterparties dealing with OTC derivatives);

(d) 21 December 2018 for counterparties in Category 4.

Where a contract is concluded between two counterparties included in different categories of counterparties, the date from which the clearing obligation takes effect for that contract shall be the later date.

2. By way of derogation from points (a), (b) and (c) of paragraph 1, in respect of contracts pertaining to a class of OTC derivatives set out in the Annex and concluded between counterparties other than counterparties in Category 4 which are part of the same group and where one counterparty is established in a third country and the other counterparty is established in the Union, the clearing obligation shall take effect on:

(a) 21 December 2018 in case no equivalence decision has been adopted pursuant to Article 13(2) of Regulation (EU) No 648/2012 for the purposes of Article 4 of that Regulation covering the OTC derivative contracts referred to the Annex to this Regulation in respect of the relevant third country; or

(b) the later of the following dates in case an equivalence decision has been adopted pursuant to Article 13(2) of Regulation (EU) No 648/2012 for the purposes of Article 4 of that Regulation covering the OTC derivative contracts referred to in the Annex to this Regulation in respect of the relevant third country:

(i) 60 days after the date of entry into force of the decision adopted pursuant to Article 13(2) of Regulation (EU) No 648/2012 for the purposes of Article 4 of that Regulation covering the OTC derivative contracts referred to in the Annex to this Regulation in respect of the relevant third country;

(ii) the date when the clearing obligation takes effect pursuant to paragraph 1.

This derogation shall only apply where the counterparties fulfil the following conditions:

(a) the counterparty established in a third country is either a financial counterparty or a non-financial counterparty;

(b) the counterparty established in the Union is:

(i) a financial counterparty, a non-financial counterparty, a financial holding company, a financial institution or an ancillary services undertaking subject to appropriate prudential requirements and the counterparty referred to in point (a) is a financial counterparty; or

(ii) either a financial counterparty or a non-financial counterparty and the counterparty referred to in point (a) is a non-financial counterparty;

(c) both counterparties are included in the same consolidation on a full basis in accordance to Article 3(3) of Regulation (EU) No 648/2012;

(d) both counterparties are subject to appropriate centralised risk evaluation, measurement and control procedures;

(e) the counterparty established in the Union has notified its competent authority in writing that the conditions laid down in points (a), (b), (c) and (d) are met and, within 30 calendar days after receipt of the notification, the competent authority has confirmed that those conditions are met.

Frontloading

OTC derivative contracts concluded between the first authorisation of a CCP under EMIR, which took place on 18 March 2014, and the later date on which the clearing obligation actually takes effect are also subject to clearing, unless they have a remaining maturity lower than the minimum remaining maturities (the so called frontloading requirement).

Therefore, frontloading may be excluded for some OTC derivative contracts or counterparties by determining the minimum remaining maturities.

(Source of the Table: FCA, EMIR – the obligation to clear and margin OTC derivative trades)

Minimum remaining maturities are set out in the Article 4 of the Delegated Regulation of 6 August 2015 - see box).

Commission Delegated Regulation (EU) 2015/2205 of 6 August 2015 supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council with regard to regulatory technical standards on the clearing obligation

Article 4

Minimum remaining maturity

1. For financial counterparties in Category 1, the minimum remaining maturity referred to in point (ii) of Article 4(1)(b) of Regulation (EU) No 648/2012, at the date the clearing obligation takes effect, shall be:

(a) 50 years for contracts entered into or novated before 21 February 2016 that belong to the classes in Table 1 or Table 2 set out in the Annex;

(b) 3 years for contracts entered into or novated before 21 February 2016 that belong to the classes of Table 3 or Table 4 of the Annex;

(c) 6 months for contracts entered into or novated on or after 21 February 2016 that belong to the classes of Table 1 to Table 4 of the Annex.

2. For financial counterparties in Category 2, the minimum remaining maturity referred to in point (ii) of Article 4(1)(b) of Regulation (EU) No 648/2012, at the date the clearing obligation takes effect, shall be:

(a) 50 years for contracts entered into or novated before 21 May 2016 that belong to the classes in Table 1 or Table 2 set out in the Annex;

(b) 3 years for contracts entered into or novated before 21 May 2016 that belong to the classes of Table 3 or Table 4 of the Annex;

(c) 6 months for contracts entered into or novated on or after 21 May 2016 that belong to the classes of Table 1 to Table 4 of the Annex.

3. For financial counterparties in Category 3 and for transactions referred to in Article 3(2) of this Regulation concluded between financial counterparties, the minimum remaining maturity referred to in point (ii) of Article 4(1)(b) of Regulation (EU) No 648/2012, at the date the clearing obligation takes effect, shall be:

(a) 50 years for contracts that belong to the classes of Table 1 or Table 2 of the Annex;

(b) 3 years for contracts that belong to the classes of Table 3 or Table 4 of the Annex.

4. Where a contract is concluded between two financial counterparties belonging to different categories or between two financial counterparties involved in transactions referred to in Article 3(2), the minimum remaining maturity to be taken into account for the purposes of this Article shall be the longer remaining maturity applicable.

Removal of the frontloading requirement

The European Commission's propositions as regards the reform of the EMIR framework published in May 2017 provide for the removal of frontloading requirements (see point (b) of Article 1(2) the Proposal for a Regulation of the European Parliament and of the Council amending Regulation (EU) No 648/2012 as regards the clearing obligation, the suspension of the clearing obligation, the reporting requirements, the risk-mitigation techniques for OTC derivatives contracts not cleared by a central counterparty, the registration and supervision of trade repositories and the requirements for trade repositories, COM(2017)208 of 4 May 2017).

Point (b) of Article 1(2) of the said draft removes the requirement laid down in point (ii) of point (b) of EMIR Article 4(1) to clear OTC derivative contracts entered into or novated on or after notification by a competent authority to ESMA on an authorisation of a CCP to clear a class of OTC derivatives but before the date from which the clearing obligation takes effect if the contracts have a remaining maturity higher than the minimum remaining maturity determined in a Commission Delegated Regulation on clearing obligations under Article 5(2)(c).

Recital 8 of the said draft Regulation foresees that:

"The requirement to clear certain OTC derivative contracts concluded before the clearing obligation takes effect creates legal uncertainty and operational complications for limited benefits. In particular, the requirement creates additional costs and efforts for the counterparties to those contracts and may also affect the smooth functioning of the market without resulting in a significant improvement of the uniform and coherent application of Regulation (EU) No 648/2012 or of the establishment of a level playing field for market participants. That requirement should therefore be removed."

Counterparties' categorisation

For the purposes of the clearing obligation counterparties in the interest rate derivative asset class are broadly categorised in the following manner:

- Clearing members for at least one of the classes of OTC IRS subject to clearing;

- Financial counterparties and alternative investment funds (AIFs) which are not clearing members and which have a higher level of activity in OTC derivatives (to be measured against the quantitative threshold (i.e. with individual portfolios above EUR 8bn);

- Financial counterparties and alternative investment funds (AIFs) which are not clearing members and which have a lower level of activity in OTC derivatives (to be measured against the aforementioned quantitative threshold);

- Non-financial counterparties not included in the other categories.

This is expressed in Article 2 and Recitals 4 - 8 of the Commission Delegated Regulation (EU) 2015/2205 of 6 August 2015 supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council with regard to regulatory technical standards on the clearing obligation.

When it comes to the breakdown of the cleared volumes in the interest rate derivative asset class to the above categories, analytical data show the following:

- clearing members (Category 1) represent 94.5% of the volume and 1.2% of the number of counterparties;

- counterparties classified in the Category 2 (i.e. with individual portfolios above EUR 8 bn) represent 4.4% of the volume and 4.5% of the number of counterparties; and

- counterparties classified in the Category 3 (i.e. with individual portfolios below EUR 8 bn) represent 1.1% of the volume and 94.3% of the number of counterparties (Consultation Paper on the clearing obligation for financial counterparties with a limited volume of activity, 13 July 2016, ESMA/2016/1125, p. 19).

However, these numbers may be somewhat skewed as a financial counterparty with a portfolio of OTC derivatives below EUR 8 bn may be classified primarily under Category 3 whereas in reality, it may belong to Category 2 because it is part of a larger group (the fact recalled by the ESMA itself).

It is noteworthy, ESMA has explained on 6 June 2016 (EMIR Q&As) the following issues:

- the self-categorisation that is necessary in order to establish which counterparties belong to which categories,

- the issue how counterparties should handle the situation where some of their counterparties have not provided the information on the category they belong to.

The text of the clarification, as well as the respective provisions of the Regulation 2015/2205 are available in the boxes below.

|

Article 2 of the Commission Delegated Regulation (EU) 2015/2205 of 6 August 2015 supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council with regard to regulatory technical standards on the clearing obligation

Categories of counterparties

For the purposes of Articles 3 and 4, the counterparties subject to the clearing obligation shall be divided in the following categories: (a) Category 1, comprising counterparties which, on the date of entry into force of this Regulation, are clearing members, within the meaning of Article 2(14) of Regulation (EU) No 648/2012, for at least one of the classes of OTC derivatives set out in the Annex to this Regulation, of at least one of the CCPs authorised or recognised before that date to clear at least one of those classes; (b) Category 2, comprising counterparties not belonging to Category 1 which belong to a group whose aggregate month-end average of outstanding gross notional amount of non-centrally cleared derivatives for January, February and March 2016 is above EUR 8 billion and which are any of the following: (i) financial counterparties; (ii) alternative investment funds as defined in Article 4(1)(a) of Directive 2011/61/EU of the European Parliament and of the Council (4) that are non-financial counterparties; (c) Category 3, comprising counterparties not belonging to Category 1 or Category 2 which are any of the following: (i) financial counterparties; (d) Category 4, comprising non-financial counterparties that do not belong to Category 1, Category 2 or Category 3.

2. For the purposes of calculating the group aggregate month-end average of outstanding gross notional amount referred to in point (b) of paragraph 1, all of the group's non-centrally cleared derivatives, including foreign exchange forwards, swaps and currency swaps, shall be included.

3. Where counterparties are alternative investment funds as defined in Article 4(1)(a) of Directive 2011/61/EU or undertakings for collective investment in transferable securities as defined in Article 1(2) of Directive 2009/65/EC of the European Parliament and of the Council (5), the EUR 8 billion threshold referred to in point (b) of paragraph 1 of this Article shall apply individually at fund level. |

Recitals 4 - 8 of the Commission Delegated Regulation (EU) 2015/2205 of 6 August 2015 supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council with regard to regulatory technical standards on the clearing obligation

(4) Different counterparties need different periods of time for putting in place the necessary arrangements to clear the interest rate OTC derivatives subject to the clearing obligation. In order to ensure an orderly and timely implementation of that obligation, counterparties should be classified into categories in which sufficiently similar counterparties become subject to the clearing obligation from the same date.

(5) A first category should include both financial and non-financial counterparties which, on the date of entry into force of this Regulation, are clearing members of at least one of the relevant CCPs and for at least one of the classes of interest rate OTC derivatives subject to the clearing obligation, as those counterparties already have experience with voluntary clearing and have already established the connections with those CCPs to clear at least one of those classes. Non-financial counterparties that are clearing members should also be included in this first category as their experience and preparation towards central clearing is comparable with that of financial counterparties included in it.

(6) A second and third category should comprise financial counterparties not included in the first category, grouped according to their levels of legal and operational capacity regarding OTC derivatives. The level of activity in OTC derivatives should serve as a basis to differentiate the degree of legal and operational capacity of financial counterparties, and a quantitative threshold should therefore be defined for division between the second and third categories on the basis of the aggregate month-end average notional amount of non-centrally cleared derivatives. That threshold should be set out at an appropriate level to differentiate smaller market participants, while still capturing a significant level of risk under the second category. The threshold should also be aligned with the threshold agreed at international level related to margin requirements for non-centrally cleared derivatives in order to enhance regulatory convergence and limit the compliance costs for counterparties. As in those international standards, whereas the threshold applies generally at group level given the potential shared risks within the group, for investment funds the threshold should be applied separately to each fund since the liabilities of a fund are not usually affected by the liabilities of other funds or their investment manager. Thus, the threshold should be applied separately to each fund as long as, in the event of fund insolvency or bankruptcy, each investment fund constitutes a completely segregated and ring-fenced pool of assets that is not collateralised, guaranteed or supported by other investment funds or the investment manager itself.

(7) Certain alternative investment funds ('AIFs') are not captured by the definition of financial counterparties under Regulation (EU) No 648/2012 although they have a degree of operational capacity regarding OTC derivative contracts similar to that of AIFs captured by that definition. Therefore AIFs classified as non-financial counterparties should be included in the same categories of counterparties as AIFs classified as financial counterparties.

(8) A fourth category should include non-financial counterparties not included in the other categories, given their more limited experience and operational capacity with OTC derivatives and central clearing than the other categories of counterparties.

ESMA's EMIR Q&As

OTC Question 24

Article 2 of Regulation (EU) 2015/2205 on the clearing obligation: Categories of counterparties

The clearing obligation (in relation to the first Regulation on the clearing obligation) takes effect on different dates depending on the classification of the counterparties to the OTC derivative transactions. When should counterparties have completed the process of (1) determining the category of counterparty to which they belong and (2) communicating this information to their OTC derivatives counterparties? What happens if a counterparty does not undergo the above process by that time?

OTC Answer 24

The first Delegated Regulation on the clearing obligation entered into force on 21 December 2015, therefore the obligations detailed in it apply to all concerned entities, in accordance with Article 4 of EMIR. The phase-in and the different frontloading start dates of this Regulation were introduced to provide sufficient time for counterparties to know to which category they and their own counterparties belong, and to prepare for the clearing of their relevant OTC derivative contracts.

Categories 1 and 4

CCPs have published the list of counterparties classified in Category 1 (see Section 1.3 of the Public Register on the Clearing Obligation). It is therefore assumed that counterparties in Category 1 have completed their self-classification and made this information available to their counterparties. In addition, for Category 1 counterparties, frontloading started to apply on 21 February 2016.

Category 4 is composed of some non-financial counterparties only. The counterparty classification between financial and non-financial counterparties should have been already completed as it is relevant for the compliance with other applicable requirements under EMIR (e.g. Article 11).

Categories 2 and 3

For counterparties which are neither in Category 1 nor in Category 4, the determination of the category of counterparty depends on the aggregate month-end average of outstanding gross notional amount of non-centrally cleared derivatives for January, February and March 2016 (at group level). In addition, the frontloading start date for counterparties in Category 2 is set at 21 May 2016.

Categorisation

Therefore, between March 2016 and 21 May 2016, counterparties should have completed the two following steps:

(1) determine whether they belong to Category 2 (in which case frontloading would be applicable to them as of 21 May 2016) or to Category 3 (in which case frontloading would not apply to them), and

(2) obtain from their counterparties in Categories 2 and 3 the outcome of their counterparty classification, and inform them that in the case this information is not provided by 21 May 2016, and where it is not possible for the counterparty to establish the category of the other counterparty, it will assume it is classified in category 2 for the purpose of compliance with the clearing obligation. In this situation, counterparties should immediately inform their counterparty of the assumption that has been made about them.

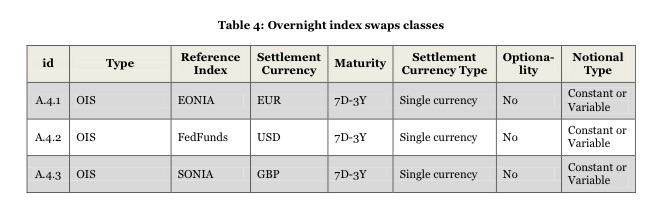

Contracts denominated in NOK, PLN and SEK

Another group of derivatives is covered by the Final Report Draft technical standards on the Clearing Obligation – Interest rate OTC Derivatives in additional currencies, of 10 November 2015 (ESMA/2015/1629).

The said Report builds on the documents related to the first RTS on OTC interest rate derivative classes denominated in the G4 currencies and proposes a clearing obligation for fixed-to-float interest rate swaps denominated in NOK, PLN and SEK and forward rate agreements denominated in NOK, PLN and SEK.

The detailed specification of the OTC derivatives classes subject to the clearing obligation pursuant to the said ESMA's Final Report of 10 November 2015 is as follows:

Fixed-to Float Interest Rate Swaps Classes

| id | Type |

Reference index |

Settlement currency |

Maturity | Settlement Currency Type |

Optionality |

Notional Type |

| C.1.1 |

Fixed-to-float |

NIBOR | NOK | 28D-10Y | Single currency | No |

Constant or Variable |

| C.1.2 | Fixed-to-float |

WIBOR | PLN | 28D-10Y | Single currency |

No |

Constant or Variable |

| C.1.3 | Fixed-to-float | STIBOR | SEK | 28D-10Y | Single currency | No | Constant or Variable |

Forward Rate Agreement Classes

| id | Type |

Reference index |

Settlement currency |

Maturity | Settlement Currency Type |

Optionality |

Notional Type |

| C.2.1 |

FRA |

NIBOR | NOK | 3D-2Y | Single currency | No |

Constant or Variable |

| C.2.2 | FRA |

WIBOR | PLN | 3D-2Y | Single currency |

No |

Constant or Variable |

| C.2.3 | FRA | STIBOR | SEK | 3D-2Y | Single currency | No | Constant or Variable |

The ESMA's Final Report findings as regards the clearing obligation for NOK, PLN and SEK have been implemented in the Commission Delegated Regulation of 10.6.2016 supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council with regard to regulatory technical standards on the clearing obligation, C(2016) 3446 final (Annex is available here).

Categories of counterparties for which different phase-in periods apply (NOK, PLN, SEK)

| Category |

Entities covered |

Phase-in

|

| 1 |

Clearing members for at least one of the classes of OTC IRS subject to clearing

|

9 February 2017 |

| 2 |

Financial counterparties and alternative investment funds (AIFs) which are not clearing members and which have a higher level of activity in OTC derivatives (to be measured against a quantitative threshold

|

9 July 2017 |

| 3 |

Financial counterparties and alternative investment funds (AIFs) which are not clearing members and which have a lower level of activity in OTC derivatives (to be measured against a quantitative threshold)

|

21 June 2019

- Commission Delegated Regulation (EU) 2017/751 of 16 March 2017 amending Delegated Regulations (EU) 2015/2205, (EU) 2016/592 and (EU) 2016/1178 as regards the deadline for compliance with clearing obligations for certain counterparties dealing with OTC derivatives

|

| 4 |

Non-financial counterparties not included in the other categories

|

9 July 2019 |

The Explanatory Memorandum to the said Regulation of 10.06.2016 reads:

"A threshold is laid down for distinguishing between counterparties in categories 2 and 3 based on their level of activity in OTC derivatives, which is to be calculated in the three months following the publication of the delegated act on the clearing obligation for Interest Rate Swaps (IRS) in G4 currencies in the Official Journal, excluding the month of the publication. It is appropriate to refer to the calculation period defined in the delegated act on the clearing obligation for Interest Rate Swaps (IRS) in G4 currencies as the dates of adoption of the two RTS are close enough to allow a large number of counterparties subject to this Regulation to perform this calculation only once by using the same reference period they used pursuant to the delegated act on the clearing obligation for Interest Rate Swaps (IRS) in G4 currencies, thus reducing their administrative burden, while being a meaningful reference period also for counterparties which do not currently clear IRS in G4 currencies and, therefore, will now need to undertake the calculation for determining the category they belong to. For funds, the threshold should be calculated at fund level, due to the segregated liability of funds.

Moreover, a different phase-in period is set out for intragroup transactions concluded between a counterparty established in a Member State and another counterparty established in a third country which belong to the same group and which fulfil certain conditions (3 years from the date of entry into force of the delegated act or an earlier date shortly after an equivalence decision is adopted regarding the third country), to allow for a sufficient period for the Commission to adopt equivalence decisions. During this period, no frontloading should take place.

The delegated act also lays down the minimum remaining maturities for the purposes of the frontloading requirement as well as the dates on which the frontloading should start (two months after the entry into force of the delegated act for categories 1 and 2)."

The said Regulation has been published in the Official Journal of the European Union on 20 July 2016 (Commission Delegated Regulation (EU) 2016/1178 of 10 June 2016 supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council with regard to regulatory technical standards on the clearing obligation). The rules enter into force on 9 August 2016.

In turn, the Brexit’s impact on the timelines of EMIR IRS mandatory clearing has been addressed by Commission Delegated Regulation (EU) 2019/565 of 28 March 2019 amending Delegated Regulation (EU) 2015/2205, Delegated Regulation (EU) 2016/592 and Delegated Regulation (EU) 2016/1178 supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council as regards the date at which the clearing obligation takes effect for certain types of contracts.

Regulatory chronicle

Regulatory chronicle

22 January 2024

11 October 2023

17 May 2022

8 February 2022

The Regulation amends the EMIR clearing obligation due to the cessation of the publication of LIBOR settings.

21 December 2020

28 March 2019

11 July 2018

ESMA Consultation Paper, Clearing Obligation under EMIR (no. 6), ESMA70-151-1530

16 March 2017

Overview of Fee Models of the EurexOTC Clear for Interest Rate Swaps

ESMA's EMIR Q&As OTC Question 24

Links

Links

Asset managers begin frontloading requirement