Reporting obligation under EMIR

- Category: EMIR reporting

The reporting requirement represents the most sweeping EMIR (Regulation 648/2012) innovation as all counterparties to all derivatives contracts (OTC and exchange-traded) need to comply and there are virtually no exceptions, all exchange and OTC derivative trades, trades with non-financial counterparties must be reported alike. As regards intragroup trades there is exemption available as from 17 June 2019, however, specific procedure and conditions must be observed in this regard.

Each opening of a new contract should be reported by the counterparties to the trade repository as a new entry, even if they are executed and then netted or terminated for other reasons during the same day. Furthermore, transactions have to be reported even if they are concluded with a counterparty that is not subject to the reporting obligation, such as an individual not carrying out an economic activity and who is consequently not considered as undertakings. In this context there is no surprise, derivatives reporting under EMIR is a massive process (in 2017 there had been on average more than 350 million trade reports submitted on a weekly basis to trade repositories).

According to the ESMA’s estimates, as of September 2017:

- a total of more than 17 billion new trades had been reported to the trade repositories (since the beginning of reporting in February 2014),

- the number of overall submissions including trades and lifecycle events exceeded 60 billion (Annex to the Statement by Steven Maijoor, Chair of ESMA to the ECON hearing, 9 October 2017, ESMA22-105-239, 2 October 2017).

However, it should be borne in mind that OTC derivatives reporting is a global initiative and different jurisdictions in different ways define the scope of OTC derivatives transactions that are reportable and the respective modalities.

Overall, approximately 26 trade repositories in 16 jurisdictions are either operational or have announced that they will be (Technical Guidance, Harmonisation of the Unique Transaction Identifier, Committee on Payments and Market Infrastructures, Board of the International Organization of Securities Commissions, February 2017, p. 2, 3).

Thus a transaction that is reportable in one jurisdiction may not be reportable in another jurisdiction or may have to be reported in a different way, for example:

− the definition of “OTC” varies between jurisdictions,

− some jurisdictions require that both counterparties to a transaction report the transaction (“double-sided reporting”) while other jurisdictions require only one of the counterparties to report the transaction (“single-sided reporting”),

− some jurisdictions permit the reporting of position data using the same format and to the same trade repositories as for the reporting of OTC derivatives transactions.

To facilitate compliance the relevant EU requirements and context have been described in greater detail in the table below.

|

EMIR reporting as a regulatory innovation |

Before EMIR there was only limited practical experience in the EU with the derivatives' reporting.

The MiFID Directive provided the EU Member States with the possibility to implement a reporting obligation also for derivatives, where the underlying is traded or admitted to trading but this was only implemented in some Member States.

Because of the restriction on the underlying, this obligation mostly covered standardised equity derivatives and generally did not include many other derivatives (see Final Report Review of the Regulatory and Implementing Technical Standards on reporting under Article 9 of EMIR of 13 November 2015 (ESMA/2015/1645), p. 3).

EMIR marks an entirely new experience with the derivatives' reporting, for two simple facts at least:

- trade reports under EMIR encompass not only equity derivatives, but all asset classes including derivatives on foreign exchanges, interest rates, commodities, indices and any other financial instruments, both OTC and on-exchange traded;

|

|

The subject of EMIR reporting

|

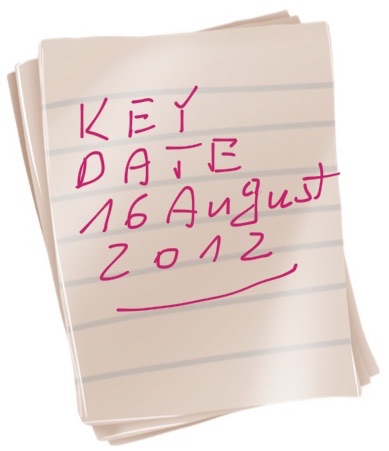

Reporting under EMIR covers concluded derivatives contracts which: (a) were entered into before 16 August 2012 and remain outstanding on that date; (b) are entered into on or after 16 August 2012.

as well as any modifications or terminations thereof.

The reporting start date is 12 February 2014, however, parties should be cognizant of the obligation to 'backload' data onto a trade repository from the above dates (see below for details).

In the context of backloading it is noteworthy, in the EMIR Review Report no. 4 of 13 August 2015 - ESMA input as part of the Commission consultation on the EMIR Review (2015/1254) ESMA recommended waiving the obligation to report contracts which were terminated before the reporting start date (i.e. 12 February 2014).

Proposed amendment to Article 9(1)(second paragraph) of EMIR was as follows: The reporting obligation shall apply to derivative contracts which: (a) were entered into before 12 February 2014 and remain outstanding on that date, or (b) were entered into on or after 12 February 2014.

This initiative is followed by the European Commission's Proposal of May 2017 for a Regulation of the European Parliament and of the Council amending Regulation (EU) No 648/2012 as regards the clearing obligation, the suspension of the clearing obligation, the reporting requirements, the risk-mitigation techniques for OTC derivatives contracts not cleared by a central counterparty, the registration and supervision of trade repositories and the requirements for trade repositories, COM(2017)208).

Among legislative modifications envisioned in the said document is the removal of backloading requirement, hence the reporting on historic transactions would no longer be required.

Recital 11 of the said draft Regulation foresees that: "Reporting historic transactions has proven to be difficult due to the lack of certain reporting details which were not required to be reported before the entry into force of Regulation (EU) No 648/2012 but which are required now. This has resulted in a high reporting failure rate and poor quality of reported data, while the burden of reporting those transactions is significant. There is therefore a high likelihood that those historic data will remain unused. Moreover, by the time the deadline for reporting historic transactions becomes effective, a number of those transactions will have already expired and, with them, the corresponding exposures and risks. To remedy that situation, the requirement to report historic transactions should be removed."

The legislative proposal impact assessment observes that the requirement to report historic trades was intended to give regulators a complete overview of the derivative markets since the entry into force of EMIR by providing them with relevant historic reference data and thus enable regulators to obtain a picture of potential ongoing risks and exposures, this has however not happened because this requirement is virtually impossible to fulfil.

Very high failure rates were caused by the lack of certain reporting elements which were not required at the respective time or by the lack of a requirement to use the Legal Entity Identifier (LEI) prior to the start of the reporting obligation

The start date for reporting collateral and valuations (applicable to financial counterparties (FCs) and non-financial counterparties above the clearing threshold (NFCs+)) is 11 August 2014.

Reporting obligation under EMIR is not restricted to derivatives concluded OTC only but applies to all derivatives (exchange-traded and intra-group including).

As was said above, the prominent feature of EMIR trade reporting is it includes not only data on the transaction itself, but also information on clearing, on-going valuation and collateralisation.

'Derivative contract' or 'derivative' under EMIR means a financial instrument as set out in points (4) to (10) of Section C of Annex I to Directive 2004/39/EC (MiFID), as implemented by Article 38 and 39 of Regulation (EC) No 1287/2006.

Hence, any change to the scope of the definitions of derivatives in MiFID has a direct effect on the scope of EMIR, in particular the derivatives' reporting obligation.

This involves serious regulatory risk, as any misinterpretation whether a particular contract represents a derivative (and, consequently, financial instrument) may follow with non-compliance versus EMIR reporting requirements.

What is particularly noteworthy from practical point of view, physically settled forwards traded on an MTF are considered OTC derivatives (included in Section C6 of Annex I to the MiFID Directive - see:

- Guidelines on the application of C6 and C7 of Annex 1 of MiFID of 20 October 2015 (ESMA/2015/1341);

hence, subject to EMIR reporting.

|

|

Entities under the reporting obligation

|

Reporting requirement under EMIR is imposed on both counterparties to the contract - to ensure data quality.

Article 9(1) of EMIR requires all counterparties and CCPs to ensure that the details of any derivative contract that they have concluded, as well as any modification or termination of such a contract, are reported to trade repositories.

It is noteworthy that the reporting obligation in the EU applies equally to financial counterparties and all non-financial counterparties in the meaning of EMIR - irrespective of whether the non-financials are above or below the clearing threshold.

In the EU both sides to the transaction have the obligation to report the contract in a system known as 'double-sided reporting' (as opposed to 'single-sided reporting', where only one party to the transaction reports).

This feature of the European Union OTC derivatives' reporting scheme, although resembles several other jurisdictions globally, (e.g. Australia, Brazil, Hong Kong, Japan and Mexico), differentiates from the analogous system applied in the United States (where only one side of a transaction has to report.

The transition from a two-sided to one-sided system was deliberated in the EU.

The European Commission's Staff considered, however, the following pros and cons of the double-sided and single-sided reporting.

The European Commission's Staff refers, firstly, to the fact that, when both counterparties to a trade are required to report data on their transaction, all elements of the reported data should match.

Where the data do not match, this is a clear indication that there is a problem either with the reporting or, in the worst case scenario, with the underlying transaction.

The trade repository can then request the two sides to verify their data with a view to reconciling the trade.

In a single-sided reporting system, this automatic check does not exist, and the trade repository has to trust that the reporting counterparty has submitted correct data.

As such, double-sided reporting generally results in higher rather than lower quality of data in trade repositories, which, in turn, means that the data is more useful.

Also, double-sided reporting simplifies the enforcement of the reporting obligation.

With this system, there is no doubt that both counterparties to the trade need to report the transaction, and there is no excuse for not doing so.

In a single-sided reporting system, sometimes quite complex rules are necessary for defining which counterparty is responsible for reporting the trade.

There are known instances where trades have gone unreported as both sides to the trade claimed that they believed the obligation to report was on the other counterparty.

With double-sided reporting, such situations will not occur by definition.

ESMA generally shares the view that double-sided reporting ensures better data quality and recommends in its contribution that this reporting system be maintained, although it suggests that the approach taken in the Securities Financing Transactions Regulation ('SFTR'), to exempt from reporting small and medium-sized non-financial counterparties, could be considered.

The European Commission's Proposal for a Regulation of the European Parliament and of the Council amending Regulation (EU) No 648/2012 as regards the clearing obligation, the suspension of the clearing obligation, the reporting requirements, the risk-mitigation techniques for OTC derivatives contracts not cleared by a central counterparty, the registration and supervision of trade repositories and the requirements for trade repositories, COM(2017)208 of May 2017 envisions the modification that transactions between a financial counterparty and a small non-financial counterparty (i.e. the non-financial counterparty that is not subject to the clearing obligation as being below the clearing threshold) would be reported by the financial counterparty on behalf of both counterparties.

Recital 14 of the said European Commission's draft Regulation reads:

"To reduce the burden of reporting for small non-financial counterparties, the financial counterparty should be responsible, and legally liable, for reporting on behalf of both itself and the non-financial counterparty that is not subject to the clearing obligation with regard to OTC derivative contracts entered into by that non-financial counterparty as well as for ensuring the accuracy of the details reported."

Draft Report of 26 January 2018 of the European Parliament (Committee on Economic and Monetary Affairs) proposed to add in this regard two modifications to the European Commission’s proposal of May 2017:

- firstly - to ensure that the financial counterparty has the data needed to fulfil its reporting obligation, the non-financial counterpartied are required to provide the details relating to the OTC derivative transactions that the financial counterparty cannot be reasonably expected to possess, and

- secondly - the right is proposed to be granted for non-financial counterparties to choose to report their OTC derivatives contracts on their own, in which case they should inform the financial counterparty accordingly (in such cases, the non-financial counterparty should remain responsible and legally liable for reporting that data and for ensuring its accuracy).

These modifications have been accepted, as finally, Article 9(1a) of EMIR as amended by EMIR REFIT provides that: “Financial counterparties shall be solely responsible, and legally liable, for reporting on behalf of both counterparties, the details of OTC derivative contracts concluded with a non-financial counterparty that does not meet the conditions referred to in the second subparagraph of Article 10(1) [of EMIR], as well as for ensuring the correctness of the details reported.”

The same Article requires that “To ensure that the financial counterparty has all the data it needs to fulfil the reporting obligation, the non-financial counterparty shall provide the financial counterparty with the details of the OTC derivative contracts concluded between them, which the financial counterparty cannot be reasonably expected to possess. The non-financial counterparty shall be responsible for ensuring that those details are correct.”

ESMA Consultation Paper of 26 March 2020 (Technical standards on reporting, data quality, data access and registration of Trade Repositories under EMIR REFIT, ESMA74-362-4; p. 13) summarises the issue - as it stands after the EMIR REFIT - as follows:

- the responsibility and liability of the financial counterparties (FC) for the reporting on behalf of the non-financial counterparty that does not meet the conditions referred to in the second subparagraph of Article 10(1) of EMIR (hereafter “NFC-”), is a new provision introduced by EMIR REFIT (it aims to reduce the burden of reporting OTC derivative contracts for NFC-);

- taking into consideration that as from 18/06/2020, FC in principle will be responsible and legally liable for the reporting of the derivatives’ details and their correctness (unless the NFC- chooses to report itself), such FC must ensure to have at their disposal all the necessary information in a timely manner in order to report all details received correctly and no later than T+1;

- the NFC- remain responsible for ensuring that the details provided are correct, however, NFC- are not required to report data on collateral, mark-to-market, or mark-to-model valuations of the contracts (Article 3(4) of the current RTS on reporting) - therefore, the scope of data to be provided by NFC- to FC that is responsible for their reporting, remains limited.

Considering that FC are a counterparty to the OTC derivative contracts concluded with NFC-, they shall already have at their disposal the information specific to the contracts as well as all information related to the other counterparty i.e. the NFC-.

In particular, the FC should possess the information related to the other counterparty, given that the FC will be expected to report it also in its own report.

ESMA is of the view that FC may not be reasonably expected to possess only the data related to the specific elements of the derivative and therefore only such elements shall be communicated by the NFC- to the FC.

In conclusion, NFC- shall provide at the conclusion of the OTC derivative contracts, the following information: Further, on 28 May 2020 the ESMA has updated the EMIR Q&As where the newly added Trade Repository (TR) Q&A 54 provides more extensive clarifications on reporting of OTC derivatives by a FC on behalf of a NFC- under EMIR Refit.

The text of the clarification is available here.

Delegation of reporting

It is the EMIR binding rule that while a counterparty or a CCP may delegate the reporting to another actor, this does not exonerate it from the obligation to report the transaction.

It is, moreover, noteworthy, under EMIR counterparties are required to ensure that data reported is agreed between both parties to a trade.

This obligation stems from the requirement of Article 9(1) of EMIR, which require counterparties and CCPs to ensure that the details of their derivative contracts are reported without duplication.

In case of derivative contracts composed of a combination of derivative contracts which need to be reported in more than one report, counterparties must also agree on the number of reports to be submitted to report such a contract (Recital 1 and 4 and Article 1 of the Commission Delegated Regulation (EU) of 19.10.2016 amending Commission Delegated Regulation (EU) No 148/2013 supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council on OTC derivatives, central counterparties and trade repositories with regard to regulatory technical standards on the minimum details of the data to be reported to trade repositories).

The specific category of counterparties under the EMIR reporting obligation are CCPs.

Counterparties to the contract or a CCP may also delegate reporting, however it must be ensured that the duplication is avoided.

ESMA in its Questions and Answers on EMIR explained that the requirement to report without duplication means that "each counterparty should ensure that there is only one report (excluding any subsequent modifications) produced by them (or on their behalf) for each trade that they carry out.

Their counterparty may also be obliged to produce a report and this also does not count as duplication.

Where two counterparties submit separate reports of the same trade, they should ensure that the common data are consistent across both reports."

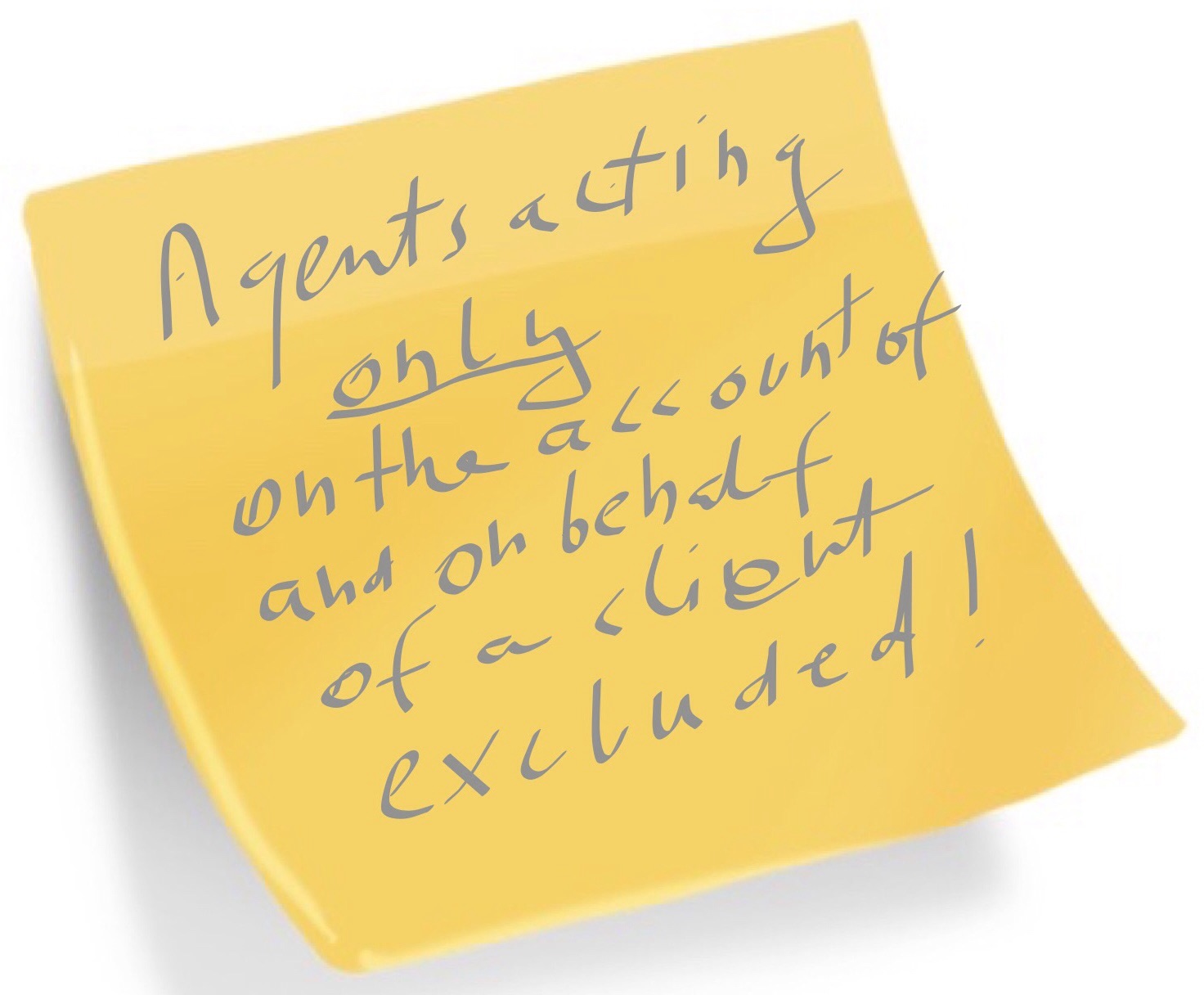

FCA in its presentation expressed a view that brokers and dealers do not have a reporting obligation under EMIR when they act purely in an agency capacity, however, there is still some uncertainty over how to report transactions where a broker, dealer or clearing member clears or facilitates a transaction for a client on a principal basis.

The ESMA stance in that regard is that in the particular case of an investment firm that is not a counterparty to a derivative contract and it is only acting on the account of and on behalf of a client, by executing the order in the trading venue or by receiving and transmitting the order, such firm will not be deemed to be a counterparty to the contract and will not be expected to submit a report under EMIR.

Where an entity is fulfilling more than one of these roles (for example, where the investment firm is also the clearing member) then it does not have to report separately for each role and should submit one report identifying all the applicable roles in the relevant fields.

However, ESMA's Final Report, Draft technical standards on data to be made publicly available by TRs under Article 81 of EMIR, 10 July 2017, ESMA70-151-370 observes (p. 14) the current reporting logic under EMIR does not allow to accurately distinguishing in all cases between the trades where the clearing member is clearing for its clients from those where it is clearing trades concluded on its own account.

|

|

Trade repositories (TRs) |

The derivatives contracts are to be reported to a trade repository registered with ESMA or recognised by ESMA.

In principle, where a trade repository is not available to record the details of a derivative contract (which is not the case currently), such details should be reported to ESMA.

ESMA approved on 7 November 2013 the registrations of the first four trade repositories under EMIR: - DTCC Derivatives Repository Ltd. (DDRL), based in the United Kingdom; - Krajowy Depozyt Papierów Wartosciowych S.A. (KDPW), based in Poland; - Regis-TR S.A., based in Luxembourg; and - UnaVista Ltd, based in the United Kingdom. The registrations took effect on 14 November 2013. This means that the requirement to report derivatives transactions to trade repositories under EMIR came into force on 12 February 2014, i.e. 90 calendar days after the official registration date.

Moreover, on 28 November 2013 ESMA approved the registrations of two further trade repositories for the European Union: - ICE Trade Vault Europe Ltd. (ICE TVEL), based in the United Kingdom; and

In the relevant communication ESMA confirmed that all the above trade repositories registered in the EU can be used for trade reporting.

The registered trade repositories covered all derivative asset classes (with the exception of ICE Trade Vault Europe Ltd., which covered commodities, credit, equities, interest rates) irrespective of whether the contracts are traded on or off exchange.

On 31 May 2017 ESMA registered as the trade repository under the EMIR, with effect from 7 June 2017, the Bloomberg Trade Repository Limited based in the United Kingdom.

They were followed the NEX Abide Trade Repository AB based in Sweden registered by ESMA with effect as from 24 November 2017 (registration covers commodities, credit, foreign exchange, equities and interest rates).

The above registrations bring the total number of TRs registered in the EU, which can be used for trade reporting, to eight.

It is possible to meet the reporting obligation by reporting to any ESMA-recognised trade repository.

The ESMA's actual list of approved trade repositories is available under the link.

The possibility for CCPs' applying for registration as a trade repository is legally excluded.

Trade repository is allowed to perform ancillary services, Article 78(5) of EMIR, however, requires these services to be operationally separate.

Entities authorised to provide other regulated activities cannot be prevented from applying for registration as a trade repository unless they are prevented from doing this by other sectoral legislation.

In these cases, similarly to the cases of ancillary activities, the regulated activities performed by the trade repository should be operationally separated from the trade repository activity.

Potential practical problem when it comes to trade repositories services may be whether they are fully authorised to add additional, diverging fields to the reporting standards as laid down in the EMIR secondary legislation. Existing practice indicates trade repositories are making use of such a freedom, however, in such a way creating one of the potential causes for trade reports mismatches.

Inevitably, fully mandatory reporting standard, where any modifications or deviations made by trade repositories would not be allowed, if set by ESMA, would contribute to establishing transparent derivatives' reporting infrastructure. It would also ease the reporting burden on the part of market participants, where some reporting mismatches are not caused by market participants' negligence, but are a simple consequence of using different trade repository services. The prescriptive specification of "matching fields" of the trade report would also facilitate full convergence.

|

|

Timelines for reporting

|

Reporting must be effected no later than the working day following the conclusion, modification or termination of the contract (Article 9 of EMIR).

All information should be reported at the end of the day in the state that it is in at that point. Intraday reporting is not mandatory (ESMA clarification in the EMIR Q&As document).

As regards the timeframe for reporting exchange-traded derivatives transactions (ETDs) cleared by the CCP, regulatory guidance issued by ESMA confirmed that where clearing takes place on the same day of execution, the report should be submitted once to a trade repository up to 1 working day after the execution, as provided under Article 9 EMIR.

ESMA has made a reservation that in rare cases where clearing takes place after the day of execution and after reporting is made, novation should be reported as an amendment to the original report up to 1 day after the clearing took place.

Where no contracts are concluded, modified or terminated no reports are expected apart from updates to valuations or collateral as required.

It means if a counterparty does not enter into any new derivative transaction during several days, there is no obligation to report the already concluded transactions every day to the TR.

European financial authorities have clearly acknowledged: "[a]s the obligation to report shall be complied with at T+1 (T being the date of conclusion/modification/termination of the contract), there is no other need to send daily reports if there are no conclusion, modifications to the contract or termination."

One should not, however, omit the fact that transactions executed during the same day that are netted or terminated for other reasons, are nevertheless required to be reported to TRs as any other trades.

When it comes to a "business day" definition (which may be significant when the counterparties to the same transaction follow different calendars), according to the ESMA for EMIR reporting purposes counterparties should follow their local time to determine the day on which the derivative was concluded, modified or terminated (the TR Question 11 as amended on 8 July 2020) - the deadline for reporting is the working day following that day.

According further to the said clarification:

|

|

Recordkeeping |

Counterparties must keep a record of any derivative contract they have concluded and any modification for at least five years following the termination of the contract.

|

|

Disclosure clause |

EMIR general rule is a counterparty or a CCP that reports the details of a derivative contract to a trade repository or to ESMA, or an entity that reports such details on behalf of a counterparty or a CCP must not be considered in breach of any restriction on disclosure of information imposed by that contract or by any legislative, regulatory or administrative provision. No liability resulting from that disclosure lies with the reporting entity or its directors or employees.

In practice, industry standards, such as:

- the ISDA 2013 Portfolio Reconciliation, Dispute Resolution and Disclosure Protocol published by the International Swaps and Derivatives Association, Inc. (the "ISDA Protocol"), and - EFET's form of EMIR Risk Mitigation Techniques Agreement (the ERMTA),

implement this rule into master agreements, however, even in the absence of such contractual provision, by virtue of the law itself the disclosure made pursuant to EMIR reporting requirements mustn't be considered a contract violation.

Among the possible practical situations is the one where a counterparty is established in a third country whose legal framework prevents the disclosure of its identity by the European counterparty subject to the EMIR reporting obligation. The issue may consequently arise, how the counterparty field of the EMIR reporting format should be filled by the European counterparty.

EMIR is rigorous in this matter. Article 9(5) EMIR provides that at least the identities of the parties to the derivative contracts should be reported to trade repositories. The European financial authorities underline this requirement cannot be waived. Therefore, a European counterparty dealing with counterparties that cannot be identified because of legal, regulatory or contractual impediments, would not be deemed compliant with Article 9(5) of EMIR.

|

|

Sources of law on EMIR reporting

|

The main source of the European Union law on the respective scope is the EMIR itself: Regulation No 648/2012 of the European Parliament and Council of 4 July 2012 on OTC derivatives, central counterparties and trade repositories.

Moreover, Article 9 of EMIR provided a mandate for ESMA to draft regulatory and implementing technical standards (RTS and ITS) on a consistent application of the reporting obligation for counterparties and CCPs.

In 2012 and 2013 ESMA fulfilled its mandate and submitted those drafts to the European Commission, which became the Regulation No 148/2013 (RTS) and Regulation No 1247/2012 (ITS):

- Commission Delegated Regulation (EU) No 148/2013 of 19 December 2012 supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council on OTC derivatives, central counterparties and trade repositories with regard to regulatory technical standards on the minimum details of the data to be reported to trade repositories - RTS (note that Delegated Regulation (EU) No 148/2013 is repealed by the Commission Delegated Regulation of 10 June 2022 supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council with regard to regulatory technical standards specifying the minimum details of the data to be reported to trade repositories and the type of reports to be used);

ESMA delivered its Final Report on EMIR reporting secondary legislation on 27 September 2012 (ESMA document 2012/600), i.e. three months after the publication of EMIR. The standards were endorsed, published and entered into force: RTS on 15 March 2013, and ITS on 10 January 2013 (but also with effect from 15 March 2013).

RTS consists of a list of reportable fields providing a definition of what the content should include. The RTS also explains how to report in the situation when one counterparty reports also on behalf of the other counterparty to the trade, the reporting of trades cleared by a CCP and the conditions and start date for reporting valuations and information on collateral.

In addition, the ITS consists of a list of reportable fields prescribing formats and standards for the content of the fields. The ITS also defines the frequency of valuation updates and various modifications which can be made to the report, as well as waterfall approach of possible methods for identifying counterparties and the product traded. Furthermore, it describes the timeframe by which all trades should be reported included historic trades which are required to be backloaded.

The amendments to the EMIR reporting standards were highlighted by the ESMA Consultation Document, Review of the technical standards on reporting under Article 9 of EMIR of 10 November 2014 (ESMA/2014/1352).

The above Consultation Document was followed by:

In October 2016 the two above Regulations have been amended - see:

Both standards will apply from 1 November 2017, except for Article 1(5) of the ITS (delaying the backloading requirement), which applies from 10 February 2017.

However:

- the reporting entities are not obliged to update all the outstanding trades upon the application date of the revised technical standards, and

- they are required to submit the reports related to the old outstanding trades only when a reportable event takes place (e.g. when the trade is modified).

Reform of the EMIR reporting scheme of November 2017 is a major one - almost 80% of the fields are new, or changed - there are 51 new fields, 22 amended fields and seven deletions.

For details on the transition to the new EMIR technical standard on reporting see below the excerpt - TR Question 44 [last update 2 February 2017].

Further legislative modifications with respect to EMIR derivatives reporting requirements are envisioned as part of the broader process of the EMIR review - see:

The European Parliament‘s Committee on Economic and Monetary Affairs presented its stance in this regard in the Draft Report of 26 January 2018 on the proposal for a regulation of the European Parliament and of the Council amending Regulation (EU) No 648/2012 as regards the clearing obligation, the suspension of the clearing obligation, the reporting requirements, the risk- mitigation techniques for OTC derivatives contracts not cleared by a central counterparty, the registration and supervision of trade repositories and the requirements for trade repositories (COM(2017)0208 – C8-0147/2017 – 2017/0090(COD)).

ESMA's Questions and Answers on EMIR (Q&As) represent non-legislative and periodically-updated piece of knowledge about required format of EMIR reporting.

Q&As deal with the most urgent issues, clarifiy some interpretations of required data fields, and are issued to ensure the consistent application of EMIR and its RTS and ITS (see EMIR Q&As).

The trade repositories' activities are regulated in detail by the Commission Delegated Regulation (EU) No 150/2013 of 19 December 2012 supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council on OTC derivatives, central counterparties and trade repositories with regard to regulatory technical standards specifying the details of the application for registration as a trade repository

|

|

Access to aggregate public data on EMIR derivatives reporting |

Websites with aggregate public data on EMIR derivatives reporting are the following:

|

|

EMIR reporting analytics

|

Since February 2014, when derivatives reporting began in Europe, the European TRs have received more than 16 billion submissions, with average weekly submissions over 300 million (ESMA assessments - communication of 29 May 2015).

In April 2015 alone, more than 200 million new trades were added: • 55% were exchange-traded derivatives (ETD) trades;

The largest portion of OTC trades was made up of foreign exchange derivatives (56%); whilst ETD trades were mainly split into Commodities (33%), Equities (27%) and Interest rates (19%) trades.

ESMA Annual Report 2014 of 15 June 2015 (2015/934) estimated the number of entities, which have direct reporting agreements with trade repositories as nearly 5,000.

|

|

Intragroup transactions |

Intragroup transactions are defined in Article 3 of EMIR as OTC derivative contracts entered into with another counterparty which is part of the same group.

Intragroup derivative transactions are usually carried out to hedge against certain market risks or aggregate such risks at the level of the group.

In general, with the exception of certain risk-mitigation techniques, from which intragroup transactions are exempt under certain conditions, other EMIR requirements apply to intragroup trades in the same way as they do to all other transactions.

Until 17 June 2019 there was no exemption available for intragroup trades from the EMIR reporting obligation, hence, until the said date they should be reported as any other trades.

Under the EMIR reporting format, the applicable field "Intragroup" for reporting such information initially was Field 32, and after amendments made by:

- Commission Delegated Regulation (EU) of 19.10.2016 amending Commission Delegated Regulation (EU) No 148/2013 supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council on OTC derivatives, central counterparties and trade repositories with regard to regulatory technical standards on the minimum details of the data to be reported to trade repositories, and

- Commission Implementing Regulation (EU) of 19.10.2016 amending Implementing Regulation (EU) No 1247/2012 laying down implementing technical standards with regard to the format and frequency of trade reports to trade repositories according to Regulation (EU) No 648/2012 of the European Parliament and of the Council on OTC derivatives, central counterparties and trade repositories;

the Field 38 in the Table 2 (Common data).

This field is intended to be populated with information on "whether the contract was entered into as an intragroup transaction, defined in Article 3 of Regulation (EU) No 648/2012."

The said field in the case of intragroup transactions should be filled with the value "Y" = "Yes", and, in the opposite situation, with the value "N" = "No".

According to the Proposal for a Regulation of the European Parliament and of the Council amending Regulation (EU) No 648/2012 as regards the clearing obligation, the suspension of the clearing obligation, the reporting requirements, the risk-mitigation techniques for OTC derivatives contracts not cleared by a central counterparty, the registration and supervision of trade repositories and the requirements for trade repositories (COM(2017)208) of May 2017, intragroup transactions have been envisioned to be excluded from EMIR reporting, if one of the counterparties is a non-financial counterparty.

Recital 12 of the said Proposal reads:

"Intragroup transactions involving non-financial counterparties represent a relatively small fraction of all OTC derivative transactions and are used primarily for internal hedging within groups. Those transactions therefore do not significantly contribute to systemic risk and interconnectedness, yet the obligation to report those transactions imposes important costs and burdens on non-financial counterparties. Intragroup transactions where at least one of the counterparties is a non-financial counterparty should therefore be exempted from the reporting obligation."

The European Commission's Staff impact assessment accompanying the said legislative draft expands this argumentation by indicating that - due to netting of internal contracts within the corporate groups - current inclusion of intragroup transactions in the EMIR reporting requirement results in as much as a threefold increase in the number of transactions which need to be reported - while not contributing to the overall risk profile of the group.

The legislators also refer to examples from other jurisdictions like the CFTC in the United States) which have excluded non-financial counterparties and small financials from the requirement to report their intragroup transactions.

Other important considerations are high bureaucratic burden due to the significant volumes of such trades but also to the fact that every entity in the group needs to be assigned a LEI.

Draft Report of 26 January 2018 of the European Parliament (Committee on Economic and Monetary Affairs) proposed to add special emphasis to the above amendment (while retaining all other preconditions), namely, that intragroup transactions with a non-financial counterparty’s participation should be exempted from the reporting obligation regardless of the non-financial counterparties’ place of establishment.

European Parliament’s Committee on Economic and Monetary Affairs argues that the intention of this modification is to exempt from the reporting obligation all transactions worldwide within a group.

The above amendments have been finally adopted in the Regulation (EU) 2019/834 of the European Parliament and of the Council of 20 May 2019 amending Regulation (EU) No 648/2012 as regards the clearing obligation, the suspension of the clearing obligation, the reporting requirements, the risk-mitigation techniques for OTC derivative contracts not cleared by a central counterparty, the registration and supervision of trade repositories and the requirements for trade repositories (EMIR REFIT), which on 28 May 2019 has been published in the Official Journal of the EU (the date of entry into force on 17 June 2019).

The intragroup EMIR reporting exemption has been, however, granted under certain conditions and subject to a specific procedure - for details see EMIR – intra-group transactions exemption.

|

Timelines for reporting

The requirement to report derivatives transactions to trade repositories under EMIR came into force on 12 February 2014 (90 days after recognition of a relevant trade repository by ESMA).

Reporting of exposures is required, for FC and NFC+ only, 180 days after the reporting start date, i.e. as from 11 August 2014.

Backloading existing trades:

• If outstanding at time of reporting date;

- 90 days to report to TR

• If not outstanding, but were outstanding between 16 August 2012 and reporting date;

- 3 years to report to TR (note that Commission Implementing Regulation of 19.10.2016 extended this term to 5 years)

Transactions within the same legal entity

Transactions within the same legal entity (e.g. between two desks or between two branches with the same LEI) need not to be reported because they do not involve two counterparties.

Non-European subsidiaries of a group for which the parent undertaking is established in the European Union

The reporting obligation to trade repositories applies to counterparties established in the European Union. Therefore, non-European subsidiaries of European entities are not subject to the reporting obligation. In the case of contracts between a EU counterparty and a non-EU counterparty, the EU counterparty will need to identify the non-EU counterparty in its report.

Note, ESMA made a specific remark with respect to reporting deadlines for the EU-relocated businesses (Q&A document referred to above).

Reporting compliance strategy

When it comes to EMIR reporting compliance strategy the fundamental choice for market participants is whether to report derivatives themselves or to delegate reporting to their counterparty or another service provider.

EMIR reporting: products and services

Point Nine Data Trust - fully automated regulatory reporting solution, reports excess of 5 million trades on a daily basis to all the major trade repositories and relevant authorities, acts as a service provider for a range of customers including corporates, retail FX brokers, funds, investment firms, asset managers and banks:

- Data extraction/receipt from systems/ third parties,

- Data Validations as per regulations,

- Data Enrichment,

- UTI Generation/Management,

- Collateral reporting,

- Valuation reporting,

- Trade/Transaction/Position reporting,

- File creation and certification,

- Acknowledgement and transmission Success/Failure notification,

- Exception Management,

- Connectivity to trade repos, and/or ARMs,

- Assistance in eligibility of reportable financial instruments,

- Error handling,

- Full audit trail,

- Access to P9 web portal,

- End of day email notifications.

The above list contains the links to products and services relative to the EMIR reporting. The list is provided for informational purposes and the administrator of Emissions-EUETS.com assumes no responsibility for its usage.

Where firms choose the option to report themselves, they face, in turn, the dillema which trade repository to use.

There are the following possibilities regarding practical configurations as regards reporting:

1) one counterparty delegates on the other counterparty;

2) one counterparty delegates on a third party;

3) both counterparties delegate on a single third party;

4) both counterparties delegate on two different third parties.

A third party may perform the function of reporting for the counterparties to the trade only through a previous agreement (on behalf of one or both counterparties), nevertheless the obligation to report lies always on the counterparties to a trade.

When reporting is delegated it is advisable for firms to safeguard free access to data included in their EMIR reports, in order to check that their reports are being correctly submitted to the trade repository. Trade repositories often offer such a type of membership (enabling only access to trade reports already entered by other counterparties), which involves significantly reduced membership fees.

When it comes to contractual tools for the EMIR reporting delegation, see, for instance, ISDA/FOA EMIR Reporting Delegation Agreement.

Brokers' role

It is useful to note that among elements to be reported is also the indication as regards the trading capacity i.e. parameter which identifies whether the reporting counterparty has concluded the contract as principal on own account (on own behalf or behalf of a client) or as agent for the account of and on behalf of a client. It is important to take into account that investment firms that provide investment services (like execution of orders or receipt and transmission of orders) do not have any obligation to report under EMIR unless they become a counterparty of a transaction by acting as principal; nothing prevents counterparties to a derivative to use an investment firm (as a broker) as a third party for TR reporting, but this is a general possibility in all cases.

When counterparty is dealing bilaterally with another counterparty through a broker, which acts as agent (introducing broker) the said broker is not signing or entering into any derivative contract with any of the counterparties and, consequently, is not considered as a counterparty under EMIR, thus also not being under the duty to report.

Moreover, in the particular case when the investment firm is not involved in the process of receiving and/or posting any collateral for the client because of direct arrangements between the client and the clearing member, the investment firm is not expected to submit any report on the value of the collateral, or on any subsequent modification as well as termination of the concluded derivative contract. So, when reporting the conclusion of a derivative contract in the trading venue the two trading scenarios should be distinguished: one in which the investment firm is itself a counterparty to the trade (in the sense meant by EMIR) and the other in which it is not, but just acted on the account of and on behalf of the client to execute the trade.

In the case of an investment firm that is not a counterparty to a derivative contract and it is only acting on the account of and on behalf of a client, by executing the order in the trading venue or by receiving and transmitting the order, such firm will not be deemed to be a counterparty to the contract and will not be expected to submit a report under EMIR. In turn, where an entity is fulfilling more than one of these roles (for example, where the investment firm is also the clearing member) then it does not have to report separately for each role and should submit one report identifying all the applicable roles in the relevant fields.

Technical rules for reporting trades with the broker participation are as follows:

- if a counterparty is itself the beneficiary to a trade it should be reported in both the "counterparty" and "beneficiary" fields;

- if a counterparty is itself the Clearing Member (CM) to a trade, it should it be reported in both the "counterparty" and "CM" fields;

-if a CM is itself the broker to a trade, it should be reported in both the "CM" and "broker" fields;

- if a broker is itself the counterparty (legal principal) to a trade, it should it be reported in both the "broker" and "counterparty" fields (ESMA Q&A, TR Question 9).

CCPs’ role in derivatives' reporting under EMIR

Article 9 provides that counterparties and CCPs should ensure reporting, not only CCPs. Counterparties and CCPs should ensure that there is no duplication of the reporting details by way of agreeing on the most efficient reporting method, to avoid duplication.

Commission Delegated Regulation of 19.10.2016 amending Commission Delegated Regulation (EU) No 148/2013 supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council on OTC derivatives, central counterparties and trade repositories with regard to regulatory technical standards on the minimum details of the data to be reported to trade

Recital 2

It is important to also acknowledge that a central counterparty (CCP) acts as a party to a derivative contract. Accordingly, where an existing contract is subsequently cleared by a CCP, it should be reported as terminated and the new contract resulting from clearing should be reported

Article 2 of the Commission Delegated Regulation No 148/2013 as amended by the Commission Delegated Regulation of 19.10.2016

Article 2

Cleared trades

1. Where a derivative contract whose details have already been reported pursuant to Article 9 of Regulation (EU) No 648/2012 is subsequently cleared by a CCP, that contract shall be reported as terminated by specifying in field 93 in Table 2 of the Annex the action type "Early Termination", and new contracts resulting from clearing shall be reported.

2. Where a contract is both concluded on a trading venue and cleared on the same day, only the contracts resulting from clearing shall be reported.

In the scenario where the CCP and counterparties use different TRs, it is possible that the CCP reports that the contract has been cleared in a TR different from the TR in which the contract has been originally reported by the counterparties. CCPs and counterparties should then do so with consistent data, including the same trade ID and the same valuation information to be provided by the CCP to the counterparties.

When it comes to the CCP's ID the practical issue arose with respect to derivative contract cleared by an entity which is not a CCP within the meaning of EMIR (e.g. a clearing house).

The ambiguity was whether the clearing house be identified in the field "CCP ID". ESMA referred to this point in its Q&As on EMIR and its answer was in the negative. Pursuant to the EU financial regulator the field "CCP ID" should only be populated with the identifier of a CCP, i.e. a central counterparty which meets the definition of Article 2(1) of EMIR.

In the same interpretation issued on 26 July 2016 ESMA also explained that if the transaction is executed in an anonymised market and cleared by a clearing house the counterparty executing the transaction should request the trading venue or the clearing house that matches the counterparties to disclose before the reporting deadline the identity of the other counterparty.

Under Article 9 of EMIR, both the counterparties and the CCP have an obligation to ensure that the report is made without duplication, but neither the CCP nor the counterparties have the right to impose on the other party a particular reporting mechanism. However, when offering a reporting service the CCP can choose the TR to be used and leave the choice to the counterparty on whether to accept or not the service for its trade to be reported by the CCP on its behalf.

The requirement to report without duplication means that each counterparty should ensure that there is only one report (excluding any subsequent modifications) produced by them (or on their behalf) for each trade that they carry out. Their counterparty may also be obliged to produce a report and this also does not count as duplication. Where two counterparties submit separate reports of the same trade, they should ensure that the common data are consistent across both reports.

Under the EMIR reporting framework CCPs also play an important role in submitting timestamps for populating the Field Clearing timestamp (Table 2 Field 36). Under the EMIR reporting format this field should be reported as the time at which the CCP has legally taken on the clearing of the trade. In turn, the Execution timestamp (Table 2 Field 25) is required to correspond to the time of execution on the trading venue of execution.

In an answer to the ETDs Reporting Question 6 (amended version applying as from 1 November 2017) ESMA underlined that:

- for markets where clearing takes place using the open offer model, these two times (the Clearing timestamp and the Execution timestamp) are expected to be the same,

- for markets where clearing takes place using novation, these two times may be different.

Article 2 of the Regulatory Technical Standard (RTS - Commission Delegated Regulation (EU) No 148/2013 of 19 December 2012) initially stipulated that where an existing contract is subsequently cleared by a CCP, clearing should be reported as a modification of the existing contract. This rule has been changed in the subsequent amendment.

Usually derivative transactions concluded on exchanges (ETDs) are cleared shortly after their conclusion, hence under the amended RTS on reporting it is provided that ETDs are reported only in their cleared form (Article 2(2) of the Commission Delegated Regulation No 148/2013 as amended by the Commission Delegated Regulation of 19.10.2016: “where a contract is both concluded on a trading venue and cleared on the same day, only the contracts resulting from clearing shall be reported”).

The Proposal for a Regulation of the European Parliament and of the Council amending Regulation (EU) No 648/2012 as regards the clearing obligation, the suspension of the clearing obligation, the reporting requirements, the risk-mitigation techniques for OTC derivatives contracts not cleared by a central counterparty, the registration and supervision of trade repositories and the requirements for trade repositories (COM(2017)208) of 4 May 2017 envisions more far-reaching modifications as regards the CCPs' role in the derivatives reporting since - according to the said legislative proposal - ETDs are to be reported only by the CCP on behalf of both counterparties.

Commission Delegated Regulation (EU) 2022/1855 of 10 June 2022 supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council with regard to regulatory technical standards specifying the minimum details of the data to be reported to trade repositories and the type of reports to be used (which will apply from 29 April 2024) reads:

"Article 2

Cleared trades

1. Where a derivative whose details have already been reported pursuant to Article 9 of Regulation (EU) No 648/2012 is subsequently cleared by a central counterparty (‘CCP’), that derivative shall be reported as terminated by specifying in fields 151 and 152 in Table 2 of the Annex to this Regulation the action type ‘Terminate’ and event type ‘Clearing’. New derivatives resulting from clearing shall be reported by specifying in fields 151 and 152 in Table 2 of the Annex to this Regulation the action type ‘New’ and event type ‘Clearing’.

2. Where a derivative is both concluded on a trading venue or on an organised trading platform located outside the Union and cleared by a CCP on the same day, only the derivatives resulting from clearing shall be reported. Those derivatives shall be reported by specifying in fields 151 and 152 in Table 2 of the Annex either the action type ‘New’, or the action type ‘Position component’, in accordance with Article 3(2), and event type ‘Clearing’."

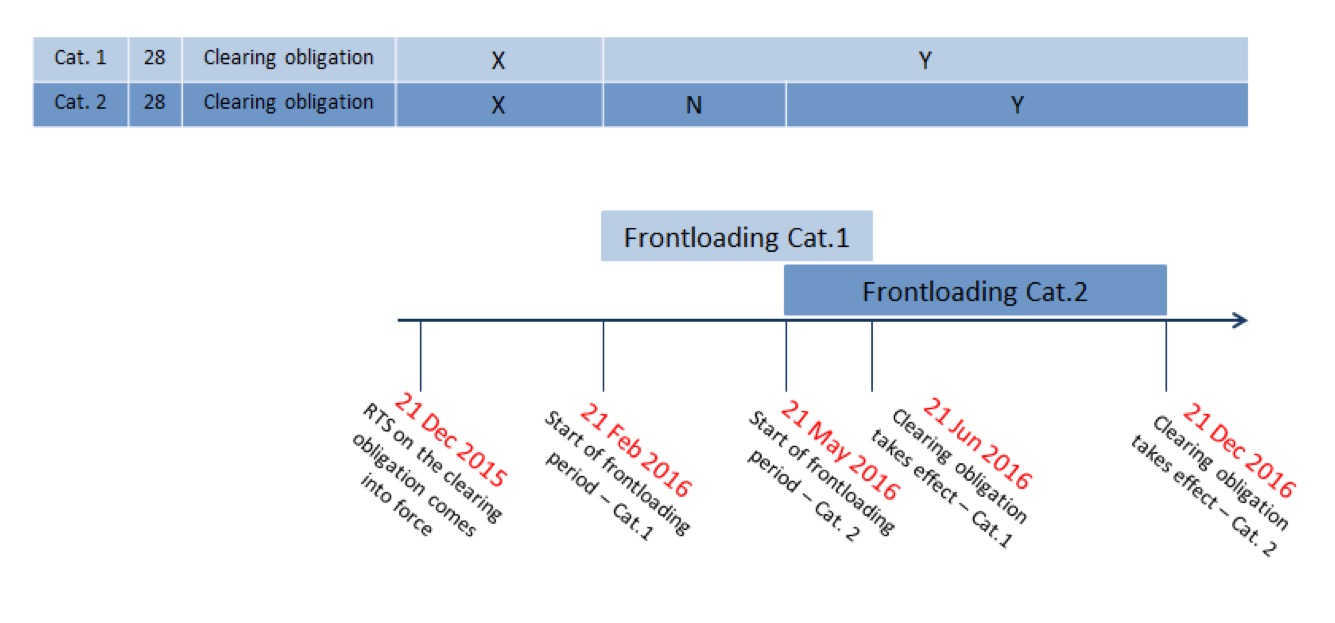

Population of the field on the clearing obligation

The applicable field for reporting data on the clearing obligation initially was Field 28, and later, under amendments made by the aforementioned Commission Delegated Regulation of 19.10.2016 and Commission Implementing Regulation of 19.10.2016, Field 34 in the Table 2 (Common data).

The field “Clearing obligation” is intended to be populated with information on "whether the reported contract belongs to a class of OTC derivatives that has been declared subject to the clearing obligation and both counterparties to the contract are subject to the clearing obligation under Regulation (EU) No 648/2012, as of the time of execution of the contract". In the case of cleared trades, the field “Clearing obligation” should be populated with “N” and the field “Cleared” – with “Y”. The field “Clearing obligation” is not applicable to the transactions executed on a regulated market and should be left blank (ESMA Q&As as from 1 November 2017).

Contracts that are entered into during the frontloading period and will have, at the date of application of the clearing obligation for that contract, a remaining maturity higher than the minimum remaining maturity specified in accordance with Article 5(2)(c) of EMIR should be flagged with "Y" in the Clearing Obligation field.

These contracts are subject to the clearing obligation from the moment the contract is entered into, even if the counterparties will effectively be required to clear them only at the date when the clearing obligation takes effect.

Until the beginning of the frontloading period for Category 1 counterparties there will be no contracts pertaining to the given classes of OTC derivatives that are subject to the clearing obligation, therefore it is considered that counterparties should report "X".

Upon the beginning of the front-loading period for Category 1 counterparties, all the counterparties shall report either "Y" or "N" for the contracts pertaining to the given classes.

The example below (included in the TR Question 42 ESMA's EMIR Q&As) illustrates how the field 28 Table 2 should be populated by the Category 1 and Category 2 counterparties for the contracts pertaining to the classes in the scope of Regulation (EU) 2015/2205 i.e. IRS derivatives.

Unique Trade Identifier (UTI)

Each reported derivative contract is required by Commission Delegated Regulation (EU) No 148/2013 to have a Unique Trade Identifier (UTI). EMIR imposes the general obligation according to which counterparties need to agree the report's contents before submitting it to TRs. According to this rule the existing technical standards prescribe that the Unique Trade Identifier must be agreed with the other counterparty (see Table 2, field 12 of the RTS). In light of the low pairing rates of the TR reconciliation process, ESMA considered that an additional prescriptive rule should be included to account for the cases where counterparties fail to agree on the responsibility to generate a UTI.

That said, it was proposed (ESMA Consultation Document, Review of the technical standards on reporting under Article 9 of EMIR of 10 November 2014 (ESMA/2014/1352)) to introduce the specific provision in the Implementing Technical Standards prescribing which reporting entity is responsible for the creation and transmission of the UTI in the absence of agreement between counterparties. This approach was upheld in the ESMA's Final Report of 13 November 2015 and finally implemented in the aforementioned Commission Regulations of 19.10.2016 and 19.10.2016.

See here for further details on rules governing the use of the Unique Trade Identifier under EMIR.

Legal Entity Identifiers (LEIs)

Legal Entity Identifiers (LEIs) are required for EMIR reporting (see Article 3 of Commission Implementing Regulation (EU) No 1247/2012).

Article 3 of the Implementing Regulation No 1247/2012 as amended by the Commission Implementing Regulation of 19.10.2016

Article 3

Identification of counterparties and other entities

1. A report shall use a legal entity identifier to identify:

(a) a beneficiary which is a legal entity;

(b) a broking entity;

(c) a CCP;

(d) a clearing member;

(e) a counterparty which is a legal entity;

(f) a submitting entity.

For customers being individuals who do not have a BIC or LEI ESMA initially adopted the view to be acceptable to use for EMIR reporting a client code, e.g. account number or member id, while for customers other than individuals LEI (and not BICs) was mandatory to identify counterparties.

However, this stance has been changed with the publication by the ESMA of the Consultation Document, Review of the technical standards on reporting under Article 9 of EMIR of 10 November 2014 (ESMA/2014/1352), where the European financial authority said:

"[t]o avoid any misuse of Interim Entity Identifier, BIC or Client codes, ESMA assessed the necessity of allowing all of those code types in all relevant fields. According to the assessment, in certain instances, a private individual could not be identified in a particular field and therefore it is proposed to delete the possibility of using a client code in that field. As LEIs, fulfilling the ROC principles and the ISO 17442 standard are already in place, there is no need to provide the possibility of using less robust identifiers like BICs or Interim Entity Identifiers any longer and therefore these are proposed to be deleted as well."

ESMA referred to these issues in the following Q&As (a) and (b):

"(a) Can a client code be used (e.g. account no. or member id) for customers who do not have a BIC or LEI?

Yes, where customers are individuals. For customers other than individuals see (b) on the ID of counterparties below.

(b) What code should be used to identify counterparties (LEIs or BICs)?

An LEI issued by, and duly renewed and maintained according to the terms of, any of the endorsed pre-LOUs (Local Operating Units) of the Global Legal Entity Identifier System.

The list of endorsed pre-LOUs is available at: http://www.leiroc.org/publications/gls/lou_20131003_2.pdf

It should be noted that legal entities and also individuals acting in an independent business capacity are eligible to obtain LEIs (see http://www.leiroc.org/publications/gls/lou_20150930-1.pdf)."

LEI for EMIR reporting purposes needs to be issued by, and duly renewed and maintained according to the terms of, any of the endorsed LOUs (Local Operating Units) of the Global Legal Entity Identifier System (see How to obtain an LEI).

One should be mindful of the fact, at its first phase, LEI does not cover branches or desks which are not legal entities, hence the same legal entity under the EMIR reporting scheme would only have one LEI (it is an issue for early review due to a need for separate identification under some cross-border resolution schemes - see Recommendation 10 of the FSB Report on a Global Legal Entity Identifier for Financial Markets).

Responding to the question whether the LEI covers branches or desks ESMA said:

"Following the Recommendation 10 of the FSB Report on a Global Legal Entity Identifier for Financial Markets (http://www.financialstabilityboard.org/publications/r_120608.pdf ), at its first phase LEI did not cover branches/desks and the same legal entity would only have one LEI: “a particular issue for early review is for the ROC to consider whether and if so how the global LEI can be leveraged to identify bodies such as branches of international banks which are not legal entities, but which require separate identification under some cross-border resolution schemes”.

The LEI ROC has undertaken such review and issued a following statement on international branches: https://www.leiroc.org/publications/gls/roc_20160711-1.pdf.

It should be noted however that the counterparties reporting under EMIR should always identify themselves with the LEI of the headquarters, given that the legal responsibility for reporting always lies on the headquarter entity and not on the branch."

Moreover, on 1 October 2015 (with updates on 20 November 2017 and 12 July 2018) ESMA explained in greater detail the issue of the LEI updates due to mergers, acquisitions and restructuring events (Q&As TR Question 40) as follows:

“TR Question 40 [Last Update: 12 July 2018]

LEI changes due to mergers and acquisitions. Update of identification code to LEI

a) How are TRs expected to treat situations where the counterparty identified in a derivative, reported to them a change in LEI due to a merger, acquisition or other corporate restructuring event or where the identifier of the counterparty has to be updated from BIC (or other code) to LEI because the entity has obtained the LEI? How are counterparties expected to notify the change to their relevant TR?

b) Who should notify the update to LEI or change in LEI of a non-EEA counterparty identified in the field “ID of the other counterparty”? What about the other fields which contain an entity identifier?

c) If the corporate restructuring event affects also the field “Country of the other counterparty”, can this field be updated by the TRs alongside the "ID of the other counterparty”?

d) Does the procedure set out in this Q&A apply also in the cases where the reporting counterparty has identified itself with a wrong code, e.g. LEI containing a typo? What should be the procedure when the “ID of the Other Counterparty” field is identified with the wrong code?

e) Under EMIR, delegation to the other counterparty is possible. Hence an entity could appear as reporting counterparty in two or more TRs. There could be an event where reports submitted to different TRs separately refer to a new LEI and an old LEI for the same counterparty. When this happens the TR which is reported the old LEI that identifies that counterparty receives a notification to update the LEI from another TR’s broadcast, what is the procedure that should be followed?

TR Answer 40 [Last Update: 12 July 2018]

a) The entity with the new LEI (e.g. merged or acquiring entity or entity which updates its identification to LEI – further “new entity”) or the entity to which it delegated the reporting shall notify the TR(s) to which it reported its derivatives about the change and request an update of the identifier in the outstanding derivatives as per point (1) below. If the change of the identifier results from a merger or acquisition, the merged or acquiring entity is also expected to duly update the LEI record of the acquired/merged entity no later than the next LEI renewal date according to the terms of the endorsed pre-LOU/accredited LOU who issued the old LEI.

The TR should identify the outstanding derivatives concerned (as informed by the new entity), where the entity is identified with the old identifier in the field reporting counterparty ID or ID of the other counterparty and replace the old identifier with the new LEI. In the case of corporate restructuring events affecting all outstanding derivatives, the TR shall identify all the outstanding derivatives where the entity is identified with the old identifier in any of the following fields: reporting counterparty ID, ID of the other counterparty, broker ID, report submitting entity ID, clearing member ID, Beneficiary ID, Underlying and CCP ID, Reference Entity and replace the old identifier with the new LEI.

Other corporate restructuring events, such as, but not limited to, partial acquisitions, spin-offs, may affect only a subset of outstanding derivatives, in which case the new entity should accordingly provide the TR with the UTIs of the derivatives impacted by that event.

This is done through the following controlled process:

1. The new entity or the entity to which it delegated the reporting, submits written documentation to the TR(s) to which it reported its derivatives and requests the change of the identifier due to a corporate event or due to the LEI code being assigned to the entity. In the documentation, the following information should be clearly presented (i) the LEI(s) of the entities participating in the merger, acquisition or other corporate event or the old identifier of the entity which updates its identification to LEI, (ii) the LEI of the new entity, and (iii) the date on which the change takes place and (iv) the UTIs of the outstanding derivatives concerned. In case of a merger or acquisition, the documentation should include evidence or proof that the corporate event has taken or will take place and be duly signed. To the extent possible, the entity should provide the required information in advance so that the change is not done retrospectively, but as of the date specified in (iii). It should be noted that failure to update the identifier on time would result in rejection of the reports submitted by the entity in case where it has been previously identified with an LEI with an appropriate status (i.e. “Issued”, “Pending transfer” or “Pending archival”) and that status has subsequently been changed to ‘Merged’.

2. The TR broadcasts this information to all the other TRs through a specific file, where the (i) old identifier(s), (ii) the new identifier and (iii) the date as of which the change should be done, are included. To the extent possible, the file should be broadcasted in advance so that the change is not done retrospectively, but as of the date specified in (iii).

3. Each of the counterparties to the derivatives, where any of the merged entities is identified, is informed of the modification by the TR to which they report.

4. TR(s) shall notify also the regulators who have access to the data relating to the derivatives that have been updated.

5. The change is kept in the reporting log by each of the TRs.

Subsequent reports should be validated against GLEIF as usual and rejected if the validation fails.

In the event that an LEI update is reported by a counterparty and then needs to be undone, the procedure explained in answer (a) should be followed again by TRs and counterparties.

b) The non-EEA counterparty does not have itself the reporting obligation under EMIR, therefore it cannot follow the procedure set out under point (a) above in order to inform about the change in the identifier. In this case, the EEA reporting counterparty or the entity to which the EEA reporting counterparty delegated the reporting should notify the TR(s) to which it reported its derivatives about the change and request the update of the identifier in the outstanding derivatives following the procedure set out in the point (a).

It should be noted that when the change in the code occurs due to the obtaining of the LEI by the non-EEA counterparty (i.e. the identifier is updated from other code to LEI), the TR does not need to broadcast the relevant information to other TRs. It is assumed that previously the non-EEA counterparty was identified with the client code which is unique at the level of the reporting counterparty, therefore each reporting counterparty would need to request the update of the identifier of the non-EEA counterparty to its respective TR. In the event that a TR receives multiple requests to change the same client code or LEI, it should contact the requesting counterparties to ensure that the correct amendment is made to the field.

Due to the above reasons, only an update of the LEI can be undertaken for the field Beneficiary ID. For the rest of the fields containing entity identifier the LEI can only be updated as these fields do not allow for reporting of other identifier.

c) Yes. In those cases where a corporate restructuring event results in a change of country of the new entity (as identified in the country of the legal address in GLEIF database), and that entity is identified in outstanding derivatives concerned by the event in the field “ID of the other counterparty”, the TR should update also the field “Country of the other counterparty”. For that purpose, the entity should notify its TR of the change in the country, in addition to other information listed in the point (a).

d) No. in the case of misreporting of its own identifier, the reporting counterparty should cancel the impacted derivatives with Action Type “Error” and re-report them with a correct LEI and the previously agreed UTI.

However, if the reporting counterparty has misreported the identifier of the other counterparty, it should cancel and re-report the derivatives contracts in question with the correct LEI and the previously agreed UTI. In this case, if the other counterparty also has the reporting obligation, and it was provided a wrong code, it should also cancel (using Action type “Error”) and re-report the derivatives with the correct LEI and the previously agreed UTI to ensure that both sides can be reconciled.

e) When a TR receives a broadcasted message from another TR which confirms that an old LEI needs to be updated to a new LEI, the TR which received the broadcast must make the update. This includes situations where the TR has not yet been informed of the need for the update by the reporting counterparty itself or the entity reporting on its behalf.”

ESMA guidance contains also the caveat that the failure to update the identifier on time would result in rejection of the reports submitted by the entity in case where it has been previously identified with an LEI with an appropriate status (i.e. “Issued”, “Pending transfer” or “Pending archival”) and that status has subsequently been changed to ‘Merged’.

The importance of the proper identification of parties to the derivative contracts has been underlined by ESMA also with respect to counterparties established in a third country whose legal framework prevents the disclosure of its identity by the European counterparty subject to the reporting obligation.

ESMA reminded that Article 9(5) EMIR provides that at least the identities of the parties to the derivative contracts must be reported to trade repositories and that this requirement cannot be waived.

Therefore, a European counterparty dealing with counterparties that cannot be identified because of legal, regulatory or contractual impediments, would not be deemed compliant with Article 9(5) of EMIR.

Exchange-traded derivatives (ETDs) reporting

The EMIR reporting obligation covers all derivative contracts (it doesn't matter OTC or exchange-traded (ETD)). The said rule is expressed literally by Article 9 of EMIR, which stipulates that financial and non-financial counterparties must ensure that the details of the said derivative contracts they have concluded and of any modification or termination are reported to a registered or recognised trade repository.

Derivative contracts admitted to trading on regulated markets represent the vast majority of ETDs, however, they don't exhaust the entire ETD's scope.

According to Article 2(32) of MiFIR ETD is "a derivative that is traded on a regulated market or on a third-country market considered to be equivalent to a regulated market" and as such does not fall into the definition of an OTC derivative as defined in EMIR.

EMIR defines OTC derivatives as contracts the execution of which does not take place on a regulated market or on a third-country market considered as equivalent to a regulated market in accordance with Article 2a of EMIR.

ESMA in the Q&As on EMIR implementation has clarified the following:

"Derivatives transactions, such as block trades, which are executed outside the trading platform of the regulated market, but are subject to the rules of the regulated market and are executed in compliance with those rules, including the immediate processing by the regulated market after execution and the clearing by a CCP, should not be regarded as OTC derivatives transactions. Therefore, these transactions should not be considered for the purpose of the clearing obligation and the calculation of the clearing threshold by NFC that only relates to OTC derivatives.

Derivatives transactions that do not meet the conditions listed in the first paragraph of this sub-answer (d) should be considered OTC. For example, derivatives contracts that are not executed on a regulated market and are not governed by the rules of an exchange at the point of execution should be considered OTC even if after execution they are exchanged for contracts traded in a regulated market. However, the replacement contract itself may be considered exchange traded if it meets the relevant conditions."

ESMA regards ETDs as "derivative contracts which are subject to the rules of a trading venue and are executed in compliance with those rules, including the processing by the trading venue after execution and the clearing by a CCP".

ETDs Reporting Question 7 – Amended version. This version shall apply from 1 November 2017.

Who should report the value of the collateral for ETDs?

ETDs Reporting Answer 7

The Initial margin posted (Table 1 Field 24), the Variation margin posted (Table 1 Field 26), the Initial margin received (Table 1 Field 28), the Variation margin received (Table 1 Field 30), the Excess collateral posted (Table 1 Field 32) and the Excess collateral received (Table 1 Field 34) should be reported by the Counterparty responsible for the report (the entity identified in the ‘who has the obligation to report’ column in the scenarios above, that is the participant identified in Table 1 Field 2 in Commission Delegated Regulation (EU) No 148/2013 (RTS on reporting to TR) .

In the particular case when the investment firm is not involved in the process of receiving and/or posting any collateral for the client because of the direct arrangements between the client and the clearing member, the investment firm is not expected to submit any report on the value of the collateral, or on any subsequent modification as well as termination of the concluded derivative contract.