Along with the main business test, the market share test (sometimes called also OMT - Overall Market Threshold or Market Size Test) was used for the determination whether the entity qualified for the MiFID II ancillary activity exemption.

The purpose of the market share test was to determine whether the persons within the group were large participants relative to the size of the financial market in that asset class and as a consequence should be required to obtain authorisation as an investment firm.

The details of the test were stipulated in Article 2 of the Commission Delegated Regulation (EU) 2017/592 of 1 December 2016 supplementing Directive 2014/65/EU of the European Parliament and of the Council with regard to regulatory technical standards for the criteria to establish when an activity is considered to be ancillary to the main business (ESMA's RTS 20).

Directive (EU) 2021/338 of the European Parliament and of the Council of 16 February 2021 amending Directive 2014/65/EU as regards information requirements, product governance and position limits, and Directives 2013/36/EU and (EU) 2019/878 as regards their application to investment firms, to help the recovery from the COVID-19 pandemic substantially modified legal framework regarding MiFID ancillary exemption.

The said Directive set out new provisions regarding the ancillary activity tests and empowered the European Commission to adopt a delegated act specifying the relevant criteria.

This delegation was exercised by adoption of the Commission Delegated Regulation (EU) 2021/1833 of 14 July 2021 supplementing MiFID II by specifying the criteria for establishing when an activity is to be considered to be ancillary to the main business at group level - which repealed the Commission Delegated Regulation (EU) 2017/592.

According to the Regulation of 14 July 2021 the "Overall Market Test has been removed as the commodity derivatives landscape in the Union has changed to such an extent that the Overall Market Test would render entities no longer eligible to the ancillary activity exemption even with no change to their business conduct" (Recital 18).

Also market participants in the course of consultations assessed the Market Size Test as overly complex and as a significant burden during the crisis.

Also, it was considered a red-tape requirement as it did not alter the status quo in terms of non-financial firms that were eligible for the exemption.

This modification is not reflected in the remainder of this article, which depicts the rules of the Market Size Test as it stood under previous provisions of the Commission Delegated Regulation (EU) 2017/592 of 1 December 2016.

ANNEX I - ARCHIVED

The market share test compares the size of a person's trading activity (all contracts in commodity derivatives, emission allowances and derivatives thereof) against the overall trading activity in the European Union on an asset class basis.

Article 2(1)(j) of MiFID II grants persons performing MiFID II activities in commodity derivatives, emission allowances and derivatives thereof an exemption if their activities are ancillary to their main business.

Article 2(4) of MiFID II requires such persons to compare the size of their trading activity in commodity derivatives, emission allowances and derivatives thereof to the overall market trading activity in a particular asset class over a certain period of time.

Hence, the OMT test compares the size of a person's trading activity against the overall trading activity in the European Union on an asset class basis to determine that person's market share (Recitals 2 and 3 of the said Commission Delegated Regulation (EU) 2017/592 of 1 December 2016).

Article 2 of the Commission Delegated Regulation (EU) 2017/592 of 1 December 2016 supplementing Directive 2014/65/EU of the European Parliament and of the Council with regard to regulatory technical standards for the criteria to establish when an activity is considered to be ancillary to the main business

Overall market threshold

1. The size of the activities referred to in Article 1 calculated in accordance with paragraph 2 divided by the overall market trading activity calculated in accordance with paragraph 3 shall, in each of the following asset classes, account for less than the following values:

(a) 4 % in relation to derivatives on metals;

(b) 3 % in relation to derivatives on oil and oil products;

(c) 10 % in relation to derivatives on coal;

(d) 3 % in relation to derivatives on gas;

(e) 6 % in relation to derivatives on power;

(f) 4 % in relation to derivatives on agricultural products;

(g) 15 % in relation to derivatives on other commodities, including freight and commodities referred to in Section C 10 of Annex I to Directive 2014/65/EU;

(h) 20 % in relation to emission allowances or derivatives thereof.

2. The size of the activities referred to in Article 1 undertaken in the Union by a person within a group in each of the asset classes referred to in paragraph 1 shall be calculated by aggregating the gross notional value of all contracts within the relevant asset class to which that person is a party.

The aggregation referred to in the first subparagraph shall not include contracts resulting from transactions referred to in points (a), (b) and (c) of the fifth subparagraph of Article 2(4) of Directive 2014/65/EU or contracts where the person within the group that is a party to any of them is authorised in accordance with Directive 2014/65/EU or Directive 2013/36/EU.

3. The overall market trading activity in each of the asset classes referred to in paragraph 1 shall be calculated by aggregating the gross notional value of all contracts that are not traded on a trading venue within the relevant asset class to which any person located in the Union is a party and of any other contract within that asset class that is traded on a trading venue located in the Union during the relevant annual accounting period referred to in Article 4(2).

4. The aggregate values referred to in paragraphs 2 and 3 shall be denominated in EUR.

Note, however that ESMA’s Opinion of 6 July 2017 (ESMA70-156-165) refers the on-venue data calculations in the denominator to the broader scope (the trading venues located in the EEA).

The eight distinct asset classes and the relevant thresholds per asset class are specified in the Commission Delegated Regulation (EU) 2017/592 of 1 December 2016.

Persons wanting to benefit from the MiFID II exemption in Article 2(1)(j) therefore have to execute a test and check whether they meet the prescribed proportions, where they compare their own trading (numerator) to the total trading in the EU market based on eight distinct asset classes (denominator).

The aggregate values are to be denominated in EUR.

In the European Commission’s opinion 31 May 2018:

- Article 2(1)(j) MiFID II requires that the test of whether the MiFID activities are ancillary needs to be assessed for both MiFID activities (dealing on own account and providing investment services other than dealing on own account) individually, and on an aggregate basis,

- in practical terms this implies that if a person undertakes both activities, it must pass the ancillary activity test with respect to both MiFID activities and cannot be exempt from MiFID II merely by passing the test for one of the MiFID activities.

Numerator

The size of the trading activities undertaken in the European Union by a person within a group in each of the asset classes is to be calculated by aggregating the gross notional value of all contracts within the relevant asset class to which that person is a party (aggregation must cover all contracts in commodity derivatives, emission allowances and derivatives thereof on the basis of a rolling average of the preceding three annual periods).

The following items should be deducted from the volume of the overall trading activity undertaken by the person:

1. intra-group transactions as referred to in Article 3 of EMIR Regulation, serving group-wide liquidity and/or risk management purposes;

2. transactions in derivatives which are objectively measurable as reducing risks directly related to the commercial activity or treasury financing activity (i.e. hedging);

3. transactions in commodity derivatives and emission allowances entered into to fulfil obligations to provide liquidity on a trading venue ("where such obligations are required by regulatory authorities in accordance with Union or national laws, regulations and administrative provisions or by trading venues");

jointly: "privileged transactions" (Article 2(4) of MiFID II).

Trading activities conducted by a MiFID authorised firm within the group are also excluded from the said aggregation.

For the calculation of the numerator the notional amount of ETD option contracts should be determined with the use of the following formula (ESMA Opinion of 7 July 2017 on ancillary activity – market size calculation, ESMA70-156-165):

lot size/multiplier (number of underlying instruments to be delivered for one contract) * quantity (number of contracts traded) * strike price.

According to the document "Joint associations' Questions & Answers (Q&A) on Regulatory Technical Standard (RTS) 20 of the Markets in Financial Instruments Directive (MiFID II)" of 16 February 2017 the numerator of the OMT test is to be applied on the person (entity) level, by each entity within the same group dealing in derivatives and not on an aggregated group level.

The above organisations argue that "the clear wording provides that under article 2(2), first subpara. RTS 20 the numerator is composed of the activities undertaken by “a person” within a group, i.e. the numerator is calculated on an individual person (entity) level".

Also the European Commission while answering on 31 May 2018 to the ESMA’s letter confirmed that the ancillary activities tests must be calculated as many times as necessary for each separate person who trades in commodity derivatives within a group.

Denominator

The overall market trading activity in each of the asset classes is to be calculated by aggregating, during the relevant annual accounting period, the gross notional value of:

1. all contracts that are not traded on a trading venue within the relevant asset class to which any person located in the European Union is a party, and

2. any other contract within that asset class that is traded on a trading venue located in the European Union.

There are multiple problems on account of lacking publicly available infrastructures to determine market size figures.

The absence of centralised place for recording on-venue and off-venue transactions for commodity derivatives and emission allowances was ignored in the MiFID II legislative process and some provisional measures become necessary.

Among those feeble and late try-outs are ESMA's documents:

- ESMA Opinion of 6 July 2017 on ancillary activity – market size calculation, ESMA70-156-165

- Final Report, Draft technical standards on data to be made publicly available by TRs under Article 81 of EMIR, 10 July 2017, ESMA70-151-370

The former of the above documents collected the data:

- from the trading venues located in the EEA only for the total year of 2015 and for the second half of the year 2016 (on-venue market size),

- from the OTC market size only for the second half of the year 2016 (based on reports submitted to the trade repositories (TRs) under the EMIR Regulation).

Given the partial availability of data (the years to be used in the calculations are 2015, 2016 and 2017), ESMA proposes that "the approximation of the total market size for 2016 could be achieved by annualising the half-year figures, and for the year 2015, assuming a similar proportion for OTC and on-venue activity during both years."

The total market size for both on-venue and OTC markets, i.e. gross notional value traded was calculated on a dual-sided basis, that is both buyer’s and seller’s notional value of each transaction was added to establish a gross notional value traded.

Overall market data

ESMA's Opinion of 6 July 2017 on ancillary activity – market size calculation, ESMA70-156-165

ESMA's Opinion of 22 December 2017 on ancillary activity – market size calculation, ESMA70-156-165

ESMA's Opinion of 2 October 2018 on ancillary activity – market size calculation, ESMA70-156-478

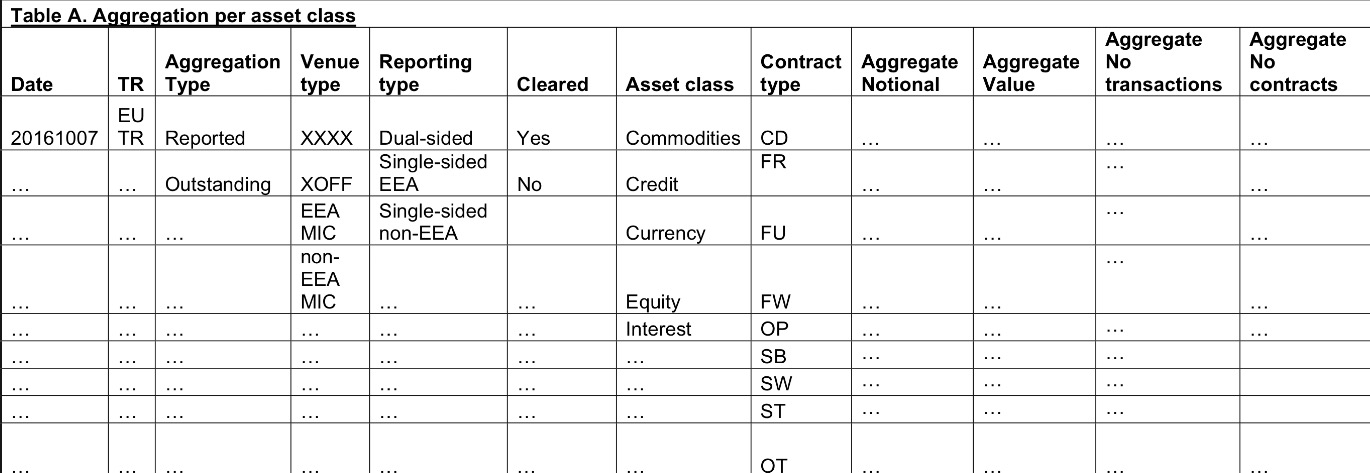

When it comes to the aforementioned ESMA's Final Report, Draft technical standards on data to be made publicly available by TRs under Article 81 of EMIR, 10 July 2017, ESMA70-151-370 - its attachment contains the draft for the Commission Delegated Regulation (EU) amending Commission Delegated Regulation (EU) No 151/2013 of 19 December 2012 supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council where the following rules for publication by the trade repository of the aggregate position data have been proposed:

- trade repository shall publish aggregate position data on its website on a weekly basis no later than Tuesday noon UTC on the derivatives reported by 23:59:59 UTC inclusive of the previous Friday;

- trade repository shall publish all aggregate data in euro and shall use the exchange rates published in the ECB website as of the previous Friday;

- trade repository shall publish aggregate position data in tabular form as detailed in Table A of the Annex to the RTS (see below) and shall keep in its website in an easily accessible form aggregate position data for the previous 104 weeks;

- when publishing the aggregations for the first time, a trade repository shall include all the relevant aggregations starting from 1 January 2018 or the relevant first date of the reference period determined pursuant to Regulation 2017/592.

ESMA argues that while it was not an original objective of EMIR to provide granular aggregate position data to the public, in the absence of TR data, market participants would need to run complex processes to compile the data across all the different venues and post-trade providers.

Clearly this process would not be error-free and it is highly possible that there will be different figures obtained by each entity and it will be impossible to compare the results.

ESMA therefore proposed the use of TRs, as they play a pivotal role in the EU derivatives reporting regime, hence, are naturally placed to perform aggregations.

According to the view presented in the aforementioned document Joint associations' Questions & Answers (Q&A) on Regulatory Technical Standard (RTS) 20 of the Markets in Financial Instruments Directive (MiFID II) of 16 February 2017, activities already authorised under MiFID I / II should be deducted equally from the numerator as well as denominator of the test where relevant.

Importantly, on 16 October 2017 ESMA has enabled access to the Financial Instruments Reference Data System (FIRDS), which is intended to be used, among others, for market data calculations of the OMT test (see ESMA database: Financial Instruments Reference Data System (FIRDS)).

Market share thresholds

The relevant thresholds of the market share are differentiated on a per-asset-class basis and take into account the trading activity of the persons within the group - as in the table below (the table reflects the so-called "backstop mechanism").

|

Proportion of non-priviledged commodity derivatives trading versus total EU commodity derivatives trading at group level (gross notional value)

|

Oil | Gas | Power | Coal | Metals | Emissions |

Derivatives on other commodities, including freight and "exotic" (Section C 10 of Annex I to MiFID II) |

|

Under 10%

|

3% | 3% | 6% | 10% | 4% | 20% | 15% |

|

10% - 49,9%

|

1.50% | 1.50% | 3% | 5% | 2% | 10% | 7.50% |

|

50% or greater

|

0.60% | 0.65% | 1.20% | 2% | 0.80% | 4% | 3% |

|

|

Territorial scope |

The market share test is calculated based on activities in the European Union.

Recitals 3 - 5 of the Commission Delegated Regulation (EU) 2017/592 of 1 December 2016 supplementing Directive 2014/65/EU of the European Parliament and of the Council with regard to regulatory technical standards for the criteria to establish when an activity is considered to be ancillary to the main business

(3) The first test compares the size of a person's trading activity against the overall trading activity in the Union on an asset class basis to determine that person's market share. The size of the trading activity should be determined by deducting the sum of the volume of the transactions for the purposes of intra-group liquidity or risk management purposes, objectively measurable reduction of risks directly relating to commercial or treasury financing activity or fulfilling obligations to provide liquidity on a trading venue ('privileged transactions') from the volume of the overall trading activity undertaken by the person.

(4) The volume of the trading activity should be determined by the gross notional value of contracts in commodity derivatives, emission allowances and derivatives thereof on the basis of a rolling average of the preceding three annual periods. The overall market size should be determined on the basis of trading activity undertaken in the Union in relation to each asset class for which the exemption is sought, including contracts which are traded on and outside trading venues in the Union.

(5) As commodity markets differ significantly in terms of size, number of market participants, level of liquidity and other characteristics, different thresholds shall apply for different asset classes in relation to the test on the size of the trading activity.

Such stance is supported by the wording of Article 2(2), first and second subpara. of the Commission Delegated Regulation (EU) 2017/592, it is also shared by important stakeholders (for example Bundesverband der Energie- und Wasserwirtschaft (BDEW), European Federation of Energy Traders (EFET), EURELECTRIC, Energy UK, EUROGAS, Futures Industry Association (FIA) and International Oil and Gas Producers association (IOGP) in the document of 16 February 2017 "Joint associations' Questions & Answers (Q&A) on Regulatory Technical Standard (RTS) 20 of the Markets in Financial Instruments Directive (MiFID II)".

Moreover, Recital 4 of the Regulation 2017/592 stipulates: "the overall market size should be determined on the basis of trading activity undertaken in the Union in relation to each asset class for which the exemption is sought, including contracts which are traded on and outside trading venues in the Union".

It is also noteworthy, the trade repositories under EMIR have only data available for activities in the European Union.

However, ESMA Opinion of 6 July 2017 on ancillary activity – market size calculation (ESMA70-156-165) with respect to on-venue data calculations in the denominator refers to the broader scope, i.e. the trading venues located in the EEA.

The ambiguities have been cleared by ESMA in Questions and Answers on MiFID II and MiFIR commodity derivatives topics updated on 14 November 2017, where in the answers to Questions 12 and 13 the EU financial regulator underlined that for the purposes of calculating the market size test under Article 2 of RTS 20:

1. transactions concluded on non-EU venues should not be included in either numerator or denominator, since those transactions do not constitute part of trading activity in the European Union;

2. OTC transactions done by non-EU entities of an EU group with EU counterparties are considered to take place in the EU and therefore should be included in the numerator of both the group that has an EU presence and the EU counterparty.

For the purpose of the denominator, these transactions would also be considered to take place in the EU.

However, on 2 October 2018 ESMA has deleted Q&A No 13.

Question 12 [Last update: 13/11/2017]

How shall transactions concluded on venues outside the EU be treated for the market size test computations under Article 2 of RTS 20?

Answer 12

Transactions concluded on non-EU venues should not be included in either numerator or denominator of the market size test, since those transactions do not constitute part of trading activity in the Union.

Question 13 [Last update: 02/10/2018]

How shall OTC transactions done by non-EU entities of an EU group with EU counterparties be counted for the market size test?

Answer 13

For the purpose of calculating the numerator, these transactions would be considered to take place in the EU and therefore should be included in the numerator of both the group that has an EU presence and the EU counterparty. For the purpose of the denominator, these transactions would also be considered to take place in the EU.

REMIT carve-out

When defining the size of the trading activity it should be noted that derivatives on wholesale energy products defined under Article 2(4) REMIT are not financial instruments in accordance with Article 4(1)(15) and Annex I C 6 MiFID II provided that they:

- are traded on an OTF, and

- "must be physically settled".

Consequently, such instruments are excluded from the respective calculations.

Calculation frequency

With regard to the data basis for the annual calculation of the market share test, according to the view presented in the aforementioned document Joint associations' Questions & Answers (Q&A) on Regulatory Technical Standard (RTS) 20 of the Markets in Financial Instruments Directive (MiFID II) of 16 February 2017, firms should be allowed to consider a number of representative trading days during the calculation period as appropriate to the complexity of their business.

Calculation Frequency and Data Basis for Ancillary Activity Tests

Question:

Should the outcomes of each of the Ancillary Activity Tests be calculated on a daily basis during the calculation period and be based on all trading days per se?

Answer:

No. The RTS 20 distinguishes between the frequency of the Ancillary Activity Tests and the underlying data basis for these tests.

With regard to the calculation frequency article 4 (1) RTS 20 states that these calculations “shall be carried out annually in the first quarter of the calendar year that follows an annual calculation period”.

Therefore, firms can calculate the Ancillary Activity Tests only once during the first quarter of a year and are not obliged to calculate these tests on a more frequent basis during the calculation periods.

With regard to the data basis for this annual calculation of the Ancillary Activity Tests, firms should be allowed to consider a number of representative trading days during the calculation period as appropriate to the complexity of their business.

Furthermore, firms should be allowed to use the clearing threshold calculations performed for the purpose of compliance with article 10 of EMIR also for the purpose of the calculations for the Ancillary Activity Tests.

Reasoning:

RTS 20 doesn’t establish a binding daily calculation frequency within a calculation period.

This is because it speaks in article 4 (1) of an annual calculation to be carried out in the first quarter of the year that follows an annual calculation period.

Therefore, persons may perform the calculation only once during the first quarter of year.

With regard to the underlying data basis for this annual calculation, article 4 (1) RTS 20 speaks of a calculation “based on a simple average of the daily trading activities or estimated capital”.

We believe that an annual calculation based on all trading days (250 days) would impose overly burdensome calculations on MiFID II exempted firms.

In particular an annual calculation of the Capital Employed Test based on positions held on all trading days would be overly burdensome as it requires complex calculations of net and gross positions.

Also for such firms, which entire portfolios of privileged and non-privileged trading activities are clearly below the defined test thresholds, a calculation based on all trading days would not be meaningful and impose unnecessary burdens.

Finally, a calculation based on all trading days would not be more meaningful than a calculation based on representative days, given the seasonality of certain commodity trading activity.

Therefore, we are of the opinion that it is more proportionate that firms may perform the calculations of the daily trading activities or estimated capital as appropriate to the scope and complexity of their business and sufficient to provide a representative yearly notification to the competent authorities about the usage of the exemption.

For these reasons we are of the opinion that the calculations can be done with an appropriate, representative granularity, i.e., based on representative trading days (e.g. for the purpose of the Capital Employed Test positions held on the last Friday of each month or each quarter).

Furthermore the re-usage of EMIR clearing threshold calculations seems justified, in particular as under EMIR and MiFID II the definitions of financial instruments, hedging and intra-group transactions are the same.

Joint associations' Questions & Answers (Q&A) on Regulatory Technical Standard (RTS) 20 of the Markets in Financial Instruments Directive (MiFID II) of 16 February 2017

Regulatory chronicle

Regulatory chronicle

14 July 2021

26 February 2021

24 July 2020

10 July 2020

27 May 2019

2 October 2018

ESMA Opinion on ancillary activity – market size calculation (ESMA70-156-478)

ESMA Opinion of 6 July 2017 on ancillary activity – market size calculation, ESMA70-156-165

Questions and Answers on MiFID II and MiFIR commodity derivatives topics ESMA70-872942901-36

Links

Links

ESMA database: Financial Instruments Reference Data System (FIRDS)

Financial Instruments Reference Files

ANNEX II - ARCHIVED

Market share test pursuant to the ESMA's Consultation Paper – Annex B Regulatory technical standards on MiFID II/MiFIR of 19 December 2014, ESMA/2014/1570

The process for the developing secondary legislation stipulating the detailed rules for applying MiFID II ancillary activity exemption was prolonged and the construction of the market share test evolved.

To show the evolution of the legislation in that regard the remarks below refer to the main points of the market share test according to the draft regulatory technical standards on criteria for establishing when an activity is to be considered to be ancillary to the main business as set out in the ESMA Consultation Paper – Annex B Regulatory technical standards on MiFID II/MiFIR of 19 December 2014 ESMA/2014/1570 (p. 373-380).

It needs to be reserved that the ESMA's draft is of historical significance today, given the final rules stipulated in the Commission Delegated Regulation (EU) 2017/592 of 1 December 2016 supplementing Directive 2014/65/EU of the European Parliament and of the Council with regard to regulatory technical standards for the criteria to establish when an activity is considered to be ancillary to the main business.

Thresholds for relevant asset classes

Pursuant to the aforementioned ESMA's Consultation Paper of 19 December 2014, an activity was considered to be ancillary to the main business in accordance with Article 2(1)(j) of MiFID II, if the size of the trading activity:

(i) in commodity derivatives of the group undertaken in the European Union accounted for less than 0.5% of the overall market trading activity in the European Union in one of the following asset classes:

-metals;

- oil and oil products;

- coal;

- gas;

- power;

- agricultural products; or

- other commodities, including freight and commodities referred to in Section C 10 of Annex I of the MiFID II Directive; or

(ii) in emission allowances or derivatives thereof of the group undertaken in the European Union accounted for less than 0.5% of the overall market trading activity in the European Union.

Calculation of the size of the trading activity

The size of the trading activity was calculated by deducting from the volume of the overall trading activity of the group in the European Union the sum of the volume of the privileged transactions (see box for the definition) undertaken by the group in the European Union.

The volume of trading activity undertaken by an entity of the group possessing a MiFID license was not counted when calculating the size of the trading in the eligible activity.

The volumes were measured using the gross notional value of contracts.

The size of the trading activity calculated in the above fashion was divided by the overall market trading activity in the European Union in the relevant asset class.

Calculation period

The calculation of the size of the trading activity was intended to be undertaken on the basis of a rolling average of three calendar years. The relevant calculations untill 2020 were scheduled as follows:

(a) for 2017, the calculation took into account the simple average of 12 months over the 2016 calendar year;

(b) for 2018 the calculation took into account the simple average of 24 months for the calendar years 2016 and 2017;

(c) for 2019 the calculation took into account the simple average of 36 months for the calendar years 2016, 2017 and 2018.

De minimis exemption

ESMA planned to apply de minimis exemption as regards ancillary activity, the ESMA's Consultation Paper of 19 December 2014 elaborated on this issue as follows (p. 523):

"Some respondents also suggested a de minimis exemption, under which smaller firms should not be required to undertake further calculations and should not be required to make an annual notification to the competent authority. ESMA appreciates this suggestion, as it would mitigate the impact on the market of every natural or legal person undertaking a transaction in a commodity derivative from having to notify annually the competent authority of the use of the exemption and being required to demonstrate their bona fide use of the exemption on request. Therefore, ESMA has explored the option of introducing a de minimis threshold. However, the mandate given to ESMA in the Level 1 text leaves very limited scope for the introduction of a de minimis threshold.

[...] ESMA is not able to introduce a de minimis threshold in relation to the annual notification. The only way ESMA may be able to introduce a de minimis threshold would be to establish a relative threshold comparing the size of the ancillary activity to the main activity of the group. It may be possible to establish a de minimis threshold if a person's trading activity only constitutes a small share of the overall market trading activity in each asset class. For example, a person may not be captured by the scope of MiFID if the size of its trading activity constitutes less than 0.25% of the overall market trading activity in each asset class. A person that falls below this threshold would not have to undertake the first test in relation to the capital employed but would still be required to make an annual notification to the competent authority."

Glossary

The aforementioned ESMA's draft of 19 December 2014 used the following glossary:

1. "eligible activity" was understood as:

(a) dealing on own account, including market makers, in commodity derivatives or emission allowances or derivatives thereof, excluding persons who deal on own account when executing client orders; or

(b) providing investment services, other than dealing on own account, in commodity derivatives or emission allowances or derivatives thereof to the customers or suppliers of their main business;

2. "main business" was understood as the overall activity of a group;

3. "privileged transactions" were understood as:

(a) intra-group transactions as referred to in Article 3 of EMIR Regulation, serving group-wide liquidity and/or risk management purposes;

(b) transactions in derivatives which are objectively measurable as reducing risks directly related to the commercial activity or treasury financing activity (i.e. hedging);

(c) transactions in commodity derivatives and emission allowances entered into to fulfil obligations to provide liquidity on a trading venue ("where such obligations are required by regulatory authorities in accordance with Union or national laws, regulations and administrative provisions or by trading venues")

Calculation for size of trading activity

(according to ESMA's Consultation Paper of 19 December 2014)

Size of the trading activity at group level in the relevant commodity asset class in the EU (numerator)

divided by

Size of the overall market trading activity in the relevant commodity asset class in the EU (denominator)

_____________

equals

% of firm's trading activity in a commodity asset class compared with the size of the overall market trading activity in the EU in that asset class

Calculation for determining the size of the firm's trading activity in a commodity asset class at group level in the EU (numerator)

(according to ESMA's Consultation Paper of 19 December 2014)

Volume of the overall trading activity in the relevant commodity asset class of the person seeking the exemption at group level in the EU

minus

Volume of privileged transactions (i.e. for intra-group transactions, transactions in derivatives reducing commercial and treasury financing risks, and transactions entered into to fulfil obligations to provide liquidity) in the relevant commodity asset class at group level in the EU

minus

Volume of trading licensed activity (i.e. trading activity that is undertaken by a MiFID authorised entity of the group) in the relevant commodity class at group level in the EU

_____________

equals

Size of the firm's trading activity in a commodity asset class at group level in the EU

Key number of the market share test

(based on ESMA's Consultation Paper of 19 December 2014)

gross notional value of the derivatives' speculative trades in the EU market reflected in the trade repository data for 2016