Sustainable investment

- Category: Taxonomy

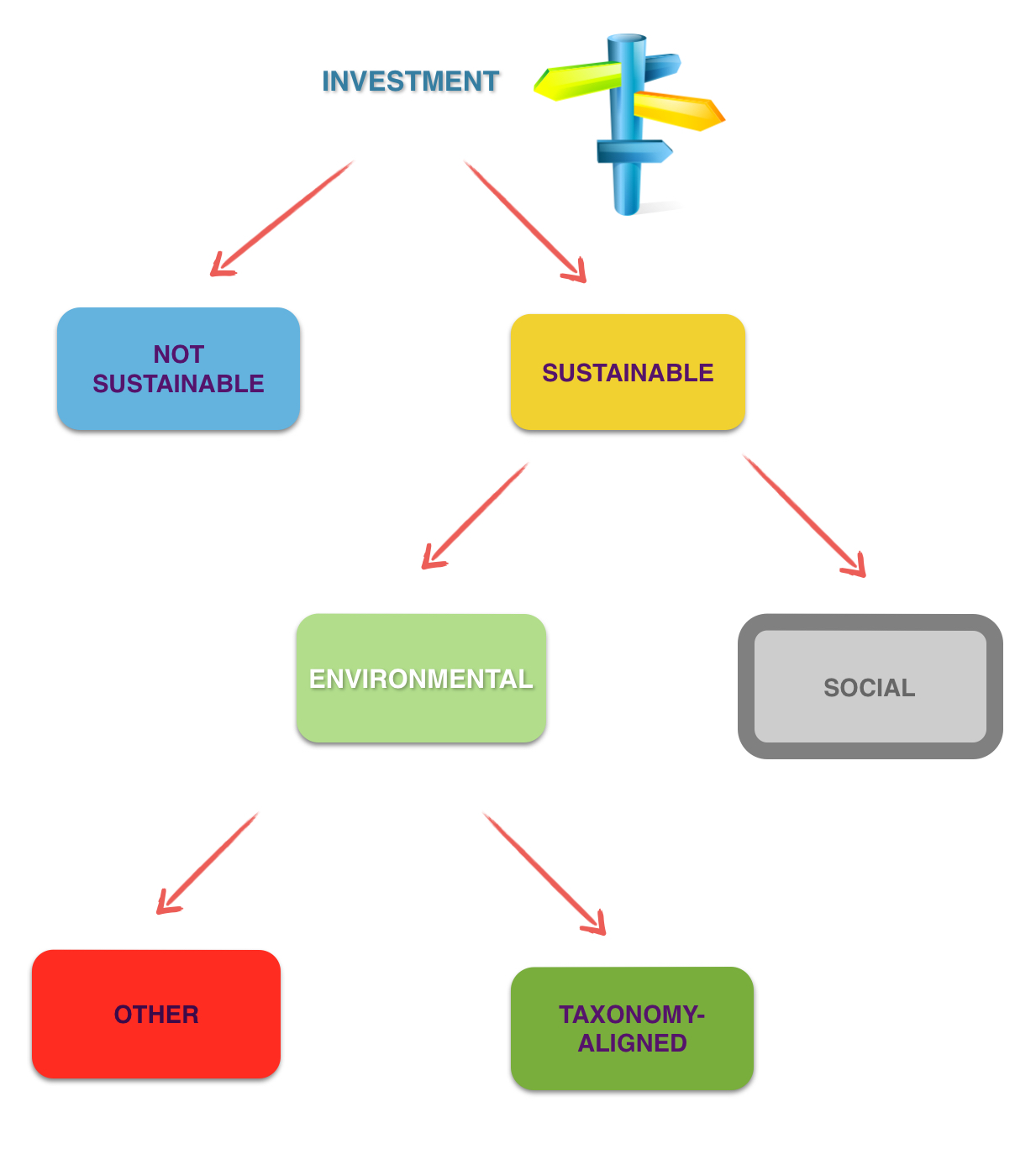

Sustainable investment is an investment in an economic activity that contributes to an environmental or social objective, provided that the investment does not significantly harm any environmental or social objective and that the investee companies follow good governance practices.

|

|

This is regulatory approved definition - see ESA’s Final report of 22 October 2021 on taxonomy-related product disclosure RTS with regard to the content and presentation of disclosures pursuant to Article 8(4), 9(6) and 11(5) of Regulation (EU) 2019/2088 (JC 2021 50, p. 36).

When it comes to legal wording it is necessary to refer to Article 2(17) SFDR, which defines sustainable investment as 'an investment in an economic activity that contributes to an environmental objective, as measured, for example, by key resource efficiency indicators on the use of energy, renewable energy, raw materials, water and land, on the production of waste, and greenhouse gas emissions, or on its impact on biodiversity and the circular economy, or an investment in an economic activity that contributes to a social objective, in particular an investment that contributes to tackling inequality or that fosters social cohesion, social integration and labour relations, or an investment in human capital or economically or socially disadvantaged communities, provided that such investments do not significantly harm any of those objectives and that the investee companies follow good governance practices, in particular with respect to sound management structures, employee relations, remuneration of staff and tax compliance'.

Hence, the SFDR defines sustainable investment as:

- an investment in an economic activity that contributes to an environmental or social objective;

- the investment does not significantly harm any environmental or social objective; and

- investee companies follow good governance practices in particular with respect to sound management structures, employee relations, remuneration of staff and tax compliance.

Relevant for the application of the SFDR concept of sustainable investments are also:

- the Commission Delegated Regulation (CDR) 2022/1288 which sets out technical details and specific requirements regarding entity-level principal adverse impact (‘PAI’) disclosures and disclosures in relation to financial products’ promotion of environmental or social characteristics and sustainable investment objectives in pre-contractual documents, on websites and in periodic reports (Article 59, point (e)(ii)); and

- the consolidated Q&A document, which puts together responses from the Commission on questions that require interpretation of Union Law and responses from the European Supervisory Authorities on matters relating to the practical application of the SFDR (Consolidated questions and answers on the SFDR and the CDR 2022/1288).

The SFDR foresees specific transparency requirements for two types of financial products:

- financial products that promote environmental or social characteristics provided that the companies in which the investments are made follow good governance practices (these are the products disclosing under Article 8 SFDR - so-called light green products); and

- financial products that have sustainable investment as their objective (these are the products disclosing under Article 9 SFDR - so-called dark green products).

Comparison of the concepts of sustainable investments under SFDR and Taxonomy environmentally sustainable activities

Both the SFDR and the Taxonomy Regulation introduce key concepts to the sustainable finance framework. Notably, they introduce definitions of ‘sustainable investment’ (SFDR) and ‘environmentally sustainable’ economic activities (Taxonomy).

Both definitions require, inter alia, a contribution to a sustainable objective and a do no significant harm (DNSH) test. But while these definitions are similar, there are differences between them which could create practical challenges for market participants.

It is noteworthy, the definition of sustainable investments in Article 2(17) SFDR includes both environmental and social objectives, while the Taxonomy Regulation is only limited to environmental objectives.

Environmentally sustainable investments may be taxonomy-aligned or not.

|

The Taxonomy Regulation imposes a requirement for financial and non-financial undertakings to report on how and to what extent their activities are associated with economic activities that qualify as environmentally sustainable. Under the Taxonomy Regulation framework the assessment of environmental sustainability is carried out at the economic activity level. Non-financial undertakings are required to disclose the extent, to which their Key Performance Indicators (KPIs): turnover, CapEx and OpEx are associated with economic activities that qualify as environmentally sustainable. The relevant disclosures provide information for all economic activities that are ‘taxonomy-eligible’ (i.e. economic activities for which Technical Screening Criteria (TSC) have been developed) and distinguish between those activities that are ‘taxonomy-aligned (i.e. environmentally sustainable) and those that are not. The disclosures also provide aggregated information on Taxonomy non-eligible economic activities (i.e. activities for which relevant TSC are not yet in place). Financial undertakings (credit institutions, insurance and reinsurance undertakings, investment firms and asset managers) are also under an obligation to report on the taxonomy-alignment of their economic activities. The Disclosures Delegated Act sets out the content and presentation of the information that should be disclosed by financial and non-financial undertakings as well as the relevant KPIs that financial undertakings should report. |

Recital 19 of the Taxonomy Regulation explains that the definition of ‘sustainable investment’ in SFDR includes investments in economic activities that contribute to an environmental objective which, amongst others, should include investments into ‘environmentally sustainable economic activities’ within the meaning of the Taxonomy Regulation - see the definition of environmentally sustainable investment in SFDR. Moreover, SFDR only considers an investment to be a sustainable investment if it does not significantly harm any environmental or social objective as set out in the Taxonomy Regulation.

|

|

Hence, the definition of “sustainable investment” in SFDR when compared to the definition of “environmentally sustainable investment” in the Taxonomy Regulation can be considered an overarching definition, encompassing the latter.

As underlined by Transition Finance Report of March 2021 of the Platform on Sustainable Finance, both definitions share some similarities, i.e.:

- focus on investment in qualifying economic activities,

- expect that an activity makes a (substantial) contribution to one or more objectives while avoiding significant harm to other objectives (social and governance objectives are not defined in the Taxonomy Regulation, but the minimum safeguards serve this purpose),

but there are also several differences:

- the SFDR definition of “sustainable investment” is a broad set of principles encompassing the widest possible range of sustainability issues, by contrast, the definition of “environmentally sustainable investment” defines six specific environmental objectives (however, financial products with an environmentally sustainable investment objective (Article 9 products) are required to disclose to what environmental objective(s) as defined in the Taxonomy Regulation the product contributes);

- while the Taxonomy Regulation requires a ‘substantial contribution’ to one or more objectives, the SFDR requires a ‘contribution’ only (this means that under the Taxonomy Regulation activities making incremental or small contributions, which may previously have been described as sustainable, do not meet the regulatory definition, activities with limited or neutral environmental footprint may also not meet the definition);

- the SFDR requires the sustainability contribution of an economic activity to be measured and disclosed using key performance indicators (KPIs) but gives flexibility to the discloser to determine the KPIs, while the taxonomy definition provides precise criteria for assessing when an activity can be considered compliant.

A comparative overview of the concepts of sustainable investments under SFDR and Taxonomy environmentally sustainable activities has been set out in the document: „Concepts of sustainable investments and environmentally sustainable activities in the EU Sustainable Finance framework” (ESMA30-379-2279,22 November 2023) - see extract below.

|

|

Taxonomy |

SFDR |

|

Which stakeholders should apply the concepts of a)Taxonomy environmentally sustainable activities; and b) sustainable investment? |

The concept of environmentally sustainable economic activities is applied by financial and non-financial undertakings which fall within scope of TR Article 8, to assess whether an economic activity is environmentally sustainable, i.e. Taxonomy-aligned. This assessment is carried out as part of the non-financial reporting of these undertakings. |

FMPs that fall within scope of the SFDR (Article 2(1) SFDR sets out a list of FMPs) to assess whether investments of Article 8 and 9 financial products can be deemed as 'sustainable investments'. |

|

What does the application of these concepts entail? |

An economic activity is deemed environmentally sustainable (taxonomy - aligned), when the following requirements are met: a) it is in an economic activity substantial contribution to one or more of the TR environmental objectives; b) do not significantly harm any of those objectives; c) compliance with certain minimum safeguards; and d) compliance with the TSC for substantial contribution and DNSH. |

An investment is deemed as sustainable' when it meets the following requirements: a) it is an economic activity contributing to an environmental or social objective; b) the investment does not significantly harm any environmental or social objective; and c) the investee companies follow good governance practices. |

|

Does the framework contain specific criteria for the application and disclosure of the concepts of SFDR sustainable investments and Taxonomy environmentally sustainable activities? |

The Commission developed sector-specific and science-based criteria (i.e. the TSC in accordance with the TR). These are set out in the Climate Delegated Act and the Complementary Climate Delegated Act for the two climate environmental objectives and the 'Environmental Delegated Act' for the remaining four environmental objectives. |

The SFDR framework does not set out specific criteria, thresholds or targets for the assessment of sustainable investments. Nevertheless, specific disclosures are prescribed for products disclosing under Article 8 or 9 that make sustainable investments. These disclosures include, amongst others: a) a description of how the sustainable investments contribute to a sustainable investment objective; b) explanations on how the SFDR DNSH principle is complied with by showing how the PAI indicators have been taken into account; c) how the sustainable investments are aligned with the OECD Guidelines for Multinational Enterprises and the Guiding Principles on Business and Human Rights set out in the eight fundamental conventions identified in the Declaration of the International Labour Organisation on Fundamental Principles and Rights at Work and the International Bill of Human Rights; and d) the good governance practices of invested companies. |

|

Do the relevant criteria refer to specific targets or thresholds? |

The EU Taxonomy TSC for substantial contribution and DNSH refer to specific targets or thresholds or specific requirements which should be met when the economic activity is carried out. |

The SFDR framework does not prescribe specific targets or thresholds for the assessment of sustainable investments; however sustainable investments must at least abide by the three criteria of Article 2(17): contribution, DNSH and good governance. |

| What is the scope of the two concepts? |

The notion of environmentally sustainable investments is applied at the economic activity level and relates to economic activities that are taxonomy-eligible i.e. economic activities for which TSC regarding substantial contribution and DNSH have been developed. Moreover, environmental sustainability under the TR relates to the 'E' aspect of ESG. |

Sustainable investments can be measured at the level of economic activity or that of a company. Additionally, sustainable investments in the SFDR framework can be in economic activities that contribute to either environmental or social objectives. |

Other regulatory clarifications

The Commission and the ESAs provided additional clarifications on the definition of sustainable investment in a series of published Q&As (Consolidated questions and answers on the SFDR and the CDR 2022/1288, Ref.: JC 2023 18, 17 May 2023).

In particular, the Commission explained that the notion of sustainable investment can be measured at the level of a company and not only at the level of a specific activity (Consolidated questions and answers on the SFDR and the CDR 2022/1288, Ref.: JC 2023 18, 17 May 2023, Q&A II.1).

The Commission explained that Articles 8 and 9 SFDR are neutral in terms of product design (Consolidated questions and answers on the SFDR and the CDR 2022/1288, Ref.: JC 2023 18, 17 May 2023, Q&A V.1).

Furthermore, the Commission clarified (Consolidated questions and answers on the SFDR and the CDR 2022/1288, Ref.: JC 2023 18, 17 May 2023, Q&A II.2) that the SFDR does not set out minimum requirements that qualify concepts such as contribution, DNSH, or good governance, i.e. the key parameters of a ‘sustainable investment’. Financial market participants (‘FMPs’) must carry out their own assessment for each investment and disclose their underlying assumptions.

Moreover, the Commission has outlined two safe harbours regarding the notion of sustainable investments under SFDR. In particular:

a) Passive funds tracking an EU Climate Benchmark. In the relevant Q&A (Consolidated questions and answers on the SFDR and the CDR 2022/1288, Ref.: JC 2023 18, 17 May 2023, Q&A V.9) the Commission explained that financial products which are passively tracking Paris-aligned Benchmarks (PABs) and Climate Transition Benchmarks (CTBs), which are financial products with carbon emissions reduction as their objective and referred to under Article 9(3) SFDR, are automatically deemed to be making sustainable investments as defined in Article 2(17) SFDR.

b) Investments in ‘environmentally sustainable’ economic activities. These investments can be automatically qualified as ‘sustainable investments’ in the context of the product level disclosures under SFDR (Notice of 13 June 2023 on the interpretation and implementation of certain legal provisions of the EU Taxonomy Regulation and links to the Sustainable Finance Disclosure Regulation (2023/C 211/01)).

This clarification will address the issue of the double assessment of those investments under both the EU Taxonomy and SFDR.

However, the Commission notes that for investments in an undertaking with some degree of taxonomy-alignment through a funding instrument that does not specify the use of proceeds, FMPs would still need to check additional elements under the SFDR in order to consider the whole investment in that undertaking as sustainable investment.

This means that the FMPs would still need to:

(i) check whether the rest of the economic activities of the undertaking comply with the environmental elements of the SFDR DNSH principle; and

(ii) assess whether they consider the contribution to the environmental objective sufficient.

The ESAs, furthermore, explained (Consolidated questions and answers on the SFDR and the CDR 2022/1288, Ref.: JC 2023 18, 17 May 2023, Q&A V.16) that, in line with the Commission’s interpretation about discretion within sustainable investments in SFDR, it is possible for FMPs to define their own contribution criteria for socially sustainable investments and create their own framework for their sustainable investments under SFDR as long as they adhere to the minimum criteria of Article 2(17) SFDR, i.e. contribution, DNSH and good governance.

FMPs should not, however, interpret Article 2(17) SFDR differently for different financial products that they make available and apply different interpretations of “sustainable investments” to different financial products that they offer.

As regards the application of the good governance practices requirement, the European Commission clarified that where investee companies do not meet this pre-condition, the financial product would be in breach of Article 8 or Article 9 SFDR.

Additionally, the Commission explained that the good governance practices do not need to be applied in case of investments in government bonds (Q&As V.5 and V.6, respectively).

|

Commission Notice of 13 June 2023 on the interpretation and implementation of certain legal provisions of the EU Taxonomy Regulation and links to the Sustainable Finance Disclosure Regulation, (2023/C 211/01) Do Taxonomy-aligned investments qualify as ‘sustainable investment’ under the SFDR? Recital 19 of the Taxonomy Regulation clarifies that ‘sustainable investments’ under the SFDR include investments into ‘environmentally sustainable economic activities’ within the meaning of the Taxonomy Regulation. In setting out what is required for an activity to be considered as ‘environmentally sustainable’, Article 18(2) makes a link between the Taxonomy Regulation and the SFDR via one of the required steps of the Taxonomy Regulation: the compliance with minimum safeguards. According to the guidance given under question 1 and 2 above, the social elements of the ‘do no significant harm’ principle are considered to be adhered to at entity level for an undertaking that discloses activities as ‘environmentally sustainable’ under the EU Taxonomy. Furthermore, according to the guidance provided in questions 1 and 2 above, the SFDR do no significant harm principle and the requirement to ensure that an investee company follows good governance practices are deemed to be fulfilled for investments in Taxonomy-aligned economic activities as these comply with the Taxonomy’s minimum safeguards. The four aspects of good governance referred to in point 17 of Article 2 of the SFDR (namely sound management structures, employee relations, remuneration of staff and tax compliance can be considered to be satisfied by the provisions referred to in Article 18 of Regulation (EU) 2020/852. Therefore, such investments in Taxonomy-aligned ‘environmentally sustainable’ economic activities can be automatically qualified as ‘sustainable investments’ in the context of the product level disclosure requirements under the SFDR. This means that investments in specific economic activities can be considered to be sustainable investments. However, if a financial market participant (FMP) invests in an undertaking with some degree of taxonomy-alignment through a funding instrument that does not specify the use of proceeds, such as a general equity or debt, the FMP would still need to check additional elements under the SFDR in order to consider the whole investment in that undertaking as sustainable investment. This means that the FMP would still need to: (i) check whether the rest of the economic activities of the undertaking comply with the environmental elements of the SFDR DNSH principle; and (ii) assess whether she/he considers the contribution to the environmental objective sufficient. |

Interactions with MiFID II

Commission Delegated Regulation (EU) 2021/1253 of 21 April 2021 amending Delegated Regulation (EU) 2017/565 as regards the integration of sustainability factors, risks and preferences into certain organisational requirements and operating conditions for investment firms include, among other things, a requirement that EU MiFID II portfolio managers and advisers ask their clients about their “sustainability preferences”, and then comply with such preferences when making decisions or providing advice.

After the amendment the term “sustainability preferences” is defined in Article 2(7) of Delegated Regulation (EU) 2017/565 as a client’s or potential client’s choice as to whether and, if so, to what extent, one or more of the following financial instruments shall be integrated into his or her investment:

(a) a financial instrument for which the client or potential client determines that a minimum proportion shall be invested in environmentally sustainable investments (as defined in Article 2(1) of the Taxonomy Regulation);

(b) a financial instrument for which the client or potential client determines that a minimum proportion shall be invested in sustainable investments (as defined in Article 2(17) of SFDR);

(c) a financial instrument that considers principal adverse impacts on sustainability factors, where qualitative or quantitative elements demonstrating that consideration are determined by the client or potential client.

Links

Links