The EU Taxonomy disclosure rules are based on the translation of environmental performance into financial variables.

|

|

26 March 2024 2023 Corporate Reporting Enforcement and Regulatory Activities Report, ESMA32-193237008-8269

|

Practical use cases regarding taxonomy reporting

Potential practical use cases regarding taxonomy reporting have been described in the document prepared for the European Commission in June 2023: "The EU Taxonomy User Guide" (p. 31 - 35) - see extract below.

|

Use Case: Reporting against the EU Taxonomy for non-financial companies What are the disclosure obligations related to the EU Taxonomy for a non-financial company?

Context

One of the key objectives of the EU Taxonomy is to increase transparency in the market and help reduce greenwashing by providing information to investors about the environmental performance of assets and economic activities of large financial institutions and large non-financial companies. The Disclosures Delegated Act is therefore a key enabler of the EU Taxonomy as it specifies the information that large financial institutions and non-financial companies must provide to investors and wider stakeholders. Disclosure requirements aim to provide the market with information on: (1) companies whose activities comply with the EU Taxonomy criteria (through disclosure of the share of revenue from EU taxonomy-aligned activities); and, (2) companies that are taking steps to get there (through disclosure of green expenditure). As the objective of your disclosure is to allow investors (or, more broadly, financial institutions) to make financing decisions, you will be required to translate your environmental performance into financial variables. Such a process will require new skills and new processes to be defined in your organisation.

Proposed approach to address your challenge

Step 1 - identify taxonomy-aligned economic activities (see Use Cases 1, 2, 3 and 4 for more information). The outcome of your assessment could be that only some of your activities are aligned. For example, if your company manufactures specific equipment for buildings, only the activities related to the products meeting specific energy efficiency thresholds as defined in the technical screening criteria for substantial contribution to climate change mitigation included in Annex I to the Climate Delegated Act will be eligible.

Step 2 - disclose the key performance indicators (KPls) for each economic activity and the total KPIs for all economic activities at the level of the relevant company or group. Such information includes both the turnover from activities identified as taxonomy-aligned, as well as any capital expenditure (and specific operational expenditure) related to expanding these activities and maintaining them as EU taxonomy-aligned. Capital expenditure that are part of an investment plan aiming to make an activity taxonomy-aligned also counts. The KPIs are defined as: (1) The turnover KPI represents the proportion of your net turnover derived from products or services that are taxonomy-aligned. The turnover KPl gives a static view of your company's contribution to environmental goals. (2) The capital expenditure (CapEx) KPI represents the proportion of the capital expenditure of an activity that is either already taxonomy-aligned or is part of a credible plan (as defined by the Commission in the EAQs: What is the EU Taxonomy Article 8 delegated act and how will it work in practice?, question 6: This Disclosures Delegated Act considers that a credible plan is a necessary condition to ensure that companies are embarking on a trajectory aimed to make their economic activities taxonomy-aligned. A credible plan should minimise companies' reputational risks, support their environmental target and develop strategic and forward-looking business decisions.") to extend or reach environmental sustainability. The capital expenditure KPl provides a dynamic and forward-looking view of companies' plans to transform their business activities. The denominator shall cover additions to tangible and intangible assets during the financial year considered before depreciation, amortisation and any re-measurements, including those resulting from revaluations and impairments, for the relevant financial year and excluding fair value changes. The denominator shall also cover additions to tangible and intangible assets resulting from business combinations. The numerator shall be equal to the part of the capital expenditure included in the denominator that is

(3) The operational expenditure (OpEx) KPI represents the proportion of the operating expenditure associated with taxonomy-aligned activities or to the capital expenditure plan. The operating expenditure KPI covers essentially non-capitalised costs related to the maintenance and servicing of companies' assets (plant, equipment) that are necessary to ensure the continued and effective use of assets.

For example, a manufacturing company that produces among others, Taxonomy-aligned energy efficiency equipment buildings report: (1) its net turnover from selling its energy efficiency equipment for buildings as its share of taxonomy-aligned turnover based on the proportion of turnover that those activities (2) new investment to expand a foctory that produces the Toxonomy aligned energy efficiency equipment for buildings as its share of Taxonomy-aligned capital expenditure t based on the proportion of capital expenditure dedicated to this investment. (3) expenditures on purchases of Taxonomy-aligned energy (e.g. renewable energy) or other Taxonomy-aligned inputs for its production process as its share of Taxonomy-aligned operating expenditure. Exception: for the environmental objective of climate change adaptation (unless for enabling activities), only the capital or operating expenditures related to making an activity climate-resilient should be taken into account. The turnover associated with the activity itself should not be counted unless it also qualifies as environmentally sustainable for its substantial contribution to another environmental objective. For example, a manufacturing plant that does not comply with the criteria for substantial contribution to climate change mitigation, but is being renovated to improve its resilience against climate change, could count the renovation as taxonomy-aligned expenditure. However, the turnover linked to the activity of the manufacturing plant, even after the plant has been made climate-resilient, would not count unless the products manufactured in the plant are taxonomy-aligned.

Annex Il to the Disclosures Delegated Act includes templates for the KPIs of non-financial companies. For example, a part of the template for the disclosure of the proportion of tumover from products or services associated with taxonomy-aligned economic activities is shown below.

See templates provided in Annex Il of the Disclosures Delegated Act.

Step 5 - identify taxonomy-non-eligible economic activities and disclose the proportion of turnover, CapEx, and OpEx related to Taxonomy non-eligible activities over total turnover, CapEx, and OpEx. See templates provided in Annex Il of the Disclosures Delegated Act.

Step 6 - provide supplementary information to show the transition of your taxonomy-eligible economic activities towards Taxonomy alignment over time and explain the key elements for change of the three KPIs during the reporting period. Remark: if your company prepares only individual non-financial statements, all the KPIs shall be provided at the level of the individual legal entity. If your company prepares consolidated non-financial statements, they shall be prepared at the level of the group.

Next steps and references

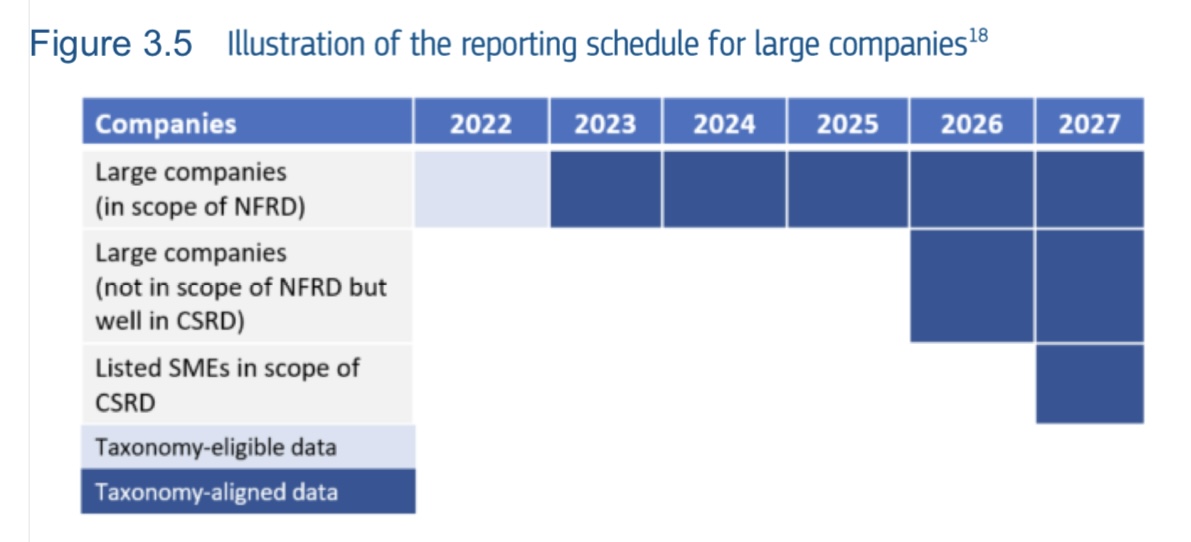

The reporting obligations will increase gradually, with the following schedule:

For more information, you should refer to the Disclosure Delegated Act, the accompanying Staff Working Document and the related FAQs published by the European Commission:

Source: The EU Taxonomy User Guide, Document prepared for the European Commission, June 2023, p. 31 -35 |

|

Use Case: Reporting against the EU Taxonomy for non-listed SMEs or non-EU companies (companies not legally established in the EU)

Your company is a non-listed SME or a non-EU company, therefore it will not need to comply with the Taxonomy disclosures referred to in the CSRD. How can you still use the EU Taxonomy to measure and report your impact on climate change adaptation and mitigation?

Context

Reporting alignment with the EU Taxonomy is not mandatory for your company, but there might be good reasons for you to start considering it already. First, depending on market developments and the review mentioned in Article 9 of the Disclosures Delegated Act, financial institutions may gradually consider the degree to which their exposures align with the Taxonomy for all types of underlying companies, including non-listed SMEs and non-EU companies, not subject to the Taxonomy disclosures under the CSRD. Therefore, if your business has European investors, they will likely be asking questions about your alignment with the EU Taxonomy. Second, European companies operating globally will be likely to apply the EU Taxonomy lens to their global operations. While the EU Taxonomy is an EU regulation, it will have implications for foreign markets that conduct business with Europe or European companies. If you are a supplier of large EU companies, your clients might also need some information on your products in order to assess and disclose the potential impacts of their own outputs (e.g., to assess Do No Significant Harm criteria for building materials). Finally, you might consider applying the EU Taxonomy disclosure rules on a voluntary basis as its criteria might provide an important reference point to demonstrate the positive impact of your activities and therefore potentially retain or attract EU investors. For instance, SMEs that provide products or services in line with the EU Taxonomy, such as manufacturing of renewable energy or energy efficiency equipment, will have the option to use the EU Taxonomy as a tool to highlight the benefits and environmental contribution of their green activities and get easier access to green finance (e.g., a green loan of a bank linked to its green bonds issuance).

Proposed approach to address your challenge

Step 1 - Assess EU Taxonomy disclosure requirements. For the reasons highlighted above, it might be important that your company already starts assessing the disclosure requirements sets in the EU Taxonomy (refer to Use Case 7) and identify your stakeholders' needs and the related required data to be collected. For example, if your company manufactures specific equipment for buildings, you should assess how to calculate/report the turnover and expenditure KPIs related to taxonomy-aligned activities. The KPIs will potentially cover some of your products if they meet the energy efficiency thresholds as defined in the technical screening criteria for substantial contribution to climate change mitigation (see Annex I of the Climate Delegated Act).

Step 2 - Identify required skills and define reporting processes. The EU Taxonomy disclosure rules are based on the translation of your environmental performance into financial variables. Such a process is not straightforward. Some requirements might be perceived as an administrative burden for smaller entities and represent an obstacle in relation to the correct and efficient voluntary reporting. It is therefore important to identify the new skills and processes that are required for your organisation. Using the above example of a company manufacturing specific equipment for buildings, you will need to collect and assess environmental and social data on your energy efficient products to demonstrate alignment with the technical screening criteria and compliance with the minimum safeguards (see Use Case 2 to 6). You will also need to collect financial information to assess the share of turnover that those products represent, and the potential expenditures related to an extension, switch or development of the production capacity of those products.

Step 3 - Apply disclosure requirements to your economic activities identified as taxonomy-aligned and follow the process described in Use Case 7. Those SMEs whose business model is focused on one green activity covered by the EU Taxonomy will have only one set of criteria applicable to their business model. For example, a small manufacturer of energy efficient windows could check relatively easily what share of its turnover, capital expenditure or operational expenditure is related to the sale of windows that comply with the EU Taxonomy criteria.

Next steps and references

Reporting obligations will be extended gradually, with the following schedule:

As described in the previous chapter, the CSRD enlarges the scope of companies that will need to publish sustainability information to all large and all listed companies (with the exception of micro companies).

For more information, you should refer to the Disclosure Delegated Act, the accompanying Staff Working Document and the related FAQs published by the European Commission:

Source: The EU Taxonomy User Guide, Document prepared for the European Commission, June 2023, p. 49 - 51 |

Regulatory chronicle

Regulatory chronicle

26 March 2024

2023 Corporate Reporting Enforcement and Regulatory Activities Report, ESMA32-193237008-8269

21 December 2023

June 2023

The EU Taxonomy User Guide, June 2023, p. 31 - 35, 49 - 51

Links

Links

Taxonomy |