EMIR clearing obligation

- Category: EMIR

The obligation to clear certain classes of OTC derivatives in Central Counterparties (CCPs) that have been authorised (for European CCPs) or recognised (for third-country CCPs) under the European Market Infrastructure Regulation ("EMIR") framework reflects the overarching objectives to reduce financial infrastructure systemic risks.

|

|

7 February 2024 Council and Parliament agree on improvements to EU clearing services The provisional agreement sets a solid active account requirement (AAR) that will require certain financial and non-financial counterparties to have an account at an EU CCP, which includes operational elements such as the ability to handle the counterparty’s transactions at short notice if need be and activity elements so that the account is effectively used. This is ensured by a number of requirements, which have to be fulfilled by these accounts, including requirements for counterparties above a certain threshold to clear trades in the most relevant sub-categories of derivatives of substantial systemic importance defined in terms of class of derivative, size and maturity. Commission welcomes political agreement on the clearing package

Capital markets Union: Council reaches agreement on improvements to EU clearing services

13 February 2023 Commission Delegated Regulation (EU) 2023/315 of 25 October 2022 amending the regulatory technical standards laid down in Delegated Regulations (EU) 2015/2205, (EU) No 2016/592 and (EU) 2016/1178 as regards the date at which the clearing obligation takes effect for certain types of contracts published in the EU Official Journal

18 October 2022 Public Register for the Clearing Obligation under EMIR (ESMA70-151-2218) updated

17 May 2022

The Regulation amends the EMIR clearing obligation due to the cessation of the publication of LIBOR settings. Targeted consultation on the review of the central clearing framework in the EU

|

This regulatory policy framework is intended to drastically rebuild the existing OTC market infrastructure. While the estimated value of total gross notional outstanding for non-centrally cleared derivative activities was in 2015 about EUR 146 trillion (see Draft Impact Assessment to ESAs' Second Consultation on margin RTS for non-cleared derivatives of 10 June 2015 p. 64), this figure was expected to decrease to about EUR 74.9 trillion (or by 49%) after the implementation of the central clearing obligation, which require about half of these transactions to be subject to mandatory central clearing.

|

|

In other words, after the implementation of the margin requirements, about 49% of the OTC derivatives market will be captured by the EMIR collateral requirement, and the remaining 51% will be cleared centrally.

Article 4(1)(b) of EMIR mandates the clearing of the OTC derivative contracts (pertaining to a class of OTC derivatives that has been declared subject to the clearing obligation) that are entered into or novated either on or after the date from which the clearing obligation takes effect or during the frontloading period detailed in Article 4(1)(b)(ii) (note that the frontloading requirement is intended to be removed - see below) and under certain conditions.

The European Securities and Markets Aurhority (ESMA) underlined all types of trade novations are covered by the clearing obligation laid down in Article 4 of EMIR, i.e. it applies each time a counterparty (being a CCP or another counterparty) steps into the trade and become a new counterparty to the trade.

The personal scope of the EMIR clearing obligation covers:

- all financial counterparties (irrespective of their size and of their volume of OTC derivatives activity - however, according to the Proposal for a Regulation of the European Parliament and of the Council amending Regulation (EU) No 648/2012 as regards the clearing obligation, the suspension of the clearing obligation, the reporting requirements, the risk-mitigation techniques for OTC derivatives contracts not cleared by a central counterparty, the registration and supervision of trade repositories and the requirements for trade repositories (COM(2017)208) of May 2017 small financial counterparties, such as small banks or funds, below the clearing threshold are proposed to be freed from the requirement to clear centrally),

- non-financial counterparties above the clearing threshold (NFCs+).

|

Under EMIR, OTC derivatives transactions that have been declared subject to a clearing obligation must be cleared centrally through a CCP authorised or recognised in the Union. |

Procedure for defining classes of OTC derivatives subject to the clearing requirement

The process at issue requires in the first place proper identification of classes of derivatives that should be subject to mandatory clearing. The prominent role in that regard EMIR reserves to the European Securities and Markets Authority (ESMA), which, in accordance with the clearing obligation procedure of Article 5 of EMIR, is entrusted with the task to develop and submit to the European Commission for endorsement draft technical standards specifying:

- the class of OTC derivatives that should be subject to the clearing obligation referred to in Article 4;

- the class of OTC derivatives that should be subject to the clearing obligation referred to in Article 4;

- the date or dates from which the clearing obligation takes effect, including any phase in and the categories of counterparties to which the obligation applies; and

- the minimum remaining maturity of the OTC derivative contracts referred to in Article 4(1)(b)(ii).

It follows, EMIR clearing obligation applies to derivatives determined in the special procedure only as "not all CCP-cleared OTC derivative contracts can be considered suitable for mandatory clearing" (Recital 15 of EMIR).

It needs to be underlined there is no automatic inclusion of the authorised classes directly into the clearing obligation, but EMIR defines the "process of identification of classes of derivatives that should be subject to the clearing obligation", based on a series of criteria to base the analysis on.

Following the said procedure after reviewing this first set of authorised classes against the EMIR criteria, ESMA has determined a subset of classes to be subject to the clearing obligation. On the contrary, several classes, are currently determined to be not fit for the clearing obligation.

What needs to be stressed, EMIR requires ESMA to define contracts subject to the clearing obligation as opposed to the conditions under which the contracts are subject to the clearing obligation as those conditions are already defined under the Level 1 text.

|

Under the bottom-up approach, ESMA determines the classes of over-the-counter (OTC) derivative contracts subject to the clearing obligation among the classes that are already cleared by central counterparties (CCPs). This process is ignited by the initial authorisation of an EU CCP, as well as any extension of CCP activities, and by the recognition of a third-country CCP. Under the top-down approach, ESMA identifies classes of OTC derivatives that should be cleared, but for which no CCP has developed an offer. Moreover, ESMA publishes a call for a development of proposals for the clearing of those classes. |

As the EMIR Review Report no.4 - ESMA input as part of the Commission consultation on the EMIR Review (2015/1254) underlines, the clearing obligation "relies on a pre-condition, which is the authorisation of CCPs or the recognition of TC-CCPs under EMIR. Indeed, counterparties can only be mandated to clear certain classes of OTC derivatives when there are CCPs meeting certain standards and that have been authorised to clear these classes. The bottom-up procedure of Article 5(2) is built on this principle. Indeed, the authorisation or the recognition of a CCP is the trigger of the bottom-up procedure to determine the classes, amongst those classes the CCP is authorised to clear, that should become subject to the clearing obligation." For each of these procedures, ESMA has up to six months from the time of the notifications to draft the respective regulatory technical standards (RTS), consult thereon and submit draft RTS for endorsement to the European Commission.

In practice, in the four consultation papers released so far (see below) ESMA applied a "grouping approach" consisting in that instead of triggering the procedure each time a CCP was authorised, as long as the different authorisations were not too far apart and as long as the classes were in the same asset class or in the same product type range, ESMA analysed and consulted on sets of classes that would span across a range of CCPs.

After the Commission's endorsement, the RTS are subject to a non-objection period by both the European Council and Parliament, after which the clearing obligation will be phased-in per type of counterparties.

The first procedure of this kind have started on 18 March 2014 following the re-authorisation under EMIR of Nasdaq OMX Clearing AB as the first EU-based CCP on 18 March 2014. In accordance with the procedure laid out under Article 5(1) of EMIR, ESMA was notified of the fact including the classes of OTC derivatives cleared by Nasdaq OMX Clearing AB - being intrest rates, debt instrument and equity (emission allowances as included in the commodity asset class were subject to this notification). Among the first three European CCPs re-authorised by ESMA under EMIR were also:

- European Central Counterparty N.V. (EuroCCP - NL), Netherlands

- KDPW_CCP, Poland.

Subsequent CCPs followed the suit - the full database of European CCPs and of the classes of assets cleared by them can be accessed here.

As ISDA Europe Conference Speech by ESMA's Chair Steven Maijoor (2015/1417) observes, half of the European CCPs clear OTC derivatives and almost all of them have since 2014 received regulatory approval from their national competent authorities confirming they comply with the higher standards embedded in EMIR.

The significant proposition that has not been included in the binding law so far is the postulate no clearing obligation be imposed unless there are at least 2 CCPs available to clear them. The underlying reason is to avoid a situation of monopoly and the concentration of risk in a single market infrastructure. The conception implies the clearing obligation to be automatically removed in case the number of CCPs available to clear a specific class falls below 2. However, under the current regulatory framework only one CCP available to clear a derivatives' class is sufficient for the clearing obligation to be made applicable.

Another area for improved clarity over the scope of the clearing obligation has been indicated by ISDA in the document of 18 July 2017 (International Swaps and Derivatives Association (ISDA) comments on the ‘EMIR Refit’ proposal, p. 3).

To avoid the accidental extension of the clearing obligation as a result of recognized CCPs subsequently clearing non-standard products variants of a product already mandated to clear, ISDA proposes amending EMIR so the only products mandated to clear are those that were offered by CCPs at the time of ESMA’s clearing determination.

As a matter of principle, the clearing obligation procedure under EMIR is a time-consuming process, large number of ESMA publications in this regard includes:

- a discussion paper,

- six consultation papers on the clearing obligation (on interest rate derivative classes, credit derivative classes, foreign-exchange non-deliverable forward classes, treatment in the current Commission Delegated Regulation of intragroup transactions with a third country group entity, as well as on financial counterparties with a limited volume of activity, an additional consultation paper was developed jointly with the ESAs on the clearing obligation following the amendments to EMIR that were introduced in the Securitisation Regulation),

- four final reports on the clearing obligation (on interest rate derivative classes, on credit derivative classes and on financial counterparties with a limited volume of activity),

- a feedback statement on non-deliverable forward classes and

- the EMIR Review Report No. 4.

The focus of the sixth ESMA consultation paper of 11 July 2018 is the treatment in the current Commission Delegated Regulation of intragroup transactions with a third country group entity. The said sixth consultation paper re-assesses the date or dates from when the requirements are due to apply for these contracts. The document refers to the following facts:

- as of the date of publication of the consultation paper, there are three Commission Delegated Regulations on the clearing obligation that have entered into force, which mandate a range of interest rate and credit derivative classes to be cleared,

- these Commission Delegated Regulations contain a deferred date of application of the clearing obligation for intragroup transactions satisfying certain conditions and where one of the counterparties is in a third country, in the absence of the relevant equivalence decision,

- the said deferred dates are approaching and there have not been any equivalence decisions to the consultation’s date with regards to the clearing obligation.

Therefore, the consultation paper looks into the reasons to extend the deferred dates of application. More in detail, in the Q&As on EMIR ESMA has indicated that if a counterparty is established in a third country, the European Commission must have adopted an implementing act under Article 13(2) of EMIR in respect of the relevant third country in order for transactions between this counterparty and the counterparty established in the European Union within the same group to qualify as intragroup transaction transactions under Article 3 of EMIR.

The three Commission Delegated Regulations on the clearing obligation, i.e.:

- Commission Delegated Regulation (EU) 2015/2205,

- Commission Delegated Regulation (EU) 2016/1178 regarding interest rate derivative classes, and

- Commission Delegated Regulation (EU) 2016/592 regarding credit derivative classes,

include a provision related to intragroup transactions with a third-country group entity, under Article 3(2) of EMIR, which provides for a deferred date of application of the clearing obligation of up to three years for these transactions, in the absence of the relevant equivalence decision.

According to the Recitals of the said Regulations, the rationale for this temporary exemption is as follows:

“For OTC derivative contracts concluded between a counterparty established in a third country and another counterparty established in the Union belonging to the same group and which are included in the same consolidation on a full basis and are subject to an appropriate centralised risk evaluation, measurement and control procedures, a deferred date of application of the clearing obligation should be provided. The deferred application should ensure that those contracts are not subject to the clearing obligation for a limited period of time in the absence of implementing acts pursuant to Article 13(2) of Regulation (EU) No 648/2012 covering the OTC derivative contracts set out in the Annex to this Regulation and regarding the jurisdiction where the non-Union counterparty is established. Competent authorities should be able to verify in advance that the counterparties concluding those contracts belong to the same group and fulfil the other conditions of intragroup transactions pursuant to Regulation (EU) No 648/2012.”

The three Commission Delegated Regulations on the clearing obligation entered into force on three different dates, which means that the three year deadline expires on three different dates for each of them:

a. 21 December 2018 for the first Commission Delegated Regulation on IRS,

b. 9 May 2019 for the Commission Delegated Regulation on CDS, and

c. 9 July 2019 for the second Commission Delegated Regulation on IRS.

Given that:

- the adoption by the European Commission of implementing acts on equivalence under Article 13 of EMIR (establishing that third-countries are considered as having legal, supervisory and enforcement frameworks equivalent to EMIR) is required for the exemption to clear derivatives subject to the clearing obligation for intragroup transactions with third-country group entities,

- as of July 2018, no such implementing act has been adopted,

in the Consultation Paper No 6 of 11 July 2018 on the Clearing Obligation under EMIR (ESMA70-151-1530) ESMA proposed to prolong the above exemptions for a limited and short period of time only (by two years for Commission Delegated Regulation (EU) 2015/2205 regarding interest rate derivative classes denominated in the G4 currencies, i.e. until 21 December 2020), and, for simplicity, to align the date for the other two Commission Delegated Regulations (EU) 2016/1178 and (EU) 2016/592 to 21 December 2020 as well.

Clearing Obligation Public Register

The Clearing Obligation Public Register contains two types of information:

1. The list of the classes of OTC derivatives notified to ESMA - this section of the register was published for the first time on 18 March 2014 after a notification was received by ESMA under the procedure described in Article 5(1) of EMIR, i.e. following the authorisation of the first CCP to clear certain classes of OTC derivatives. This part of the Public Register is updated after each CCP authorisation. The European financial regulator's task will be in each case to assess whether the classes of OTC derivatives notified meet the criteria defined in EMIR, and, if the conditions prove fulfilled, to propose draft regulatory technical standards (RTS) on the clearing obligation with respect to those classes of assets. It is noteworthy, the clearing obligation procedure defined in Article 5(2) of EMIR is triggered every time a new CCP clearing OTC derivatives is authorised. In this type of procedure ESMA will only assess the suitability of classes notified.

This means that if CCPs are authorised on different dates, several clearing obligation procedures may run in parallel.

The classes of OTC derivatives listed may become subject to the clearing obligation in accordance with the clearing obligation procedure defined in Article 5 of EMIR and be added to the public register when the relevant Regulatory Technical Standards enter into force.

2. The list of classes subject to the clearing obligation - this section of the register will be published immediately after the entry into force of the RTS specifying the classes of OTC derivatives subject to the clearing obligation.

These RTS will be adopted following the procedure described in Article 5(2) of EMIR.

Clearing Obligation Public Register can be accessed here.

Updates of the public register for the clearing obligation are available by subscribing to the ESMA website and creating alerts. An email is then sent every time a new document is published by ESMA.

Classes of OTC derivatives subject to the clearing obligation

Increasingly supported by data retrieved from European Trade Repositories, ESMA is in the process of analysing contracts that are currently offered for clearing by European CCPs, to determine whether they meet the criteria defined in EMIR to be subject to the clearing obligation (which relate to standardization, liquidity, and availability of pricing information).

Based on the above-described procedure and legal requirements ESMA consulted so far on the clearing obligation for Interest Rate Derivatives (IRS), Credit Default Swaps (CDS) and Non-Deliverable Forwards (NDFs) instruments already, while commodity derivatives have not yet been proposed by ESMA for mandatory clearing.

A first set of rules will require counterparties to clear interest rate swaps (IRS) denominated in EUR, GBP, JPY and USD (the "G4 currencies"). The second set of rules under EMIR will require mandatory clearing of certain Index Credit Default Swaps (CDS).

Interest Rate Derivatives (IRS)

Interest rate derivatives represent the significant portion of the market as this asset class concentrates approximately 80% of the total volumes of OTC derivatives. ESMA launched a public consultation in July 2014 (ESMA/2014/799 published on 11 July 2014) and in October 2014 submitted to the European Commission its final proposal (ESMA/2014/1184 published on 1 October 2014) to impose a clearing obligation on several classes of interest rate swaps denominated in the G4 currencies (EUR, GBP, JPY and USD).

Certain aspects of the clearing obligation for IRS sparked, however, vivid discussion between ESMA and the European Commission (ESMA's Opinion Draft RTS on the Clearing Obligation on Interest Rate Swaps of 29 January 2015 (2015/ESMA/223) and ESMA's Revised Opinion Draft RTS on the Clearing Obligation on Interest Rate Swaps of 6 March 2015 (2015/ESMA/511)), mainly due to the need to amend the timeline of entry into force and introduce a special carve-out for intragroup transactions concluded with non-EU counterparties.

Finally, the European Commission adopted on 6 August 2015 (see the European Commission press release of 6 August 2015) a Delegated Regulation that requires mandatory clearing through central counterparties for the following types of over-the-counter (OTC) interest rate derivative contracts denominated in the G4 currencies (GBP, EUR, JPY and USD):

- Fixed-to-float interest rate swaps (IRS), known as 'plain vanilla' interest rate derivatives,

- Float-to-float swaps, known as 'basis swaps',

- Forward Rate Agreements,

- Overnight Index Swaps.

The specific classes within the scope as well as specific features (among others the index used as a reference for the derivative, its maturity, and the notional type) were set out in the Annex to the Delegated Regulation.

The Regulation envisioned for the phase-in the clearing obligation for the above G4 currencies over a period of three years according to counterparty category (as well as the frontloading requirement for financial counterparties in categories 1 and 2).

The said Delegated Regulation after a scrutiny by the European Parliament and the Council has been published in the Official Journal of the European Union with the entry into force on the twentieth day following publication (Commission Delegated Regulation (EU) 2015/2205 of 6 August 2015 supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council with regard to regulatory technical standards on the clearing obligation). This legislative act is sometimes called: "First Delegated Regulation on the clearing obligation".

Furthermore, ESMA launched a public consultation in May 2015 (ESMA/2015/807 published on 11 May 2015) with a proposal to extend the scope of IRS to 6 other currencies, namely the Czech Koruna (CZK), Danish Krone (DKK), Hungarian Forint (HUF), Norwegian Krone (NOK), Polish Zloty (PLN) Swedish Krona (SEK).

This was followed by the Final Report Draft technical standards on the Clearing Obligation – Interest rate OTC Derivatives in additional currencies, of 10 November 2015 (ESMA/2015/1629), which proposed a clearing obligation for fixed-to-float interest rate swaps denominated in NOK, PLN and SEK and forward rate agreements denominated in NOK, PLN and SEK. The said ESMA's Report findings as regards the clearing obligation for NOK, PLN and SEK have been implemented in the Commission Delegated Regulation of 10.6.2016 supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council with regard to regulatory technical standards on the clearing obligation, C(2016) 3446 final (Annex is available here). The said Regulation has been published in the Official Journal of the European Union on 20 July 2016 (Commission Delegated Regulation (EU) 2016/1178 of 10 June 2016 supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council with regard to regulatory technical standards on the clearing obligation). This Regulation comes as the third delegated act on the clearing obligation as, in the meantime, the separate regulation stipulated the clearing obligation on CDS asset classes (see below).

See more on the clearing obligation for IRS...

Credit Default Swaps (CDS)

When it comes to the Credit Default Swaps (CDS) asset class, ESMA consulted stakeholders in July 2014 on a proposal for mandatory clearing on certain CDS indices (ESMA/2014/800 published on 11 July 2014, the index CDS included are untranched iTraxx Europe Main and iTraxx Europe Crossover with 5Y tenor). Although the feedback received to this consultation was broadly positive, ESMA temporarily suspended the delivery of the final proposal to the European Commission until the first rules on the clearing obligation for IRS are finalised.

On 2 October 2015 ESMA finalised and issued a draft Regulatory Technical Standard for CDS, which has been adopted by the European Commission on 1 March 2016 (Commission Delegated Regulation (EU) 2016/592 of 1 March 2016 supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council with regard to regulatory technical standards on the clearing obligation - sometimes called: "Second Delegated Regulation on the clearing obligation". The said standard defines types of CDS contracts, which will have to be centrally cleared, the types of counterparties covered by the obligation and the dates by which central clearing of CDS will become mandatory.

In effect wo iTraxx Index CDS have been subjected to the clearing obligation:

|

See also:

ESMA website on clearing obligation

ICE Clear Europe Clearing Rules, 13 December 2019

|

- Untranched iTraxx Index CDS (Main, EUR,5Y),

- Untranched iTraxx Index CDS (Crossover, EUR,5Y).

The new rules on Index CDS mirror the overall approach of the first RTS on IRS, in particular with regards to the categorisation of counterparties, the scope for frontloading and the treatment of intragroup transactions.

Non-Deliverable Forwards (NDFs) nad equity derivatives

ESMA issued a consultation paper in October 2014 (ESMA/2015/1185 published on 1 October 2014) with a proposal of mandatory clearing for certain FX products, namely non-deliverable forwards, or NDFs.

Based on the feedback received, ESMA has concluded that more time would be needed to address the concerns raised in the responses, and has decided not to propose a clearing obligation on those classes at this stage (ESMA's Feedback Statement of 4 February 2015, 2015/ESMA/234). Similarly, ESMA did not propose draft regulatory technical standards to make equity derivatives subject to the clearing obligation.

General remarks on classes of OTC derivatives subject to the clearing obligation

Overall, the scope of the clearing obligation may expand in future to other currencies but also possibly to other classes as CCPs gradually develop their clearing offer (see Verena Ross, Executive Director, European Securities and Markets Authority, Keynote speech at IDX 2015, London, 09 June 2015 ESMA/2015/921).

To summarise, the legislative system regarding derivatives subject to the mandatory clearing may seem complicated and not user-friendly. It consists of several independent and separate RTS. There are separate RTS even for derivatives within the same asset class (IRS). The verification of multiple regulations to establish which asset classes are subject to the clearing obligation and whether the provisions are final and binding or in the legislative procedure yet, appears onerous. To cope with this problem ESMA's Report of 10 November 2015 (ESMA/2015/1629, p. 6) underlines the list of classes subject to the clearing obligation is consolidated in one place - the Public Register available on the ESMA website. Therefore, consolidated and central place of information for the list of classes subject to the clearing obligation is not intended to be achieved via an RTS, but it is provided for by the ESMA's Public Register.

Clearing obligation phase-in periods

The distribution of trades among financial counterparties is highly concentrated, i.e. that a relatively small number of counterparties account for an important share of the total market. This asymmetry was one of the justifications for the adoption of a phased-in implementation schedule for the clearing obligation, i.e. starting with the few but most active counterparties (clearing members) and adding progressively an increasing number of less active counterparties. This asymmetric distribution is present in both asset classes that first became subject to the clearing obligation i.e. the interest rate and the credit asset classes, where the largest 100 counterparties accounted for 96%-97% of the OTC derivative volume, measured by outstanding notional amounts (Consultation Paper on the clearing obligation for financial counterparties with a limited volume of activity, 13 July 2016, ESMA/2016/1125, p. 12).

The milestones for the staged implementation of the clearing obligation are set out in the table below.

| Category |

Entities covered |

(G4 currencies) |

Commission Delegated Regulation (EU) 2016/592 of 1 March 2016 supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council with regard to regulatory technical standards on the clearing obligation (European Index CDS) |

(NOK, PLN, SEK) |

| 1 |

Clearing members for at least one of the classes of OTC IRS subject to clearing

|

21 June 2016 |

9 February 2017 |

9 February 2017 |

| 2 |

Financial counterparties and alternative investment funds (AIFs) which are not clearing members and which have a higher level of activity in OTC derivatives (to be measured against a quantitative threshold

|

21 December 2016 | 9 August 2017 | 9 July 2017 |

| 3 |

Financial counterparties and alternative investment funds (AIFs) which are not clearing members and which have a lower level of activity in OTC derivatives (to be measured against a quantitative threshold)

Dates comprise the amended deadlines for Category 3 counterparties as set out in the

|

21 June 2019 |

21 June 2019 |

21 June 2019 |

| 4 |

Non-financial counterparties not included in the other categories

|

21 December 2018 | 9 May 2019 | 9 July 2019 |

(Note: where a contract is concluded between two counterparties included in different categories of counterparties, the date from which the clearing obligation takes effect for that contract shall be the later date)

In the aforementioned ESMA's Consultation Paper of 13 July 2016 on the clearing obligation for financial counterparties with a limited volume of activity (ESMA/2016/1125) ESMA proposed a two-year postponement of the date of application of the clearing obligation for Category 3, compared to the dates that are currently set out in the Delegated Regulations. Indeed, delaying the application of the clearing obligation by 2 years for counterparties in Category 3 means that the deadline for this category of counterparties would come after that of Category 4 (comprising non-financial counterparties above the clearing threshold).

It may be questionable that the proposed delay of the clearing obligation is only for Category 3 counterparties, while the clearing obligation for Category 4 counterparties (being mostly less sophisticated entities) would remain unchanged and enter into force 6 months before the obligation for Category 3 counterparties. However, ESMA's Final Report on the clearing obligation for financial counterparties with a limited volume of activity of 14 November 2016, ESMA/2016/1565 upheld this approach arguing Category 4 counterparties are sometimes much more sophisticated than the ones in the Category 3 and pointing out minor systemic relevance of Category 3 counterparties, which represent only 5.1% of the volume on the CDS market versus 1.1% of the volume in the IRS market. ESMA, moreover, proposed in the Final Report to align the three compliance dates for Category 3 in the three Delegated Regulations on IRS and CDS.

As a result, compared to the Consultation paper, ESMA has modified in its Final Report the compliance date for Category 3 in the Delegated Regulation on IRS denominated in NOK, PLN and SEK and in the Delegated Regulation on CDS. This uniform compliance date for Category 3 is now 21 June 2019.

The above legislative propositions have been upheld by the Commission Delegated Regulation (EU) 2017/751 of 16 March 2017 amending Delegated Regulations (EU) 2015/2205, (EU) 2016/592 and (EU) 2016/1178 as regards the deadline for compliance with clearing obligations for certain counterparties dealing with OTC derivatives.

In turn, the Brexit’s impact on the timelines of EMIR mandatory clearing has been addressed by Commission Delegated Regulation (EU) 2019/565 of 28 March 2019 amending Delegated Regulation (EU) 2015/2205, Delegated Regulation (EU) 2016/592 and Delegated Regulation (EU) 2016/1178 supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council as regards the date at which the clearing obligation takes effect for certain types of contracts.

In the same vein (Brexit), the European Commission reminded on 14 July 2020 in the Notice to Stakeholders on Withdrawal of the United Kingdom and EU rules in the field of post-trade financial instruments (REV1 - replacing the notice dated 8 February 2018) that, in the absence of the relevant agreement, the loss of EU authorisation of CCPs established in the United Kingdom will affect their ability to continue performing certain activities (e.g. compression) and fulfilling certain obligations (e.g. default management) with regard to contracts concluded before the end of the transition period.

A higher capital charge will apply to exposures resulting from positions in derivatives held by credit institutions and investment firms established in the EU in non-CCPs established in the EU and recognised CCPs established in a third country are recognised CCPs established in third countries.

This is because only authorised qualifying CCPs (QCCPs), which have a favourable capital treatment under CRR (see Article 4(1)(88) of CRR, subject to the transitional provisions of Article 497 of CRR and Commission Implementing Regulation (EU) 2017/2241 of 6 December 2017 - transitional period for third-country CCPs until 15 June 2018).

Counterparties classification

The existing system of counterparty classification was designed taking into consideration the criteria set up in EMIR, in particular:

- the level of sophistication of the counterparties and the type and number of counterparties active in the relevant OTC derivative markets (criteria (d) of Article 5(5) of EMIR), and

- the differences in the legal and operational capacities of the counterparties (criteria (f) of Article 5(5) of EMIR).

|

Recitals 4 - 8 of the Commission Delegated Regulation (EU) 2015/2205 of 6 August 2015 supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council with regard to regulatory technical standards on the clearing obligation (4) Different counterparties need different periods of time for putting in place the necessary arrangements to clear the interest rate OTC derivatives subject to the clearing obligation. In order to ensure an orderly and timely implementation of that obligation, counterparties should be classified into categories in which sufficiently similar counterparties become subject to the clearing obligation from the same date. (5) A first category should include both financial and non-financial counterparties which, on the date of entry into force of this Regulation, are clearing members of at least one of the relevant CCPs and for at least one of the classes of interest rate OTC derivatives subject to the clearing obligation, as those counterparties already have experience with voluntary clearing and have already established the connections with those CCPs to clear at least one of those classes. Non-financial counterparties that are clearing members should also be included in this first category as their experience and preparation towards central clearing is comparable with that of financial counterparties included in it. (6) A second and third category should comprise financial counterparties not included in the first category, grouped according to their levels of legal and operational capacity regarding OTC derivatives. The level of activity in OTC derivatives should serve as a basis to differentiate the degree of legal and operational capacity of financial counterparties, and a quantitative threshold should therefore be defined for division between the second and third categories on the basis of the aggregate month-end average notional amount of non-centrally cleared derivatives. That threshold should be set out at an appropriate level to differentiate smaller market participants, while still capturing a significant level of risk under the second category. The threshold should also be aligned with the threshold agreed at international level related to margin requirements for non-centrally cleared derivatives in order to enhance regulatory convergence and limit the compliance costs for counterparties. As in those international standards, whereas the threshold applies generally at group level given the potential shared risks within the group, for investment funds the threshold should be applied separately to each fund since the liabilities of a fund are not usually affected by the liabilities of other funds or their investment manager. Thus, the threshold should be applied separately to each fund as long as, in the event of fund insolvency or bankruptcy, each investment fund constitutes a completely segregated and ring-fenced pool of assets that is not collateralised, guaranteed or supported by other investment funds or the investment manager itself. (7) Certain alternative investment funds ('AIFs') are not captured by the definition of financial counterparties under Regulation (EU) No 648/2012 although they have a degree of operational capacity regarding OTC derivative contracts similar to that of AIFs captured by that definition. Therefore AIFs classified as non-financial counterparties should be included in the same categories of counterparties as AIFs classified as financial counterparties. (8) A fourth category should include non-financial counterparties not included in the other categories, given their more limited experience and operational capacity with OTC derivatives and central clearing than the other categories of counterparties. |

Besides clearing members, financial counterparties have been grouped according to their levels of legal and operational capacity regarding OTC derivatives, which was approximated by the level of activity of the counterparties in OTC derivatives.

Category 2 is distinguished from Category 3 based on quantitative threshold to differentiate small from large market participants, while still capturing a significant level of risk under the Category 3 (Recital (6) of the Commission Delegated Regulation (EU) 2015/2205 of 6 August 2015 and the Commission Delegated Regulation (EU) 2016/1178 of 10 June 2016, and Recital (5) of the Commission Delegated Regulation (EU) 2016/592 of 1 March 2016).

This quantitative threshold is set uniformly across all three delegated regulations adopted so far, at the level of EUR 8 billion (aggregate month-end average of outstanding gross notional amount of non-centrally cleared derivatives for January, February and March 2016 - assessed at a group level).

The assessment at group level "was introduced at international level as a tool to dissuade avoidance practice, consisting of splitting an entity into smaller sub-entities each below the relevant threshold" (Final Report on the clearing obligation for financial counterparties with a limited volume of activity, 14 November 2016, ESMA/2016/1565p. 15).

Another consideration are potential shared risks within the group. However, for investment funds the EUR 8 bn threshold applies separately to each fund since the liabilities of a fund are not usually affected by the liabilities of other funds or their investment manager. Counterparties in Category 1 can be easily identified, as the classification of counterparties in Category 1 (clearing members) was made publicly available by all CCPs which are clearing the OTC derivatives subject to the clearing obligation, see the Public Register for the clearing obligation under EMIR). In turn, the counterparty classification between Category 2 and 3 is much more complex and could only be approximated on the basis of a number of assumptions (Consultation Paper on the clearing obligation for financial counterparties with a limited volume of activity, 13 July 2016, ESMA/2016/1125, p. 18).

As the consequence of common assumptions, all three delegated regulations on the clearing obligation adopted so far, share almost identical reasoning as regards counterparties classification. This is expressed in:

- Recitals 4 - 8 of the Commission Delegated Regulation (EU) 2015/2205 of 6 August 2015 supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council with regard to regulatory technical standards on the clearing obligation,

- Recitals - 4 - 8 Commission Delegated Regulation (EU) 2016/1178 of 10 June 2016 supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council with regard to regulatory technical standards on the clearing obligation, and

- Recitals 3 - 7 of the Commission Delegated Regulation (EU) 2016/592 of 1 March 2016 supplementing Regulation (EU) No 648/2012 of the European Parliament and of the Council with regard to regulatory technical standards on the clearing obligation.

See in the box an exemplary citation from the Commission Delegated Regulation (EU) 2015/2205 of 6 August 2015.

Process for removing a derivative contract from the scope of the clearing obligation

There was also a controversy regarding the procedure to be followed-up on the occasion of removing a derivative contract from the scope of the clearing obligation. The only possibility foreseen by EMIR in such a case is to modify the relevant RTS. However, while it was less contentious that the addition of a new derivatives' class should exclusively be possible via the full RTS procedure, it was argued that the RTS procedure, due to its prolonged character, would not be appropriate in case where there is an urgent need to remove a specific derivatives' class already included in the clearing obligation from its scope.

|

Proposal for a Regulation of the European Parliament and of the Council amending Regulation (EU) No 648/2012 as regards the clearing obligation, the suspension of the clearing obligation, the reporting requirements, the risk-mitigation techniques for OTC derivatives contracts not cleared by a central counterparty, the registration and supervision of trade repositories and the requirements for trade repositories, COM(2017)208, May 2017

Inserted new Article 6b of EMIR:

“Article 6b Suspension of clearing obligation in situations other than resolution

1. In circumstances other than those referred to in Article 6a(1), ESMA may request that the Commission suspend the clearing obligation referred to in Article 4(1) for a specific class of OTC derivative or for a specific type of counterparty where one of the following conditions is met: (a) the class of OTC derivative is no longer suitable for central clearing on the basis of the criteria referred to in the first subparagraph of paragraph 4 and in paragraph 5 of Article 5; (b) a CCP is likely to cease clearing that specific class of OTC derivative and no other CCP is able to clear that specific class of OTC derivative without interruption; (c) the suspension of the clearing obligation for a specific class of OTC derivative or for a specific type of counterparty is necessary to avoid or address a serious threat to financial stability in the Union and that suspension is proportionate to that aim. For the purposes of point (c) of the first subparagraph, ESMA shall consult the ESRB prior to the request referred to therein. Where ESMA requests that the Commission suspend the clearing obligation referred to in Article 4(1), it shall provide reasons and submit evidence that at least one of the conditions laid down in the first subparagraph is fulfilled. 2. The request referred to in paragraph 1 shall not be made public. 3. The Commission shall, within 48 hours of the request referred to in paragraph 1 and based on the reasons and evidence provided by ESMA, either suspend the clearing obligation for the specific class of OTC derivative or for the specific type of counterparty referred to in paragraph 1, or reject the requested suspension. 4. The Commission’s decision to suspend the clearing obligation shall be communicated to ESMA and shall be published in the Official Journal of the European Union, on the Commission’s website and in the public register referred to in Article 6. 5. A suspension of the clearing obligation pursuant to this Article shall be valid for a period of three months from the date of the publication of that suspension in the Official Journal of the European Union. 6. The Commission, after consulting ESMA, may extend the suspension referred to in paragraph 5 for additional periods of three months, with the total period of the suspension not exceeding twelve months. An extension of the suspension shall be published in accordance with Article 4. For the purposes of the first subparagraph, the Commission shall notify ESMA of its intention to extend a suspension of the clearing obligation. ESMA shall issue an opinion on the extension of the suspension within 48 hours of that notification."

Recital 10 It should be possible to suspend the clearing obligation in certain situations. First, that suspension should be possible where the criteria on the basis of which a specific class of OTC derivative has been made subject to the clearing obligation are no longer met. That could be the case where a class of OTC derivative becomes unsuitable for mandatory central clearing or where there has been a material change to one of those criteria in respect of a particular class of OTC derivative. A suspension of the clearing obligation should also be possible where a CCP ceases to offer a clearing service for a specific class of OTC derivative or for a specific type of counterparty and other CCPs cannot step in fast enough to take over those clearing services. Finally, the suspension of a clearing obligation should also be possible where that is deemed necessary to avoid a serious threat to financial stability in the Union. |

ESMA Final Report Draft technical standards on the Clearing Obligation – Interest Rate OTC Derivatives of 1 October 2014 (ESMA/2014/1184) invoked a number of reasons why ESMA might need to act as a matter of urgency to remove a specific class from the clearing obligation, in particular:

- a drop in the liquidity of the contracts leading the CCPs to impose extremely high margin requirements,

- a situation where a CCP is no longer authorised/recognised or ceases to clear a specific derivatives' class and the other CCPs are unable to absorb the resultant trade activity or stressed market conditions leading to clearing member defaults.

ESMA concluded that the RTS on the clearing obligation is not an appropriate instrument to address the above problems since it is beyond the empowerment for ESMA under EMIR.

Following the above considerations the Proposal for a Regulation of the European Parliament and of the Council amending Regulation (EU) No 648/2012 as regards the clearing obligation, the suspension of the clearing obligation, the reporting requirements, the risk-mitigation techniques for OTC derivatives contracts not cleared by a central counterparty, the registration and supervision of trade repositories and the requirements for trade repositories, COM(2017)208 published by the European Commission in May 2017 introduces specific provisions for the suspension of the clearing obligation.

Article 1(6) of the said draft inserts to EMIR a new Article 6b that gives the European Commission the power, on specific grounds, to temporarily suspend any clearing obligation on the basis of a request from ESMA and lays down the procedure for the suspension.

The said Proposal explains the respective reasons as follows:

"Article 1(6) inserts to EMIR a new Article 6b that gives the Commission the power, on specific grounds, to temporarily suspend any clearing obligation on the basis of a request of ESMA and lays down the procedure for the suspension. As also pointed out by ESMA, this power is needed since in certain specific circumstances, continued application of the clearing obligation may be impossible (for example because the CCP(s) clearing the biggest portion of a certain OTC derivatives class may exit that market) or may have adverse effects for financial stability (for example because the clearing obligation would impede bilateral hedging for counterparties without access to the centrally cleared market). Such developments may occur unexpectedly, and the current procedure for the removal of a clearing obligation that would require the amendment of a regulatory technical standard, can be too slow to respond to the changing market circumstances or financial stability concerns. The new power is subject to tightly framed conditions, and the suspension would be limited in time. The procedure to permanently remove the clearing obligation remains unchanged, and this will always require an amendment of a regulatory technical standard."

However, in reaction to the above legislative initiative, the FIA Response of 18 July 2017 to the European Commission EMIR Review Proposal – Part 1 (REFIT Proposals) underlines that an effective, timely and transparent process for the suspension of the clearing obligation is required and the consequences of suspension should be spelt out.

The more fundamental flaw of the European Commission's proposal has been indicated by the International Swaps and Derivatives Association (ISDA) in its comments of 18 July 2017. ISDA questions what would happen to the MiFIR trading obligation were the clearing obligation to be suspended. ISDA argues that whilst the trading obligation is not part of EMIR, it is directly linked, as the derivatives subject to the trading obligation are a sub-set of those derivatives subject to the clearing obligation. ISDA concludes that should the clearing obligation be suspended for a class of derivatives that are wholly or partially subject to the trading obligation, it is vital that the trading obligation is simultaneously suspended. If this is not the case, the derivatives would still be required to be traded on venue, and hence would likely be required to be cleared under the rules of the trading venue, meaning that the suspension would have little practical effect. According to ISDA, this should be explicitly addressed as part of the EMIR Refit, as it is fundamental to the practical effectiveness of a suspension.

Transitory issues - frontloading

Interesting considerations of business risks of a general nature involved with the process for phasing in the mandatory clearing under EMIR are included in the recitals to the first regulatory technical standards finalised (i.e. relating to IRS). The fact these regulatory technical standards are IRS-specific does not rectrict the broader applicability of this thread given the recurring character of the phasing-in procedure, separate for each class of OTC derivatives.

The source of the said risk is embedded in the EMIR Regulation itself as the level 1 legislation imposes the clearing requirement not only on contracts entered into or novated on or after the date from which the clearing obligation takes effect, but also on contracts concluded after the notification to ESMA that follows the authorisation of a CCP to clear a certain class of OTC derivatives, but before the date on which the clearing obligation takes effect, provided the remaining maturity of such contracts at the date on which the obligation takes effect justifies it - Article 4(1)(b)(ii) (provision applicable to financial counterparties only).

The above-mentioned minimum remaining maturities are specified by the European Commission in the delegated acts.

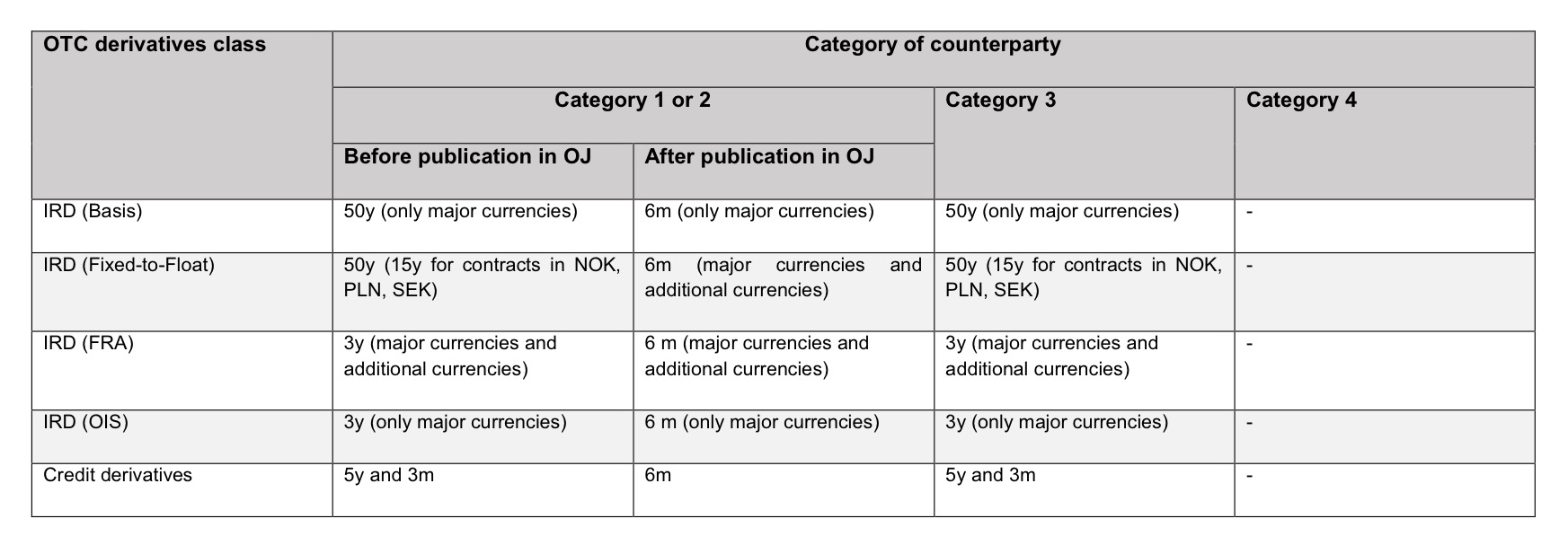

Mandatory Clearing - Minimum Remaining Maturity

Source of the table: Discussion Paper, The trading obligation for derivatives under MiFIR, 20 September 2016, ESMA/2016/1389, p. 28

The term "frontloading" in this context denotes the obligation to clear contracts in the latter period. The regulator refers to the problem involved in the following words:

"Before regulatory technical standards adopted pursuant to Article 5(2) of Regulation (EU) No 648/2012 enter into force, counterparties cannot foresee whether the OTC derivative contracts they conclude would be subject to the clearing obligation on the date that obligation takes effect. This uncertainty has a significant impact on the capacity of market participants to accurately price the OTC derivative contracts they enter into since centrally cleared contracts are subject to a different collateral regime than non-centrally cleared contracts."

Given the above complexities the IRS framework for mandatory clearing start-up had been arranged via an exchange of letters between ESMA and the European Commission (the European Commission's letter to ESMA of 18 December 2014) excluding frontloading until legal certainty is reached on the exact set of classes subject to the clearing obligation and the CCPs authorised to clear them.

It was, moreover, agreed between the European Commission and ESMA that the certainty would be reached no later than on the date of publication of the RTS in the Official Journal of the Union hence that the frontloading obligation could not be delayed beyond that date.

Conseqently, the frontloading period has been further divided into two parts with divergent legal consequences:

- the period between the notification to ESMA and the publication of the relevant RTS in the Official Journal; and

- the period following the publication of the relevant regulatory technical standards in the Official Journal and the date on which the clearing obligation takes effect.

OTC derivative contracts entered into within the former period will not be subject to the frontloading requirement, while OTC derivative contracts entered into in the latter one may be subject to the frontloading obligation depending on the minimum remaining maturity as at the date of the application of the clearing obligation for that OTC derivative contract.

The reason why the frontloading obligation should not apply immediately after the notification of the classes to ESMA are the pricing complexities related to the uncertainty of a possible forward clearing requirement. As the European Commission observed in its letter to ESMA of 18 December 2014, "counterparties need time to calculate the price of the frontloading to include it in their contracts and communicate their counterparties whether they are subject to the frontloading requirement".

Counterparties, moreover, need time to analyse their contracts whether they are subject to the clearing frontloading obligation as well as implement necessary arrangements for the frontloading to take place.

Given the categories of counterparties are also differentiated with the use of thresholds, there is sufficient time necessary to carry out the adequate calculations.

According to the Level 1 requirement the frontloading obligation only applies to financial counterparties, consequently non-financial counterparties remain beyond the scope.

Removal of the frontloading requirement

The European Commission's propositions as regards the reform of the EMIR framework published in May 2017 provide for the removal of frontloading requirements (see point (b) of Article 1(2) the Proposal for a Regulation of the European Parliament and of the Council amending Regulation (EU) No 648/2012 as regards the clearing obligation, the suspension of the clearing obligation, the reporting requirements, the risk-mitigation techniques for OTC derivatives contracts not cleared by a central counterparty, the registration and supervision of trade repositories and the requirements for trade repositories, COM(2017)208 of 4 May 2017).

Point (b) of Article 1(2) of the said draft removes the requirement laid down in point (ii) of point (b) of EMIR Article 4(1) to clear OTC derivative contracts entered into or novated on or after notification by a competent authority to ESMA on an authorisation of a CCP to clear a class of OTC derivatives but before the date from which the clearing obligation takes effect if the contracts have a remaining maturity higher than the minimum remaining maturity determined in a Commission Delegated Regulation on clearing obligations under Article 5(2)(c).

Recital 8 of the said draft Regulation foresees that:

"The requirement to clear certain OTC derivative contracts concluded before the clearing obligation takes effect creates legal uncertainty and operational complications for limited benefits. In particular, the requirement creates additional costs and efforts for the counterparties to those contracts and may also affect the smooth functioning of the market without resulting in a significant improvement of the uniform and coherent application of Regulation (EU) No 648/2012 or of the establishment of a level playing field for market participants. That requirement should therefore be removed."

Clearing obligation with respect to swaps resulting from the exercise of a swaption

A swap which results from the exercise of a swaption is subject to the clearing obligation when any of the following conditions are met:

(i) the swap and the corresponding swaption are entered into on or after the date on which the clearing obligation takes effect; or

(ii) the swap is entered into on or after the date on which the clearing obligation takes effect and the corresponding swaption is entered into on or after the date on which the frontloading obligation starts to apply and before the date on which the clearing obligation takes effect; or

(iii) the swap and the corresponding swaption are entered into on or after the date on which the frontloading obligation starts to apply and before the date on which the clearing obliga-tion takes effect, and the swap has a remaining maturity which is higher than the minimum remaining maturity defined in the RTS on the clearing obligation.

The table below summarises different cases (source: ESMA's EMIR Q&As, OTC Question 20).

| Before "frontloading window" |

During "frontloading window" |

On or after date on which the clearing obligation takes effect

|

Is the swap resulting from the swaption subject to the clearing obligation? |

| Swaption entered into and exercised |

Yes (i) |

||

|

Swaption entered into

|

Swaption exercised

|

Yes (ii) |

|

| |

Swaption entered into and exercised |

Yes if the swap has a remaining maturity above the minimum remaining maturity defined in the RTS (iii) |

|

|

Swaption entered into |

Swaption exercised |

No |

|

|

Swaption entered into

|

Swaption exercised |

No |

Mandatory clearing application problems

Among the entire spectrum of practical issues involved with the process for implementation of the clearing obligation, the following deserve to be accounted for in the first place: Mandatory clearing means essential elements of the OTC contracts, including the pricing of interest rate OTC derivatives subject to the clearing obligation and concluded before that obligation takes effect, will have to be adapted within short timeframes in order to incorporate the clearing. This process of forward-clearing involves important adaptations to the pricing models and amendments to the documentation of OTC derivatives contracts, providing appropriate representations, and making relevant changes to systems, controls and internal procedures to reflect these determinations and representations. Thus, counterparties need to analyse their portfolios to identify contracts potentially subject to this requirement (taking account of their counterparties' statuses).

Mandatory clearing preparation phase represents, moreover, the appropriate moment to examine whether the intragroup exemption could be applied under circumstances and whether its use is adequate to the company's business model (see more on intragroup exemption from mandatory clearing).

In the case the above analysis shows the counterparty is within the scope of application of mandatory clearing, the need to arrange for the necessary clearing relationships arises. Clearing members (included in category 1) already posess the necessary organisational and legal infrastructure to fulfill all requirements involved with mandatory clearing, hence, new requirements will not necessarily be particularly burdensome for them. However, the ability of most counterparties to fulfil their clearing obligations is subject to the availability of clearing services provided by clearing members or their clients in the case of indirect clearing.

How to report clearing obligation in the EMIR trade reports

The indication whether the reported trade is subject to the clearing obligation initially was populated in Field 28 in the Table 2 (Common data) of the EMIR transactions reporting format. Subsequently, under amendments made by:

the applicable field is Field 34.

This field is intended to be populated with information on "whether the reported contract belongs to a class of OTC derivatives that has been declared subject to the clearing obligation and both counterparties to the contract are subject to the clearing obligation under Regulation (EU) No 648/2012, as of the time of execution of the contract".

Clearing obligation under MiFID II/MiFIR

Article 29(1) MiFIR extends the scope of the clearing obligation to all derivative transactions concluded on a regulated market. Under the MiFID II contracts "arising exclusively for clearing or settlement purposes" are excluded from the scope of the term "transaction" - see Article 2(5)(b) of the Commission Delegated Regulation (EU) 2017/590 of 28 July 2016 supplementing Regulation (EU) No 600/2014 of the European Parliament and of the Council with regard to regulatory technical standards for the reporting of transactions to competent authorities. Hence the said contracts are not reportable under the MiFID II transaction reporting scheme.

Interconnected points

Mandatory clearing test, as set up by EMIR, represents the first step for establishing MiFIR trading obligation.

EMIR, Articles 4 - 6

Article 4

Clearing obligation

1. Counterparties shall clear all OTC derivative contracts pertaining to a class of OTC derivatives that has been declared subject to the clearing obligation in accordance with Article 5(2), if those contracts fulfil both of the following conditions:

(a) they have been concluded in one of the following ways:

(i) between two financial counterparties;

(ii) between a financial counterparty and a non-financial counterparty that meets the conditions referred to in Article 10(1)(b);

(iii) between two non-financial counterparties that meet the conditions referred to in Article 10(1)(b);

(iv) between a financial counterparty or a non-financial counterparty meeting the conditions referred to in Article 10(1)(b) and an entity established in a third country that would be subject to the clearing obligation if it were established in the Union; or

(v) between two entities established in one or more third countries that would be subject to the clearing obligation if they were established in the Union, provided that the contract has a direct, substantial and foreseeable effect within the Union or where such an obligation is necessary or appropriate to prevent the evasion of any provisions of this Regulation; and

(b) they are entered into or novated either:

(i) on or after the date from which the clearing obligation takes effect; or

(ii) on or after notification as referred to in Article 5(1) but before the date from which the clearing obligation takes effect if the contracts have a remaining maturity higher than the minimum remaining maturity determined by the Commission in accordance with Article 5(2)(c).

2. Without prejudice to risk-mitigation techniques under Article 11, OTC derivative contracts that are intragroup transactions as described in Article 3 shall not be subject to the clearing obligation.

The exemption set out in the first subparagraph shall apply only:

(a) where two counterparties established in the Union belonging to the same group have first notified their respective competent authorities in writing that they intend to make use of the exemption for the OTC derivative contracts concluded between each other. The notification shall be made not less than 30 calendar days before the use of the exemption. Within 30 calendar days after receipt of that notification, the competent authorities may object to the use of this exemption if the transactions between the counterparties do not meet the conditions laid down in Article 3, without prejudice to the right of the competent authorities to object after that period of 30 calendar days has expired where those conditions are no longer met. If there is disagreement between the competent authorities, ESMA may assist those authorities in reaching an agreement in accordance with its powers under Article 19 of Regulation (EU) No 1095/2010;

(b) to OTC derivative contracts between two counterparties belonging to the same group which are established in a Member State and in a third country, where the counterparty established in the Union has been authorised to apply the exemption by its competent authority within 30 calendar days after it has been notified by the counterparty established in the Union, provided that the conditions laid down in Article 3 are met. The competent authority shall notify ESMA of that decision.

3. The OTC derivative contracts that are subject to the clearing obligation pursuant to paragraph 1 shall be cleared in a CCP authorised under Article 14 or recognised under Article 25 to clear that class of OTC derivatives and listed in the register in accordance with Article 6(2)(b).

For that purpose a counterparty shall become a clearing member, a client, or shall establish indirect clearing arrangements with a clearing member, provided that those arrangements do not increase counterparty risk and ensure that the assets and positions of the counterparty benefit from protection with equivalent effect to that referred to in Articles 39 and 48.

4. In order to ensure consistent application of this Article, ESMA shall develop draft regulatory technical standards specifying the contracts that are considered to have a direct, substantial and foreseeable effect within the Union or the cases where it is necessary or appropriate to prevent the evasion of any provision of this Regulation as referred to in paragraph 1(a)(v), and the types of indirect contractual arrangements that meet the conditions referred to in the second subparagraph of paragraph 3.

ESMA shall submit those draft regulatory technical standards to the Commission by 30 September 2012.

Power is delegated to the Commission to adopt the regulatory technical standards referred to in the first subparagraph in accordance with Articles 10 to 14 of Regulation (EU) No 1095/2010.

Article 5

Clearing obligation procedure

1. Where a competent authority authorises a CCP to clear a class of OTC derivatives under Article 14 or 15, it shall immediately notify ESMA of that authorisation.

In order to ensure consistent application of this Article, ESMA shall develop draft regulatory technical standards specifying the details to be included in the notifications referred to in the first subparagraph.

ESMA shall submit those draft regulatory technical standards to the Commission by 30 September 2012.

Power is delegated to the Commission to adopt the regulatory technical standards referred to in the second subparagraph in accordance with Articles 10 to 14 of Regulation (EU) No 1095/2010.

2. Within six months of receiving notification in accordance with paragraph 1 or accomplishing a procedure for recognition set out in Article 25, ESMA shall, after conducting a public consultation and after consulting the ESRB and, where appropriate, the competent authorities of third countries, develop and submit to the Commission for endorsement draft regulatory technical standards specifying the following:

(a) the class of OTC derivatives that should be subject to the clearing obligation referred to in Article 4;

(b) the date or dates from which the clearing obligation takes effect, including any phase in and the categories of counterparties to which the obligation applies; and

(c) the minimum remaining maturity of the OTC derivative contracts referred to in Article 4(1)(b)(ii).

Power is delegated to the Commission to adopt regulatory technical standards referred to in the first subparagraph in accordance with Articles 10 to 14 of Regulation (EU) No 1095/2010.

3. ESMA shall, on its own initiative, after conducting a public consultation and after consulting the ESRB and, where appropriate, the competent authorities of third countries, identify, in accordance with the criteria set out in points (a), (b) and (c) of paragraph 4 and notify to the Commission the classes of derivatives that should be subject to the clearing obligation provided in Article 4, but for which no CCP has yet received authorisation.

Following the notification, ESMA shall publish a call for a development of proposals for the clearing of those classes of derivatives.

4. With the overarching aim of reducing systemic risk, the draft regulatory technical standards for the part referred to in paragraph 2(a) shall take into consideration the following criteria:

(a) the degree of standardisation of the contractual terms and operational processes of the relevant class of OTC derivatives;

(b) the volume and liquidity of the relevant class of OTC derivatives;

(c) the availability of fair, reliable and generally accepted pricing information in the relevant class of OTC derivatives.

In preparing those draft regulatory technical standards, ESMA may take into consideration the interconnectedness between counterparties using the relevant classes of OTC derivatives, the anticipated impact on the levels of counterparty credit risk between counterparties as well as the impact on competition across the Union.

In order to ensure consistent application of this Article, ESMA shall develop draft regulatory technical standards further specifying the criteria referred to in points (a), (b) and (c) of the first subparagraph.

ESMA shall submit those draft regulatory technical standards to the Commission by 30 September 2012.

Power is delegated to the Commission to adopt regulatory technical standards referred to in the third subparagraph of this paragraph in accordance with Articles 10 to 14 of Regulation (EU) No 1095/2010.

5. The draft regulatory technical standards for the part referred to in paragraph 2(b) shall take into consideration the following criteria:

(a) the expected volume of the relevant class of OTC derivatives;

(b) whether more than one CCP already clear the same class of OTC derivatives;

(c) the ability of the relevant CCPs to handle the expected volume and to manage the risk arising from the clearing of the relevant class of OTC derivatives;

(d) the type and number of counterparties active, and expected to be active within the market for the relevant class of OTC derivatives;

(e) the period of time a counterparty subject to the clearing obligation needs in order to put in place arrangements to clear its OTC derivative contracts through a CCP;

(f) the risk management and the legal and operational capacity of the range of counterparties that are active in the market for the relevant class of OTC derivatives and that would be captured by the clearing obligation pursuant to Article 4(1).

6. If a class of OTC derivative contracts no longer has a CCP which is authorised or recognised to clear those contracts under this Regulation, it shall cease to be subject to the clearing obligation referred to in Article 4, and paragraph 3 of this Article shall apply.

Article 6

Public register

1. ESMA shall establish, maintain and keep up to date a public register in order to identify the classes of OTC derivatives subject to the clearing obligation correctly and unequivocally. The public register shall be available on ESMA’s website.

2. The register shall include:

(a) the classes of OTC derivatives that are subject to the clearing obligation pursuant to Article 4;

(b) the CCPs that are authorised or recognised for the purpose of the clearing obligation;

(c) the dates from which the clearing obligation takes effect, including any phased-in implementation;

(d) the classes of OTC derivatives identified by ESMA in accordance with Article 5(3);

(e) the minimum remaining maturity of the derivative contracts referred to in Article 4(1)(b)(ii);

(f) the CCPs that have been notified to ESMA by the competent authority for the purpose of the clearing obligation and the date of notification of each of them.

3. Where a CCP is no longer authorised or recognised in accordance with this Regulation to clear a given class of derivatives, ESMA shall immediately remove it from the public register in relation to that class of OTC derivatives.

4. In order to ensure consistent application of this Article, ESMA may develop draft regulatory technical standards specifying the details to be included in the public register referred to in paragraph 1.

ESMA shall submit any such draft regulatory technical standards to the Commission by 30 September 2012.

Power is delegated to the Commission to adopt the regulatory technical standards referred to in the first subparagraph in accordance with Articles 10 to 14 of Regulation (EU) No 1095/2010.

ESMA's Letter of 27 January 2017 to the European Commission on the EMIR Review and ESMA sanctioning powers under EMIR and CRAR, ESMA70-708036281-19, p. 7

Clearing obligation

First of all, ESMA welcomes the first proposal made in the Commission's EMIR Review report, the need to introduce a mechanism to suspend the clearing obligation. The recommendation was made in the EMIR Review Report No.4 and is one that received a lot of support through the multiple consultations on the clearing obligation. In a stressed scenario where a need to suspend the clearing obligation would materialise, time would be of the essence. It is important that the mechanism allowing for the clearing obligation to be suspended provides for a swift and clear decision making process. We believe ESMA is well positioned to assess and decide on such a scenario.

Secondly, the Commission's report also addresses the frontloading requirement. On that topic, ESMA would like to reiterate that costs significantly outweigh the benefits. ESMA is of the opinion that the frontloading requirement could be removed while not compromising on the overarching objective of reducing systemic risk. On the other hand, ESMA is of the opinion that intragroup transactions are not free of risks. As a result, it seems appropriate that counterparties are subject to the same requirements for these transactions, including the clearing obligation, unless a series of conditions are met ensuring that their risks are properly mitigated. However, ESMA believes that the wording of Article 3 could be further clarified.

Thirdly, following the EMIR Review and more recently the consultation paper and the final report on the clearing obligation for financial counterparties with a smaller volume of activity, we understand that the Commission is suggesting reconsidering the scope of counterparties to be subject to the clearing obligation (as well as for bilateral margining). On this topic, we remain of the opinion that the first priority is to address the problems impeding client clearing and indirect clearing to develop wider. With respect to the Leverage Ratio framework, ESMA welcomes the proposed changes to CRR announced in November 2016.

However, other impediments remain, in particular with regards to the possible conflict of law with national insolvency regimes, therefore ESMA is of the opinion that the wording in Article 48 should be improved to provide the levels of protection initially envisaged. This was developed in more details in the EMIR Review Report No.3.

Lastly, with respect to small financial counterparties that could benefit from some exemptions, ESMA stands ready to assist the Commission in defining the criteria that could be used to properly identify them. For instance, if these included certain thresholds, these could be the subject of technical standards to include the proper input from stakeholders.

|

Point (b) of Article 1(2) removes the requirement laid down in EMIR to clear OTC derivative contracts entered into or novated on or after notification by a competent authority to ESMA on an authorisation of a CCP to clear a class of OTC derivatives but before the date from which the clearing obligation takes effect if the contracts have a remaining maturity higher than the minimum remaining maturity determined in a European Commission Delegated Regulation on clearing obligations

Article 1(6) inserts to EMIR a new Article 6b that gives the European Commission the power, on specific grounds, to temporarily suspend any clearing obligation on the basis of a request from ESMA and lays down the procedure for the suspension

|

Amendments developed in the context of the benchmark transition